Mat Hope

18.03.2014 | 3:25pmSometimes, the Chancellor must feel like he just can’t win. When he introduced the UK’s top-up carbon tax – the carbon price floor – environmentalists called it costly and ineffective. Now that he’s announced it’s going to be frozen, the same groups are accusing him of abandoning the UK’s climate change agenda.

Derided policy

The carbon price floor is a top-up tax: it exists to bolster the existing EU price of carbon.

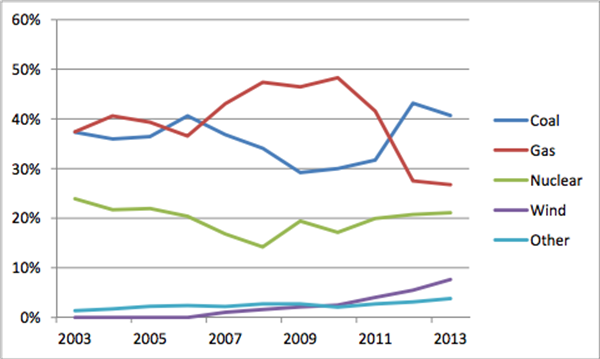

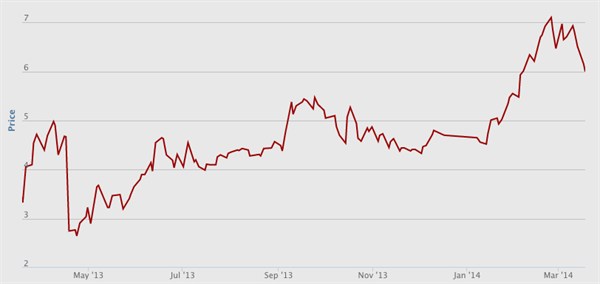

Energy companies already pay to pollute under the EU emissions trading scheme (ETS), buying permits to emit greenhouse gases when they generate electricity. But the price of the permits crashed to a record low last year, meaning there’s much less of a financial incentive for companies to cut their emissions.

The carbon price floor is meant to solve this by putting a minimum price on how much power generators in the UK pay to pollute. If the ETS price drops below this level, companies pay the difference to the UK Treasury. The carbon price floor was set to increase each year, from around £16 per tonne of carbon dioxide in 2013, to around £70 by 2030.

The EU carbon price, March 2014

The EU carbon price, March 2014

This may sound like a neat way to get polluters to pay for their emissions, but the policy was generally derided when it was introduced.

Left-leaning thinktank, IPPR, said the scheme was socially regressive, and risked hitting the poor the hardest. Meanwhile Greenpeace’s deputy political director, Joss Garman, described the policy as “precisely the sort of measure that destroys public confidence in environmental policies”.

Symbolism

How things change. Now that it looks as though the carbon price floor will be frozen at 2014 levels – a bit under £20 per tonne – many are calling on Osborne to reconsider.

Their main point is that while the carbon price floor is a far from perfect climate policy, it’s one of only which directly targets greenhouse gas emissions. Freezing it sends the message that the UK government is no longer committed to tackling climate change, they argue.

Guy Newey, Head of Environment & Energy at right-leaning thinktank Policy Exchange, argues in a blog the measure is less dysfunctional than many other climate policies, and efforts would be better spent improving those instead.

Many economists maintain the most effective way to make companies cut emissions is by putting a price on carbon, Newey points out. The carbon price floor does just that, even if it is much lower than many academics recommend.

Commentators also suggest that freezing the UK’s carbon price runs the risk of making coal a more attractive investment by making polluting cheaper. The renewables industry is worried prospective investors may get scared off by the move, choosing to back fossil fuels while they remain profitable instead.

Campaigners and chief executives alike say freezing one of the UK’s landmark climate policies just two years after it was introduced could make it hard to trust the government’s climate change promises again. Even if they weren’t all that keen on it to begin with.

Limited impact

That makes scrapping the carbon price floor sound like a pretty terrible idea. But in practice it’s not so clear cut. The carbon price floor looks less important when the wider European policy context is taken into account.

While freezing the carbon price floor would undoubtedly cut the cost of coal generation, it’s unclear whether the measure was having much of an effect in the current economic climate. Coal generation in the UK has remained high since 2012 – the year before the carbon price floor was introduced.

That’s because coal is currently very cheap, partly thanks to a shale gas boom in the US which allows it to export cut-price coal to Europe. At the same time, other European Union policies such as the Large Combustion Plant Directive (LCPD) – which puts strict limits on a plant’s sulphur dioxide and nitrogen oxide emissions – mean almost all coal plants are due to be shut in a couple of years.

The combination of cheap coal and impending closures mean companies are eager to eke out every last bit of a coal plant’s profitability while they still can. Coal’s cheapness has been more economically significant than the cost of emitting carbon dioxide in recent years, and it’s unclear whether keeping the carbon price floor would change that.

Missed opportunities

The government had a chance to end the reign of old coal last year but passed it up. That decision is likely to have had a bigger impact on the fossil fuel industry than freezing the carbon price floor will.

As the energy bill entered its final legislative stages, an amendment was added which would have extended the emissions performance standard – which sets a strict limit on emissions from new power plants – to old coal plants. The amendment was voted down by coalition government MPs.

So while Osborne’s expected decision to freeze the carbon price floor probably won’t have much of an immediate impact on the future of the UK’s coal plants, it continues the government’s approach to getting the most out of the UK’s fossil fuels while it still can. Symbolically, it’s yet another step away from the prime minister’s promise to lead the “greenest government ever”.

Update, 18/03/14, 1600: This article originally appeared with the title 'Budget 2014: Why shed a tear for the unloved carbon price floor?'