Guest post: Understanding the government’s capacity market

Byron Orme

04.01.16A guest post from Byron Orme, research fellow in energy, transport and climate policy at the Institute for Public Policy Research (IPPR).

This week, an IPPR report said the government’s capacity market is broken. With a consultation on reforms to the capacity market ending today, Orme explains what the much-criticised policy was supposed to achieve and where it has gone wrong.

The capacity market is the government’s primary policy for ensuring security of electricity supply. It offers payments to power generators for being available to generate at certain times, and to demand response providers for being able to reduce electricity demand.

The market takes the form of an auction, held every year, for capacity to be delivered in four years’ time. Firms bid into the auction at the price they need to stay open to generate electricity, or to be built from scratch in time to generate.

The amount of capacity that is needed is decided by the secretary of state for energy and climate change, following a recommendation from National Grid. The capacity market was introduced in 2014 as part of a wider programme of reform (known as Electricity Market Reform), designed to decarbonise the UK’s electricity supply while keeping the lights on and costs affordable.

What has it delivered so far?

There have been two main auctions so far, held in December 2014 and 2015. These resulted in the award of £2.8bn in subsidies, mainly to existing power stations.

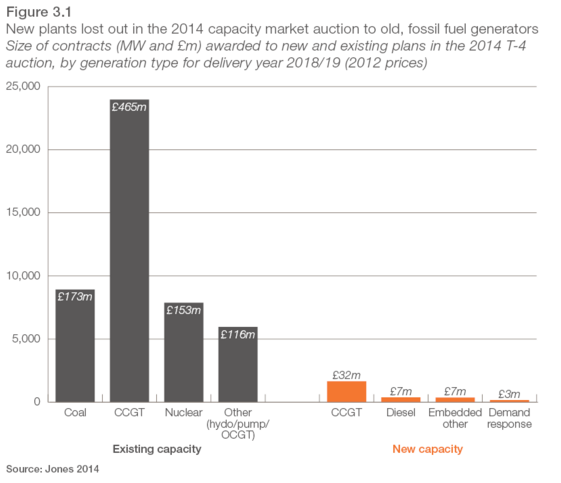

The so-called ‘clearing price’, the amount per kilowatt (kW) paid out, has been relatively low in each auction. The chart below shows who won contracts, and how much they received in the first auction (here’s the data from Sandbag).

As can be seen, coal power stations will receive £173m in contracts for winter 2018/19, with multi-year contracts adding up to £293m in total. The UK’s nuclear power stations all received payments amounting to £153m in total, despite being highly likely to have stayed open anyway.

The results of 2015’s auction were similar, but it also saw a marked increase in the amount of diesel generators winning contracts, despite those being one of the most polluting form of generation. As they are able to earn money in different parts of the market, they are able to compete to deliver their capacity at a low price.

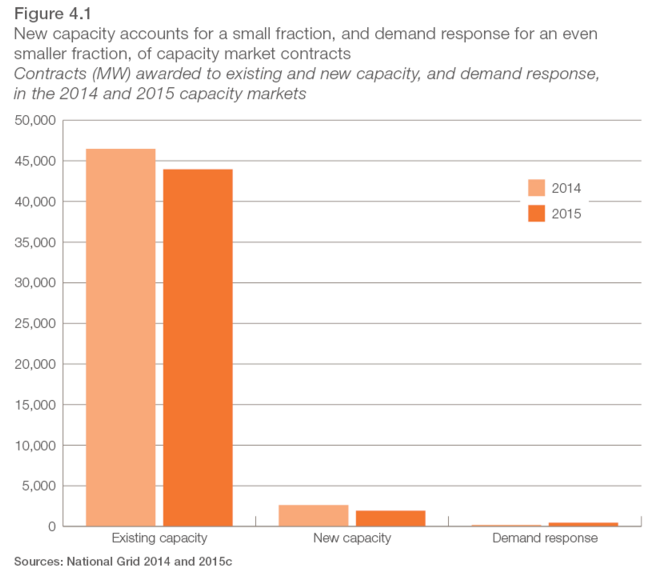

In the first auction, just over 5% of contracts went to new capacity and just 0.35% to demand response providers, as can be seen in the graph below.

What are the problems with it?

Critics of the scheme think there are three main problems with it. The first is that it provides continuing subsidies to fossil fuel generators, and highly polluting diesel plants, at a time when the UK is trying to decarbonise its electricity system.

Indeed the energy market now has two contradictory policies working against one another – the carbon price floor penalises coal-fired power stations at the same time as the capacity market rewards them. Decarbonising electricity will be even more important as the heat and transport sectors are increasingly electrified.

The capacity market also awards payments to plants that would have been open anyway – in the first auction, around a third of the plants which won contracts signalled they would have stayed open with no or very little payments. These windfall payments are arguably not the best use of bill payers’ money.

The market is also focussed on the needs of large fossil fuel and nuclear plants rather than new technologies which can reduce costs to bill payers by shifting demand. Such technologies can reduce the need to build expensive new power stations and the amount of time that the most expensive stations need to run.

As can be seen from the graph above, demand response providers have been awarded very few contracts so far.

What can be done to change it?

The government is currently consulting on changes which could mean more new gas-fired power stations are contracted, mainly by purchasing more capacity overall.

The risk of this is that highly polluting plant will still be subsidised, and there will be even higher payments to power stations that would have been open anyway.

IPPR has recommended that a host of changes should be made to reduce the costs of the capacity market, and to better align it with the government’s principal goals: security of supply, affordability and decarbonisation.

First, there should be separate auctions for new and old capacity, so that there is more control over the amount of new capacity bought, and so the same payments required to get those plants built are not paid to plants which would have been open anyway.

The Committee on Climate Change should provide advice to the secretary of state on the level of new capacity recommended by National Grid.

Second, there should be an Emissions Performance Standard preventing highly polluting plants from bidding for capacity contracts, to end the situation where bill payers are subsidising diesel and coal power stations.

Finally, there should be a much greater role for demand response. The National Infrastructure Commission has recently shown that moving to a more flexible and efficient system of demand management could save bill payers up to £8bn a year by 2030.

What other options are there?

The capacity market needs to work in a rapidly changing energy system in which the cost of renewables is falling and new demand management technologies such as storage are becoming available.

Greater visibility for investors through an extended levy control framework would help renewables develop into the 2020s. Along with a growing use of demand response and storage, a lower-carbon system would rely less on the fossil fuel and nuclear plant currently being subsidised through the capacity market.

An even more radical reform has previously been recommended by Catherine Mitchell, professor of energy policy at Exeter University. She has argued that we can best facilitate a move to a decentralised, flexible and efficient system by looking again at the whole regulation of our energy market, as New York State is currently doing.