Media reaction: US Inflation Reduction Act and the global ‘clean-energy arms race’

Multiple Authors

02.03.23Multiple Authors

03.02.2023 | 2:15pmLast summer, US president Joe Biden made history by passing the largest package of domestic climate measures ever under the Inflation Reduction Act (IRA).

After earning praise at home for the bill – which includes $369bn for climate measures such as tax breaks for clean energy and electric vehicles – Biden proudly presented his new green agenda to the world at the COP27 climate summit in Egypt in November.

But, at the sidelines of the talks, tensions were already brewing about how the IRA may affect industry and business in other countries – and even fuel a global “clean-energy arms race”.

World leaders from Brussels to Seoul say the small print of the IRA – which stipulates that generous subsidies will only be on offer to companies operating mostly or wholly in the US – amounts to “green protectionism” and could harm business overseas.

Now – as the EU publishes its response to the IRA – Carbon Brief examines why the bill is fuelling global trade tensions, how key countries from Canada through to China and India are responding and what the media reaction has been.

- Why is the US Inflation Reduction Act causing a stir in other countries?

- How has the EU reacted?

- How has the UK reacted?

- How have other parts of North America reacted?

- How have major Asian economies reacted?

- What does the US make of the global response?

- How has the media reacted?

Why is the US Inflation Reduction Act causing a stir in other countries?

On 16 August 2022, Biden signed the IRA into law, describing it as “the most significant legislation in history to tackle the climate crisis”.

The bill contains $437bn of “investments” including tax credits by the federal government, of which $369bn will go towards “energy security and climate change”.

As Carbon Brief noted in its in-depth summary of the release of the IRA, the initial reaction to the bill was generally positive – both domestically and internationally.

However, in the months that followed, countries began to express their discontent at the “protectionist” measures contained within the bill. In September 2022, South Korea was one of the first countries to speak out against the IRA. The Financial Times reported:

“Seoul is furious that EVs manufactured by Hyundai in South Korea will be excluded from generous consumer tax credits contained in the IRA.”

By December, French president Emmanuel Macron was warning that the IRA risked “fragmenting the west”, according to the FT.

But what is it exactly about the bill that has other countries concerned?

A major focus of the bill is incentivising clean-energy manufacturing and production within the US.

As the Guardian reported, the IRA “offers huge subsidies and tax credits to companies investing in renewable energy technologies, such as batteries, solar panels and wind turbines – as long as the products and parts they manufacture are made in America”.

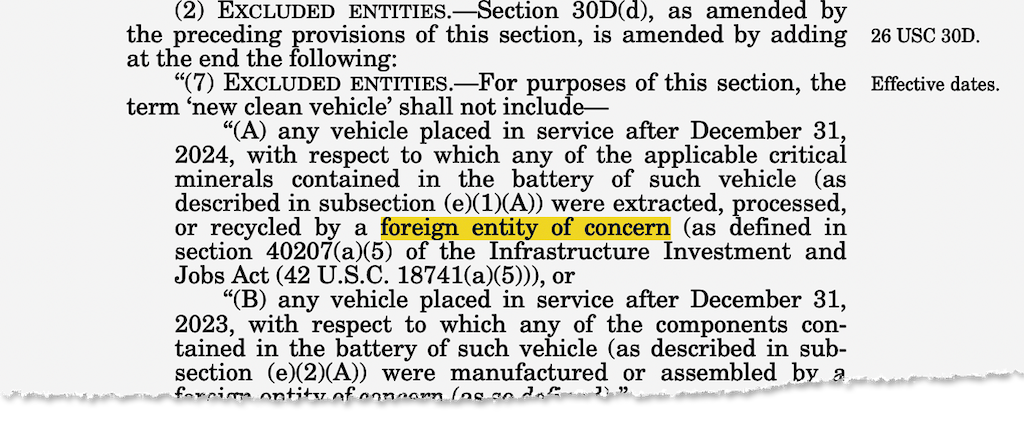

The extract below shows the section of the IRA that stipulates that clean-energy tax credits should only apply to sales of products made within the US.

Another major target of the IRA is boosting domestic production of EVs and their components.

As Alan Beattie, author of the FT’s Trade Secrets newsletter explained in October, the IRA’s passage on “clean vehicles” contains rules to exclude those made in other countries:

“It contains blatantly discriminatory measures, offering US consumers tax credits to buy electric vehicles only if they’re assembled in North America. It also requires critical minerals and batteries increasingly to be bought from North America or a country with which the US has a preferential trade agreement, and deters sourcing from high-risk countries such as China.”

The IRA effectively snubs countries such as China by stipulating that EVs that include components manufactured or assembled by a “foreign entity of concern” are excluded from receiving tax breaks.

But even economies with better relations with the US, such as the EU, South Korea and the UK, are affected by rules favouring EVs assembled in North America, according to Beattie. (Biden denies this was the intention of his legislation, see: What does the US make of the global response?)

A separate article in the FT explained that the small print on tax breaks for clean energy and EV production means that “companies are [essentially] rewarded for reorganising supply chains to be located either in the US or among allies and partners”. It added:

“The EU says the IRA’s local-content requirements are incompatible with World Trade Organization rules that are meant to bar discrimination against products based on their country of origin.”

(Canada, South Korea and the UK have also accused the US of flouting WTO rules.)

The incentives set out in the IRA have already driven “a swathe of electric vehicle and battery makers” to announce new investment plans in the US, according to a separate FT explainer. It said:

“Among them are large European companies. BMW announced a nearly $2bn investment in South Carolina late last year, for example, as it expands its existing plant and builds an additional battery plant nearby. Freyr announced a $1.7bn initial capital investment in Georgia late last year. Enel also announced it would build a solar photovoltaic cell and panel factory in the US.”

Since the IRA was passed into law last August, at least 20 new or expanded clean energy manufacturing plants have been announced in the US, according to the FT.

This week, the EU released its own Green Deal Industrial Plan – a package of measures widely interpreted to be the bloc’s direct response to the IRA.

Some see this as evidence that the IRA has sparked a “clean-energy arms race” – whereby major economies will battle to introduce more and more generous policies to attract green businesses.

EU Observer reported that experts are split on whether this will be a help or hindrance in the global fight against climate change. The publication explained:

“Experts have warned a bonanza of competing subsidies could result in a ‘race to the bottom’ as companies could threaten to move overseas unless they receive ever higher subsidies. But others believe the planet may benefit from green competition as states try to overtake each other in embracing cleaner, cheaper energy.”

How has the EU reacted to the Inflation Reduction Act?

The act has caused a significant stir in European circles with the European Commission this week setting out green industry finance proposals partly to counter the IRA.

On 25 November last year, commission vice-president Valdis Dombrovskis said many of the “green subsidies” in the IRA “discriminate against EU automotive, renewables, battery and energy-intensive industries”.

He called for EU companies and exports to be “treated in the same way in the US as American companies and exports are treated in Europe”.

In November, Reuters reported that a task force set up between the EU and US to discuss “specific concerns” about the IRA was aimed to avoid any “kind of trade war”, according to the German economy minister.

The “brewing transatlantic trade spat”, as it was described on 17 November by Politico, was overshadowing efforts to restore the EU-US relationship since Donald Trump left US office, according to officials spoken to by the publication.

Euractiv reported that IRA issues also loomed over a 25 November meeting of EU trade ministers.

Reuters quoted Germany’s finance minister, Christian Lindner, as saying in November:

“I have not been assured that the American side has completely grasped how great our concerns about the consequences are.”

France and Germany were at the forefront of the EU response to the IRA. French president Emmanuel Macron visited Biden in Washington in late November. The meeting was a “turning point” in EU-US discussions around the IRA, according to France’s finance minister Bruno Le Maire in a joint interview with Reuters and the Financial Times.

Macron warned on his first day of the visit that the US climate law risked “fragmenting the west”, the Financial Times reported. By the end of the visit, CNN reported that Biden said the US makes “no apologies” for the law, but that there were some “glitches” and amendments that may be made.

The French president “snatched an unexpected win” with this admission from Biden, Politico said, quoting the US President as saying:

“I never intended to exclude folks who were cooperating with us. That was not the intention.”

Discussions at the EU-US Trade and Technology Council in December last year “moved the needle in order to get closer to a solution” on IRA issues, Bloomberg reported.

At a European leaders summit on 15 December, European Council president Charles Michel said the bloc wants “to get exemptions like Canada and Mexico” in the IRA, ABC News reported.

The EU had been discussing response options and rumours were circulating in Brussels around raising the IRA issue at the World Trade Organization, the Washington Post reported, adding that the French president also came up with the idea of a “Buy European Act”.

On 17 January, European Commission chief Ursula von der Leyen announced that the EU would mobilise state aid and a sovereignty fund to entice firms away from moving to the US to avail of IRA benefits.

Von der Leyen said the bloc would pass legislation to speed up the granting of licences for green-tech firms, the Times reported, adding that the sovereignty fund would use existing funds from the long-term EU budget.

This has been a key issue for some EU countries. The Irish Times reported on 27 January that seven EU states wrote a letter to EU trade chief Valdis Dombrovskis to oppose any new money for green industry originating from outside of existing bloc funding.

Dutch prime minister Mark Rutte also said he will oppose any new EU money being used to fund the response to the US law, the Financial Times said. Rutte said there was no need for “fresh money” with “so much money at this moment in the system” already.

The EU’s response to the IRA should not “threaten functioning markets and fair competition”, the executive vice-presidents of the European Commission wrote in the Financial Times. They added:

“A tit-for-tat reaction risks significant economic self-harm. Instead, to make Europe the home of industrial innovation as we transition to net-zero, we need common action through an EU green deal industrial plan.”

The head of the International Energy Agency said the EU needs a “master plan for a new industrial strategy” to keep pace with the “age of clean-energy technology manufacturing”, Bloomberg reported on 27 January.

According to the EU internal market commissioner quoted in Reuters that day, the EU wanted a deal quickly to resolve the IRA dispute. Thierry Breton said Europe must draw from the US law “without emulating all their elements”.

A draft version of the EU’s response to the IRA began to emerge in late January. An early leak included proposals for new funding for the green-tech industry to counterbalance subsidies in the US and China, Reuters reported. But diplomats told the publication that these proposals were likely to be changed before a meeting on 9-10 February.

The Financial Times said a later draft showed the commission planned to propose a relaxation of state-aid rules, including tax benefits, to support green-sector investment.

Reuters said the draft also showed that producers of technologies such as renewable hydrogen and batteries could receive faster permits in the EU. The newswire also reported that the commission would not propose any new joint EU borrowing for its plan.

This was confirmed when the final versions of the “Green Deal Industrial Plan” were released on Wednesday this week. The plan included proposals to increase levels of state aid to allow Europe to compete with the US as a manufacturing hub for electric vehicles, Reuters reported.

🇧🇪 As powerhouse of innovation and hub for renewables production, Belgium has all it takes to help shape the clean tech revolution.

— Ursula von der Leyen (@vonderleyen) January 26, 2023

So, glad to present our Green Deal Industrial Plan to the Belgian business community tonight, with PM @alexanderdecroo ↓ https://t.co/VDJ3PSwdKJ

Von der Leyen proposed loosening state aid rules for renewable energy investment until the end of 2025, the newswire continued, while also recognising that not all EU countries will be able to offer subsidies to the same extent as France or Germany.

Portugal’s finance minister had previously said the package should ensure that the “smaller European countries cannot lose to the larger countries in an internal competition”, according to an earlier Reuters report.

EU member states will decide whether they want to back the commission’s proposals at a summit on 9-10 February. In the days before this, Reuters said Germany’s economy minister and France’s finance minister will visit Washington to discuss IRA concerns with their US counterparts.

How has the UK reacted to the Inflation Reduction Act?

The UK government’s response to the IRA has been nowhere near as strong as the EU’s, but the measures have, nevertheless, caused a stir among politicians and industry groups.

Speaking at the World Economic Forum annual meeting in Davos, business secretary Grant Shapps described the IRA as “dangerous because it could slip into protectionism”, according to the Sun.

As reported by Reuters, chancellor Jeremy Hunt has also expressed his displeasure, telling journalists:

“Yes, we have some concerns about the Inflation Reduction Act and the reason is that we believe in free trade.”

The UK has “concerns” about the US government’s Inflation Reduction Act, Chancellor Jeremy Hunt tells @BloombergTV https://t.co/ma1Lb7Oao4 pic.twitter.com/IK0FVDQHoR

— Bloomberg TV (@BloombergTV) January 27, 2023

In a letter sent to US trade representative Katherine Tai, international trade secretary Kemi Badenoch wrote that the IRA would benefit “our most prominent competitors”, which the Daily Telegraph described as “a reference to China because of the threat to Western supply chains”. Badenoch also expected the UK to receive special treatment, the paper reported, quoting her saying:

“The UK expects to be and should, as the closest of US allies, be part of any flexibilities in the implementation of the IRA.”

Former energy minister and “net-zero tsar” Chris Skidmore also sounded the alarm about the IRA in his independent review of the government’s approach to net-zero, released at the start of January.

The report mentioned the measures 22 times, alongside other major interventions by the EU, France and Germany. It emphasised the relatively weak position that the UK was in, compared to some of its economic rivals:

“In this context, the absence of long-term funding commitments to some of the major technologies we know will be required by the UK appears to be creating unnecessary uncertainty and risk.”

A Daily Telegraph article noted that the UK is at risk of being “caught in the crossfire” of a subsidy war, as EU nations plan to take firm action in response to the US measures.

Meanwhile, industry groups have warned that clean-energy companies are already starting to choose the US over the UK. In response, the nation should “send its own bold investment signals to maintain its leadership position”, according to Alistair Phillips-Davies, chief executive of energy firm SSE, quoted in the Times.

In an article about the collapse of the electric car battery startup Britishvolt, Politico referenced the IRA and efforts in mainland Europe to pump money into similar ventures. “The clock is ticking for the UK to up its game”, it stated.

Despite the UK’s relatively muted response to the IRA so far, Bloomberg reported that the nation was “continuing to express its concerns privately to the US”. It said business and trade ministers had been holding meetings with their US counterparts, and hoping that their grievances would be addressed.

Meanwhile, the opposition Labour party has begun to spell out its case for more decisive action. According to the Financial Times, shadow climate and net-zero secretary Ed Miliband has stated that “the government should be acting with a British version of the Inflation Reduction Act”.

How have other parts of North America reacted?

The Canadian government’s “fall economic statement” last November made clear that it was taking the actions of its powerful southern neighbour seriously:

“In light of the US IRA, significant steps will need to be taken to ensure that Canada remains competitive in North America and the world.”

Specifically, it announced plans to establish “an investment tax credit of up to 30% for investments in clean technologies…battery storage solutions and clean hydrogen”, framing this as a direct response to the IRA.

Canadian prime minister Justin Trudeau had previously put more of a positive spin on the IRA than the leaders of some other nations, describing it as “raising the bar in a great way”.

According to CBC, Trudeau stated that the reason the US had to introduce such significant measures was because, unlike Canada, “they don’t have a price on pollution”. He added that “they are starting to catch up to where Canada is”.

(It is worth noting that Canada has repeatedly failed to meet its climate targets and has the worst record of any G7 nation for cutting emissions since the Paris Agreement was signed.)

However, Canadian finance minister Chrystia Freeland also acknowledged that there were “elements” of the IRA that Canada needed to “respond to”, according to Reuters. On top of the fall economic statement measures, she said there would be “further action in the budget in the spring”.

The government has been under pressure from business leaders who have argued that there is no time to waste, according to BNN Bloomberg. The outlet reported that industry group the Business Council of Canada said Freeland should move the budget date into February instead of March or April

At the same time, the US’ neighbours have explicitly welcomed elements of the IRA that directly benefit them.

After concerns that electric-vehicle tax credits in the act would only apply to US carmakers, instead the final wording specified “North American” companies, opening it up to Canada and Mexico.

This was celebrated by the Mexican economic ministry, which released a statement saying “in our region, we produce together to compete globally”, according to Mexico Business News.

IRA tax credits are also dependent on critical minerals in electric-vehicle batteries coming from not only the US, but also countries with which it has a free-trade agreement, such as Canada and Mexico.

How have major Asian economies reacted?

China

Commentators in China have reacted adversely to the IRA, with experts labelling the law as “naive”, “deceptive” and “likely [to] provoke a global trade war not seen since the end of the World War II”. Simultaneously, many have called for the EU to “join hands” with China and other “emerging market economies” against the US move.

For example, an article in state-run newspaper China Daily quoted Yan Shaohua, an associate professor at Shanghai’s Fudan University, who said:

“[I]t is important that the EU’s response does not reflect a zero-sum thinking as the US does. China and the EU have more consensus and common interests than differences in the area of the green transition. Both sides should work together to make sure that their competition serves not only their national interests but also the common good of our planet.”

A comment in the government-supporting Global Times by researcher Zhigao He drew connections between the war in Ukraine and US-EU relations. He wrote: “Europe is not only facing the impact of the Russia-Ukraine conflict, but also suffering the backlash of America First” and that “the US reaps the benefits while Europe swallows the bitter fruits.”

An earlier piece in the Global Times by Zhao Yongsheng in January warned that “the IRA not only targets European new-energy vehicles (NEV), but the entire European industrial chain”. He added that “only when European countries join forces with other economies, they may be able to form a considerable constraint on the US…and [force] it to implement at least partial exemptions for China and European countries in NEVs and green energy.”

A Global Times editorial two weeks ago said that “clean tech may become a spotlight of the mutual cooperation between the two sides [the EU and China]”.

South Korea

Reactions from other major Asian superpowers, particularly South Korea, have been largely negative.

In an interview with Euractiv, South Korea’s trade minister Dukgeun Ahn pointed to the “myopic” and “discriminatory structure of the law” which could affect European and Korean producers. Ahn called for the EU to work with Korea “to make the [IRA] system more compatible with the WTO, so as not to cause unnecessary trouble to strategically important parts of our industry”.

At the same time, the outlet reported Ahn remarking that while the EU “has long been a very important gatekeeper for the world trading system based on the rule of law”, many of its own proposals “incorporate the similar kind of spirit of the IRA”. It quotes him saying:

“In case the EU steps across that limit, we will have to deal with the opening of Pandora’s box. Japan, Korea, China, every country will engage in this very difficult race to ignore global trading rules, which we spent the past few decades to build.”

An article in the Diplomat from September last year outlines the “friction” the IRA has caused in US-South Korea relations and that “South Korea’s concerns extend beyond the details of the Inflation Reduction Act”.

According to the piece, “Seoul has worked with the Biden administration to deepen the economic relationship between [both countries], specifically on supply chain resilience, semiconductors, and climate change”. It continues that “South Korean firms have made a series of significant investment commitments in the US”, which are now at stake.

A story in the Financial Times around the same time said that “Seoul is furious that EVs manufactured by Hyundai in South Korea will be excluded from generous consumer tax credits”.

An editorial by the East Asia Forum said that “from architect-in-chief to enforcer-in-chief, the US has become spoiler-in-chief of the international trade regime”.

Meanwhile, Brad Glosserman, deputy director of a Tama University thinktank, commented in the Japan Times that while “a race to the bottom to attract green industries will [arguably] lead to duplication and waste…[t]he world needs as much green investment as can be mustered; any waste from competing subsidies will be utterly overwhelmed by the costs of climate change”. Efficiency losses, he wrote, “are the equivalent of change lost in sofas”.

India

In India, the IRA has received a muted media reaction, but the government has responded via a budget that places “green growth” and subsidies for domestic renewables production front-and-centre.

In a piece in Time magazine, Amitabh Kant, India’s G20 sherpa, described the IRA as “the most protectionist act ever drafted in the world.” He added:

“You don’t [decarbonise] by being uncompetitive and doing something which you’ve been against all your life. You believed in market forces and now you do this?”

Kant called on the US to rethink its legislation that favours its own manufacturers and “find a way out for its trusted partners”, including India. India is the current G20 president and Kant said he is keen that the forum be used to discuss issues, resolve differences and develop “rules of the road for so-called green hydrogen” that India, for one, wants to export to the world.

Business paper Mint, in a recent editorial, pointed out that the IRA is part of a US strategy of “friendshoring”. It argues that India should, instead, build up its own manufacturing prowess as the answer to the IRA, because “companies know all too well that there are never permanent friends”.

Mint added that “for all the noises being made about the rise of a new global order in which geopolitics will dictate supply chains”, it was difficult to imagine any significant realignments beyond “minor adjustments that make commercial sense and reduce the risk of zero-Covid type disruptive policies to corporate profits”. It continued:

“Which government – how long can even the US go on spending billions on subsidies and tax credits – in today’s world of precariously high public debt levels is in a position to compensate companies for staying away from the cheapest sources of inputs and technology and falling in line with choices dictated by geopolitical calculations?”

Avantika Goswami, programme manager for climate change at thinktank CSE, described the law as “a belated effort by the US to meaningfully invest in decarbonisation, albeit at a scale far below its fair share”. However, she added that “it’s not the worst thing to have the biggest climate perpetrator pursue green industrial policy”. Goswami tells Carbon Brief:

“The US has allocated billions in tax breaks for domestic companies and consumers, which is a reversal in its decades-long stance on free trade. It has sparred with India at the WTO on subsidies in the past, for domestic solar manufacturing, for example.

“Global south countries such as India should then be allowed to do the same and grow their own domestic green industries and collectively negotiate for more equitable trade terms.

“While the US has indicated that India is a part of its ‘friendshoring’ efforts, it is too early to tell how our export revenues or market share will be affected as a result of greater onshoring.”

Others believe that the IRA has opened up a “new and interesting space” for domestic political and policy conversations, with a range of risks and caveats. The Centre for Policy Research’s Prof Navroz Dubash, for instance, sees the IRA as a shift in policy emphasis towards a “transition framing” of the climate problem.

It is a framing he thinks could bring about a low-carbon transition through means that include “technology development and deployment, rather than one driven largely by market actors reacting to market signals, albeit supplemented by a carbon price”.

The former, he tells Carbon Brief, sees a “steering and picking winners role for the state”, while the latter implies “a price-and-disappear’ role for the state”. Dubash adds:

“The demonstration effect of the IRA on other countries is likely to be considerable, and, I think, positive. It is now respectable again to think of green developmental states. From a practical perspective, the scale of the US and its domination in the innovation ecosystem means that there are likely to be a stream of positive global externalities through technology spillovers.”

The risks that include trade conflicts, however, are not small and the conditions under which such “green developmental states” can work are limited, he warns:

“They need to have enough of a fiscal war chest to deploy, they need information to support the private sector, yet not being so much in bed with them so as to be captured.

“Only a few countries can be leaders in new technologies and not everyone can be a winner; it may be particularly hard for poorer and smaller nations. The arrangements of states working with industry for green transformation may also concentrate the gains of that transformation. Green crony capitalism is a real risk.”

What does the US make of the global response?

The US has issued strong statements defending the measures outlined in the IRA, while also seeking to reassure and offer concessions to countries through bilateral meetings.

Back in November, former US vice president Al Gore defended the IRA as a “truly historic accomplishment” in the fight against climate change and challenged the EU “to match what the US has done” rather than “fight” it, Politico reported.

In December, Biden held a bilateral meeting with Macron, where he said he made “no apologies” to Europe for the IRA, but acknowledged there were “glitches” that he saw as fixable. He told the French president:

“But the essence of it is: we’re going to make sure that the US continues – and just as I hope Europe will be able to continue – not to have to rely on anybody else’s supply chain.

“So, there’s tweaks that we can make that can fundamentally make it easier for European countries to participate and/or be on their own. But that is something that is a matter to be worked out.

“There is no fundamental – it was never intended, when I wrote the legislation – I never intended to exclude folks who were cooperating with us. That was not the intention.”

In January, a feature in Time magazine captured a mood of exasperation in the US in response to international criticism of the IRA. The feature reads:

“The attacks are, on their face, startling. The US has faced criticism for decades for failing to implement policies to cut its emissions and address the scale of climate change. Now it is being attacked for doing just that.”

The feature added that, following the meeting with Macron, the Biden administration has “sought to take the edge off” the law with some concessionary measures. It explained:

“Guidance released by the Treasury Department in late December suggested that the US would try to take a flexible approach as it implements the IRA’s auto provisions.

“But for the most part the US remains adamant that the law is actually a huge boon to other countries. The enormous American investment in the IRA will bring down the cost of clean energy technology not just for the US but also for the rest of the world. In doing so, officials say, the US is footing the green energy research and development costs bill for everyone else.”

An explainer in the New York Times added that “the US and European Union have been searching for changes that could be made to mollify both sides before the US tax-credit rules are settled in March”, but that the “Biden administration appears to have only limited ability to change some of the law’s provisions”. It added:

“Members of Congress say they intentionally worded the law to benefit American manufacturing.”

On 17 January, US trade representative Katherine Tai told journalists in Brussels that the country had placed “highest priorities” on addressing EU fears over the IRA, Reuters reported.

A day later, US special climate envoy John Kerry told a crowd at Davos that Europe could do more to match the US on green spending, according to the FT.

Referring to green subsidies, he said:

“Our point of view is that we need more of it…Europe already spends an enormous amount of money, but let’s go folks. All of us need to be doing more.”

How has the media reacted?

The global furore over the IRA has sparked a wave of newspaper editorials and comment pieces in Asia (see: How have major Asian economies reacted?), Europe and the US.

An editorial in the FT published in January urged the US and the EU to find “common ground on subsidies”. It said:

“The IRA was, no doubt, a wake-up call for Europe to go further on its existing climate change efforts, but if the collateral damage is a collapse in the US and the EU’s relationship, and a race to the bottom on competition rules, it will come at a severe cost.”

Separately, the FT published a column by its European economic commentator Martin Sandbu, which said the EU “should welcome a green subsidy race”. He argued:

“The disagreements all revolve around one big difference of judgement as to which of two dangers is the greatest: the competitive threat to EU industry or a subsidy race to the bottom? The problem for cogent decision-making is that both ‘dangers’ are misconceived.

“To see US spending on greening its energy, industry and transport as a threat reveals a European inferiority complex. The real threat is that the US fails to make good on its belated intention to address climate change. With debt ceiling politics kneecapping Washington’s ability to spend even what it has already budgeted, it is misplaced to fear it is doing too much.”

He added that one of the EU’s largest fears about the IRA – that it will convince European companies to do business in the US – appears misguided:

“The idea that there is only so much investment to go around in the world is a lump of investment fallacy…The task is not to stop a European company from building a wind farm, battery factory or electric vehicle plant in the US, but to ensure they get built in Europe regardless.”

Elsewhere, an editorial in the Economist described the IRA as “ambitious, risky and selfish”. It said:

“Biden is taking an epoch-making political gamble. He is acting on so many fronts because he had no choice. The only way to build a majority in Congress was to bolt a Democratic desire to act on climate change on to hawkish worries about the threat from China and the need to deal with left-behind places in the American heartland. On its own, each of these concerns is valid. But, in terms of policy, the necessity to bind them together has led America into a second-best world. The goals will sometimes conflict, the protectionism will infuriate allies and the subsidies will create inefficiencies.”

In the Spectator, assistant editor Cindy Yu argued that the US’s stipulations on EVs (see: Why is the US Inflation Reduction Act causing a stir in other countries?) exposed its willingness to betray allies in the green industrial fight. She wrote:

“Whatever happens, this episode seems to confirm an uncomfortable suspicion for those in Brussels, Seoul and beyond: that, though the US is rallying supporters in a global contest against China, it will still sell out its allies when American interests are at stake. Perhaps the most effective counter to ‘America First’ is for others to put themselves first – and spend accordingly.”

In the Daily Telegraph, world economics editor Ambrose Evans-Pritchard described the IRA’s “protectionist” measures as an “outrage”, but added “Europe is learning to love it”. He said:

“Eurocrats like the IRA because it opens the door to new EU slush funds along the lines of the €800bn pandemic Recovery Fund. These fall under the control of the Commission and serve as a stealth tool for centralisation and creeping fiscal union.”

But he added that countries outside of the US, the EU and China may suffer as the big powers escalate their efforts to attract clean energy business:

“Biden’s protectionism may end up being a blessing so long as he does not push it too far. But the stark division of the global trading system into three giant blocs pursuing fortress green strategies is more than awkward for the rest of the world, watching from the sidelines with dismay.

“The middle powers will have to match them with a criss-cross alliance of their own, assembling an even larger bloc with even greater market muscle.”

Elsewhere, several comment pieces have examined how an escalating green trade war between the US and the EU might affect efforts to reach net-zero in the UK.

In the i newspaper, chief political commentator Paul Waugh said that the “race for green jobs” will “squeeze” the UK. But “Biden’s climate change plan isn’t a threat to the UK, it’s an opportunity,” he added.

Sky News business presenter Ian King published an analysis arguing that, caught between the US and the EU, the UK is “at risk of being tossed like a cork on the high seas”. He argued:

“The problem is that, with the public finances shattered by the pandemic and now under strain due to both surging debt servicing costs and the cost of subsidising energy bills, the UK is in no position to throw as much money at green subsidies as either the US or the EU.”

“All is not lost, though,” he continued, arguing that the UK could make “smart fiscal choices rather than believing we can outspend the competition”. He added:

“The question is whether the political willpower exists to do this.”

Elsewhere, Sunday Times associate editor Oliver Shah argued that Biden’s “big green bazooka” has highlighted the UK’s failures in providing attractive policies for clean-energy investment. He wrote:

“Time is running out for the Tories to jettison the bad ideas and string the good ones together into a vision that makes sense. Government is never the source of growth, but the IRA shows how powerful it can be as an enabler.”

Guardian economics editor Larry Elliott agreed that the IRA shows that the UK is “thinking small”. He argued:

“Realistically, a different approach will require a change of government, and it was notable that [UK Labour Party leader Keir] Starmer used his visit to Davos to promote his idea for a green prosperity plan – a blueprint for a net-zero transition that would require a more activist state.”

In the Observer, chief political commentator Andrew Rawnsley said that, when it comes to green spending, the US is “out the blocks”, the EU is “hurrying along the track”, China is “competing too” and the UK “still hasn’t tied its shoelaces”.

Across the Atlantic, an editorial in the Washington Post argued that the “Europeans have a point” about Biden’s “America-first” climate plan. It said:

“The IRA’s ‘incentives’ violate the spirit, and maybe the letter, of international trade laws the US itself did so much to create and pledged to follow…The Biden administration should try to implement the law in such a way as to permit more European market access.”

However, an editorial in the Wall Street Journal in December expressed little sympathy for “complaints from European and Canadian leaders”. It continued:

“As for ‘climate protectionism’, Europeans also play the game. Europe is planning to implement a carbon border adjustment tariff on imports produced in countries with higher CO2 emissions, including possibly the US.”

(A second Wall Street Journal editorial published in February appeared to change tact, saying that Europe is “understandably upset at the IRA’s raw protectionism”.)

-

Media reaction: US Inflation Reduction Act and the global ‘clean-energy arms race’