Analysis: Switch to electric vehicles would add just 10% to UK power demand

Simon Evans

07.27.17Simon Evans

27.07.2017 | 5:21pmEarlier this week, UK environment secretary Michael Gove announced plans to ban the sale of new petrol and diesel cars by 2040.

The proposed ban, which may be less stringent than it first appears, has nevertheless sparked a deluge of news and comment. Many reports include concerns – or inflated claims – over the demand for power if the UK switches to electric vehicles (EVs).

Yet a wholesale move to EVs, in order to meet a ban on petrol and diesel cars, would add just 10% to UK electricity demand, new analysis from consultants Cambridge Econometrics shows. This would also dramatically cut car CO2 emissions, even after accounting for electricity generation.

Carbon Brief runs through the results and looks again at the debate over EV power demand.

Sales mix

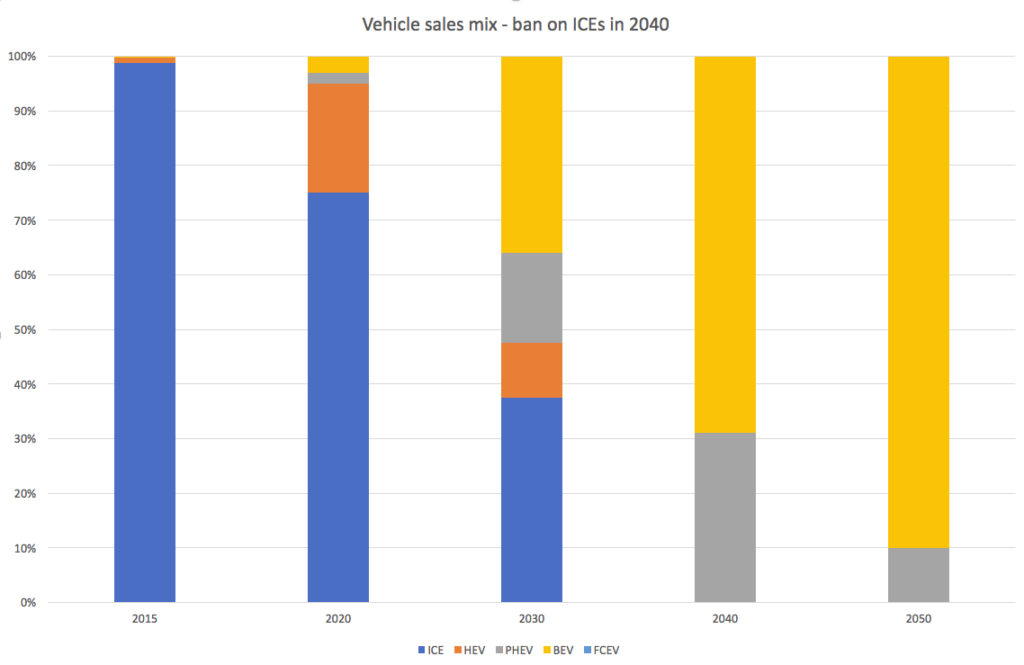

In its model, developed for a 2015 report, Cambridge Econometrics assumes there is gradual progress towards a ban on sales of internal combustion engine (ICE) cars in 2040.

Given the lack of clarity over what type of cars will be covered by the ban, it simply assumes that hybrid petrol and diesel cars (HEV) are included, but plug-in hybrids (PHEV) are not. Ultimately, battery electric vehicles (BEV) dominate new sales.

The chart below shows the changing vehicle sales mix in the model.

Shares of car sales in selected years in a model that imposes steady progress towards a petrol and diesel ban in 2040. ICE is internal combustion engine; HEV is hybrid electric; PHEV is plug-in hybrid; BEV is battery electric and FCEV is fuel-cell electric vehicles. Source: Cambridge Econometrics E3ME model.

Cambridge Econometrics also explored the impact of an earlier ban on new ICE cars and vans, kicking in by 2030. The sales mix changes in a similar way, except BEVs take over earlier on. Next, the model looks at how new sales filter through the UK vehicle fleet, using data on average lifetimes and turnover rates.

The model then uses average vehicle tailpipe emissions and data on electricity demand per kilometre to estimate the environmental impacts of this overall fleet.

CO2 emissions

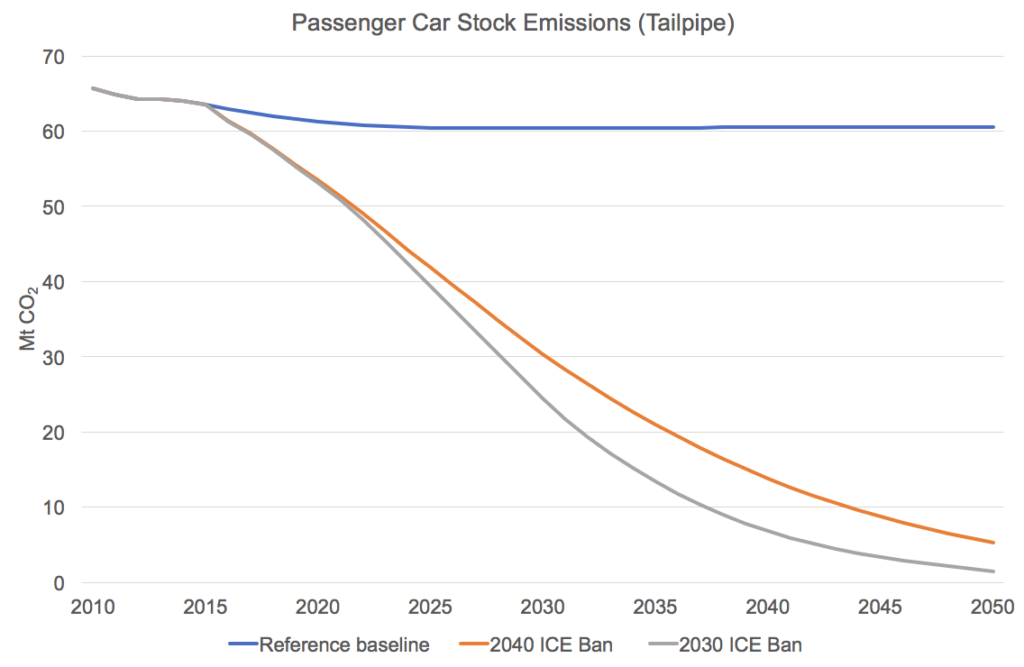

Domestic transport currently emits around 120 million tonnes of CO2 (MtCO2) per year, roughly a fifth of the UK total. Tailpipe emissions from petrol and diesel cars accounts for around half of this, a little over 60MtCO2 per year.

For either ban year, a rise in electric vehicle uptake dramatically cuts these emissions, the Cambridge Econometrics modelling shows. If, on the other hand, there were no improvement in car emissions and the sector continued to emit 60MtCO2 each year, this would be equivalent to half the UK’s total carbon budget in 2050.

The Committee on Climate Change (CCC) suggests a more stringent 91% emissions reduction target for 2050 would be the midpoint of ambition needed to stay in line with the 1.5C of the Paris Agreement on climate change. In this case, 60MtCO2 from cars would make up more than 80% of the UK’s carbon budget in 2050.

These examples illustrate why, as Gove told BBC Radio 4 this week: “There is no alternative. We can’t carry on with diesel and petrol cars, not just because of the health problems they cause, but also because the emissions that they cause would mean that we would accelerate climate change, do damage to our planet and to the next generation.”

Returning to the new modelling, a 2040 ban on new sales would cut tailpipe emissions to around 14MtCO2 in 2040, while a 2030 ban would see them fall to around half that level, or 7MtCO2 (see chart, below).

Tailpipe emissions would continue to fall after the ban on new sales kicks in, as zero-emissions EVs work their way through the stock of cars and plug-in hybrids lose market share.

Tailpipe CO2 emissions from the UK’s car fleet if car standards stand still at current levels (reference baseline), or with a 2030 or 2040 ban on petrol and diesel cars. Source: Cambridge Econometrics E3ME model.

Generating CO2

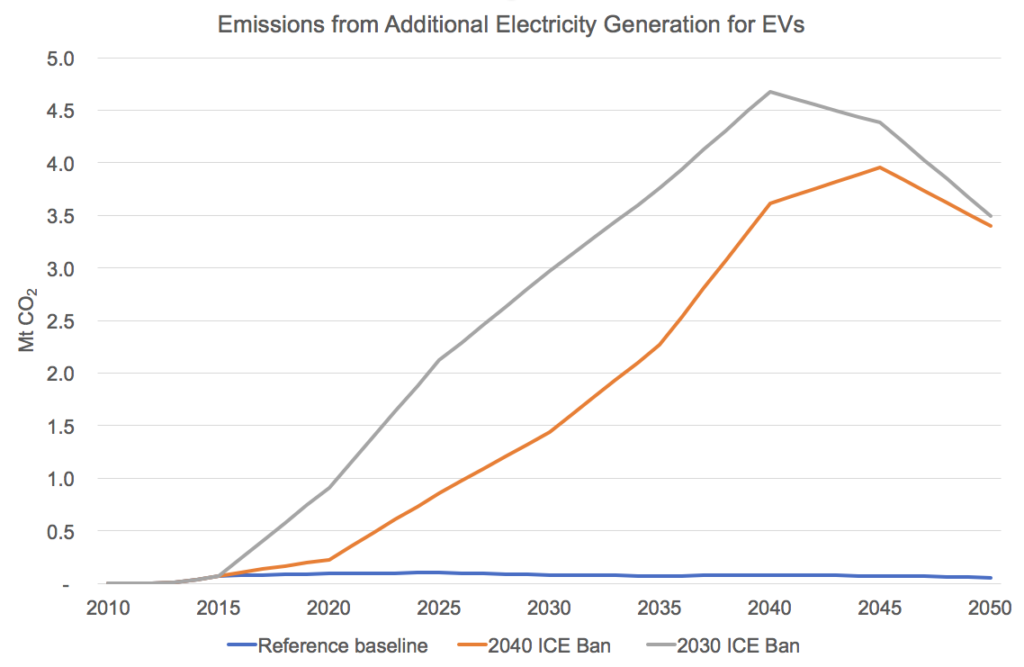

The additional electricity demand from EVs could increase emissions in the power sector, depending on how the electricity is generated. This would partially offset the gains in tailpipe emissions, but only to a very limited extent, according to Cambridge Econometrics’ model.

For example, with a 2040 ban, tailpipe emissions fall to 14MtCO2 that year, with additional power sector emissions adding just 4MtCO2 to the total (see chart, below). This limited impact is partly down to expected improvements in the emissions rate of the power sector, which is gradually cutting the amount of CO2 per unit of electricity, in line with UK climate goals.

Power sector CO2 emissions due to electricity demand for EVs in the UK’s car fleet, if car standards stand still at current levels (reference baseline), or with a 2030 or 2040 ban on petrol and diesel cars. Source: Cambridge Econometrics E3ME model.

Note that EVs offer CO2 savings even under relatively CO2-heavy electricity grids including coal-fired generation. This is because EVs are more efficient than combustion-engine cars. Similarly, the CO2 associated with manufacturing EV batteries is more than offset by savings during EVs’ lifetimes.

A comprehensive literature review from the International Council on Clean Transportation (ICCT) says EVs offer CO2 savings of 40-50% compared to average combustion engine vehicles. This includes full lifecycle emissions including manufacture, use and electricity generation, based on an EU average grid mix. This means EVs could cut global emissions by 1.5 billion tonnes of CO2 per year in 2050, a second ICCT study says.

Cumulative CO2

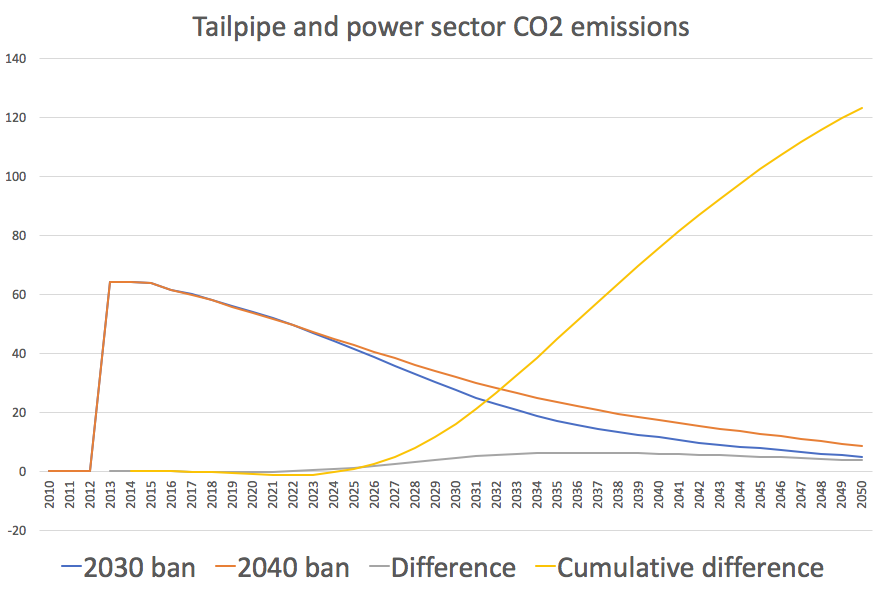

A 2030 ban on new sales would force earlier adoption of zero-emissions vehicles, aiding UK progression towards its carbon targets. For comparison, the CCC says close to 100% of new sales should be zero-emissions by 2035, if the UK is to stay on track with its goals.

There is a relatively small difference in emissions between the 2030 and 2040 ban scenarios modelled by Cambridge Econometrics. However, this small difference could still be significant when compared to the UK’s shrinking carbon budgets, which reach around 120MtCO2e in 2050.

Adding together savings at the tailpipe, minus extra emissions from power stations, a 2030 ban would cut UK CO2 by an additional 6MtCO2 in 2040, compared to a ban that only begins in 2040 (grey line, below). This is equivalent to roughly 2.5% of the UK’s carbon budget in that year.

Cumulative savings could reach 123MtCO2 by 2050 (yellow line, below), if there is an earlier 2030 ban instead of the currently proposed 2040 date.

Total CO2 emissions associated with the UK car fleet from tailpipe and electricity generation under a 2030 or 2040 ban (red and orange lines). The difference in emissions between the two scenarios is shown in grey and the cumulative difference in yellow. Source: Cambridge Econometrics E3ME model.

Electricity demand

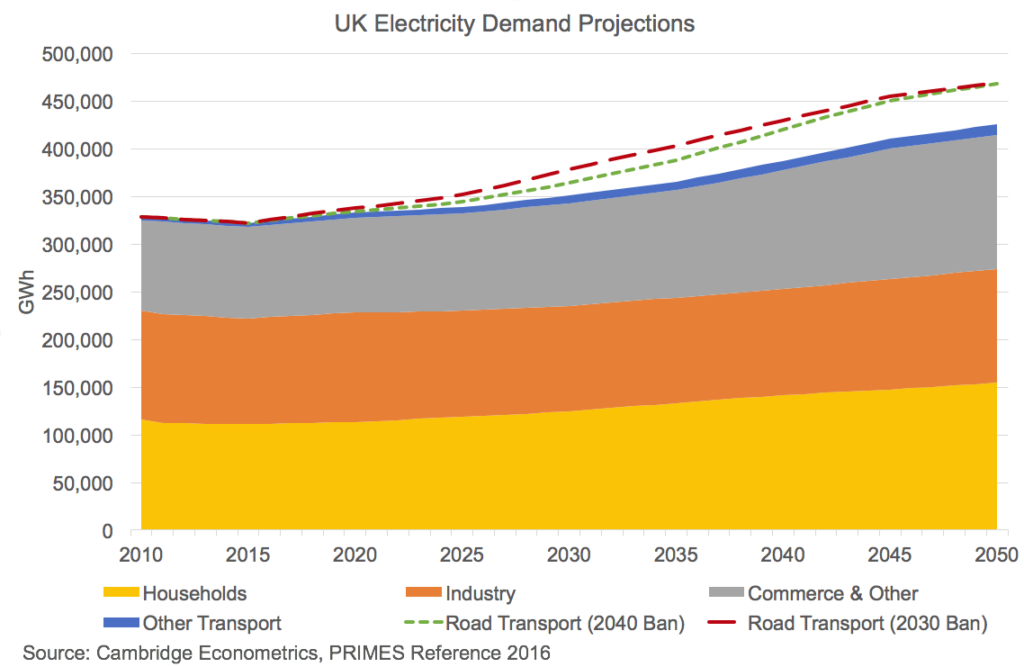

The demand from EVs also increases overall UK electricity needs. However, total demand would only increase modestly, by around 10% in 2050, the Cambridge Econometrics modelling suggests.

In total, EV electricity demand would rise to 40-45 terawatt hours (TWh) per year. In the context of overall rising demand, this amounts to just 10% of the 2050 total. This range is in line with National Grid scenarios, which suggest EV electricity demand of 35TWh in a 2C pathway and up to 46TWh in another scenario.

(On the other hand, electricity demand from oil refineries would be cut. In 2016, refineries accounted for around 5TWh of demand, BEIS figures show).

UK electricity demand by sector (blue, grey, orange and yellow areas) and the additional demand due to EV demand with a 2030 (red dashed line) or 2040 ban (green dashed line). Source: Cambridge Econometrics E3ME model and the EU PRIMES Reference 2016 scenario.

Peak demand

EV charging is expected to raise peak UK power demand, as well as increasing electricity needs across the course of a year. If EV charging is uncontrolled, this increase could be very substantial, placing undue strain on the electricity grid or requiring high levels of investment.

This worst-case scenario has been the focus for a number of news and comment articles, as well as wider commentary by radio and TV personalities, all presenting it as an inevitable consequence of a switch to EVs. The Telegraph, for example, says:

“The extra electricity needed will be the equivalent of almost 10 times the total power output of the new Hinkley Point C nuclear power station being built in Somerset.”

There are several unrealistic assumptions behind this misleading media narrative, which Carbon Brief covered in an earlier factcheck. Chief among them is the intuitively appealing idea that EV owners will all return home from work around the same time and immediately start charging their cars.

This simplistic view ignores the evidence from existing EV users. Some domestic customers already take advantage of dual-rate Economy 7 tariffs to charge their cars cheaply at night, while others plug in to public charging points while they are at work.

In fact, EV charging reaches a peak two hours later than expected, at 9pm, outside the period of overall peak UK demand, according to research for the electricity distribution firm UK Power Networks.

In addition, the research found that customers on time-of-use tariffs, where prices vary with the time of day, reduced their charging during peak periods by more than third, and up to 70% in some months, suggesting there is significant potential to shift demand in response to price signals.

Dr Liana Cipcigan, reader at Cardiff University’s Institute of Energy, has been researching how to integrate EVs into the grid for 10 years. During a secondment to the National Grid she contributed to its Future Energy Scenarios, looking at the range of peak demand EVs could require.

Cipcigan points to the huge difference between controlled versus uncontrolled charging, as well as the positive impact EVs can have. For example, charging can turn on or off to help balance the grid.

EV batteries can also feed power to the grid during peaks in demand. Cipcigan is looking at this so-called vehicle-to-grid concept, though some doubt it will be acceptable to consumers given repeated charging and discharging of batteries can reduce their lifetime. (Recent research suggests that, contrary to expectations, managed use of vehicle-to-grid could actually increase battery lifetimes.)

These pieces of work are among a large range of projects investigating the challenges from and solutions to large-scale EV charging. An Imperial College London study, for example, looked at EV charging in London while consultants EA Technology have developed a potential solution to congestion on local power grids due to EVs.

Earlier ban

In an article explaining its new analysis, Cambridge Econometrics says:

“Some have questioned why the ban is not being introduced earlier. The share of low and zero-emission vehicles will rise rapidly in any case, supported by European legislation, as electric vehicles become more attractive to consumers, with costs falling and battery range increasing.”

According to projections from analysts Bloomberg New Energy Finance, explored in a recent Bloomberg article, around 80% of cars sold in the UK are likely to be electric by 2040, even if there is not petrol and diesel ban. This would leave less than 20% of sales for internal combustion engine vehicles or hybrids.

The BNEF forecasts for EVs are among the most optimistic, with EVs reaching cost parity with petrol and diesel by 2022. A February Grantham Institute study sees them reach cost parity even sooner, in 2020. BNEF has published a useful comparison of different international-level EV outlooks, including its own and those from oil firms, energy agencies and banks.

Despite these optimistic outlooks, Cambridge Econometrics go on to say that there are challenges to a 2030 ban, which “need to be addressed to realise the benefits”. These hurdles include meeting the infrastructure and energy needs of EVs, as well as building a new manufacturing base and retraining the sector’s already-skilled workforce.

A Times editorial and a Guardian comment are among those arguing that the 2040 ban is too late, given the air pollution crisis facing the UK. The Times says:

“Ministers are under a legal obligation to cut [air pollution] emissions to safe levels in the ‘shortest possible time’. Waiting until 2040 does not fulfil that obligation and obvious ways to accelerate the process are being left untried.”

Both point primarily to the air pollution problem, as well as other nations, which they say have agreed to earlier bans. The UK announcement comes after a similar ban proposed in France.

However, frequently cited “bans” in some countries have yet to be formally agreed. The governments of Norway (2025), the Netherlands (2025), India (2030) and Germany (2030) are discussing ambitious ban timetables, though debates in these countries continue to rage.

For example, a 2030 ban in a draft German government plan was dropped while reports last year that Norway had already agreed a ban appear to be premature.

-

Analysis: Switch to electric vehicles would add just 10% to UK power demand