China Briefing 24 July 2025: EU-China climate statement; World’s largest megadam; Clean-tech exports

Anika Patel

07.24.25Anika Patel

24.07.2025 | 3:05pmWelcome to Carbon Brief’s China Briefing.

China Briefing handpicks and explains the most important climate and energy stories from China over the past fortnight. Subscribe for free here.

Key developments

New EU-China climate statement

CLIMATE STATEMENT: European Council president António Costa and European Commission president Ursula von der Leyen signed an EU-China agreement on climate with Chinese premier Li Qiang at today’s EU-China summit, following a meeting with President Xi Jinping. (The Chinese version calls the statement a “joint statement”, while in the EU version it is a “joint press statement”). In it, the two sides “agree to demonstrate leadership together to drive a global just transition” and promote “ambitious, equitable, balanced and inclusive outcomes” at COP30. The statement also highlighted an agreement to “facilitat[e] access to quality green technologies and products, so that they can be available, affordable and beneficial for all countries, including the developing countries”.

NO LANGUAGE ON COAL: According to a commission press release, the EU “reiterated its commitment to…enhance” climate cooperation with China, plus “encouraged China to propose an ambitious plan for its emission reductions up to 2035 and to step up its international finance contributions”. This echoed earlier comments to Reuters by EU climate commissioner Wopke Hoekstra that China must “take more of a leadership role” on climate action and “move out of the domain of coal”. However, the joint statement itself did not contain any language on coal. According to the statement, focuses for bilateral cooperation include the “energy transition, adaptation, methane emissions management and control, carbon markets and green and low-carbon technologies”, with the commission press release noting that the two sides had “intensive engagement” on emissions trading systems and the “circular economy” over the past 18 months.

CLEAN-TECH TENSIONS: The commission press release also noted that “current trade relations remain critically unbalanced”, with no further details on an expected agreement on electric vehicles. In an earlier meeting, according to state news agency Xinhua, Xi told his counterparts that “China and the EU should deepen green and digital partnerships and promote mutual investment cooperation”. It said he added: “It is hoped that the European side will keep trade and investment markets open, refrain from using restrictive economic and trade tools, and provide a favorable business environment for Chinese enterprises to invest and prosper in Europe.”

MEANS OF PRODUCTION: Earlier, China had issued “new restrictions” on technologies crucial to manufacturing electric vehicle (EV) batteries, reported the New York Times, with government licenses required for “any overseas transfer”. Cory Combs, head of supply chain research at consultancy Trivium China, told Carbon Brief: “My expectation is that Beijing will clear major Chinese producers to use their own tech in their own overseas facilities, but not to license to foreign competition”. He added that these restrictions were less likely to “impede climate cooperation” compared to the “massively disruptive” controls on exports of minerals and gallium metal extraction technologies.

Controversial ‘megadam’ launched

MEGADAM: Premier Li Qiang launched a “megadam” project, which is “expected to be the world’s largest hydroelectric facility”, on the Yarlung Tsangpo River in Tibet, reported the Hong Kong-based South China Morning Post (SCMP). It added that the project, which raised significant concerns when proposed earlier this year, could provide 300 terawatt-hours of electricity – “three times that of the Three Gorges dam” and roughly the same as the UK’s entire output. According to the Communist party-affiliated newspaper People’s Daily, Li “described [the dam] as a project of the century”, adding that “special emphasis must be placed on…prevent[ing] environmental damage”. The project could also help “bolster economic growth as current drivers show signs of faltering”, Reuters said. (See below.)

Sign up to Carbon Brief's free "China Briefing" email newsletter. All you need to know about the latest developments relating to China and climate change. Sent to your inbox every Thursday.

POWER ‘TORRENT’: Elsewhere, China has completed a 4,000km power transmission project in the Taklaman desert that will “create a torrent of green power” from renewable-energy rich Xinjiang province, according to Xinhua. The new infrastructure, which took 15 years to build, will “double transmission distance and boost transmission capacity” to three gigawatts (GW), allowing “connections to other regional power grids for long-distance power transmission”, SCMP reported. Separately, nationwide installations of solar capacity in June reached 14GW, down 36% year-on-year and down from 93GW of new solar in May, BJX News said.

INTER-GRID TRADING: Regulators approved a proposal by China’s two major grid companies to develop “routine power-trading” between different operators in China, BJX News reported, with the aim of strengthening China’s power supply. Business news outlet Jiemian said that, according to the grid operators’ plan, regulators will focus on “listed trading” (挂牌交易) of low-carbon electricity between specific provinces. A government official told industry outlet International Energy Net that the move was partially driven by the need to manage the integration of large amounts of new renewable energy capacity into the grid.

Clean-tech a key growth driver

LEADING THE PACK: According to an official at China’s National Bureau of Statistics (NBS), China’s “new-three” industries “continue to maintain high growth rates”, China Environment News reported. The climate-related news outlet quoted an NBS official stating that China’s new-energy vehicle (NEV) industry grew 36% and the lithium-ion battery industry grew 53% in the first half of 2025, compared to overall economic growth of just over 5%. Meanwhile, the number of patents generated by clean-tech companies has “doubled” since 2020, with “53,000 invention patents granted” in 2024, according to the state-run newspaper China Daily.

‘GREEN FINANCE’: China has released a catalogue clarifying which projects can receive “green finance”, reported BJX News, noting that the list includes manufacturing of lithium-ion batteries and other “power-industry equipment projects”. The catalogue “serves as a reference for the future issuance of green loans and green bonds” and should “boost liquidity in the green finance market”, according to China Daily.

NEW PLAYBOOK: A high-level meeting on “urban work” attended by President Xi Jinping ended by pledging that the “focus [of China’s housing industry] will be directed toward building green, low-carbon and beautiful cities”, state news agency Xinhua reported. Reuters said that the meeting underscored that China is “abandoning [a strategy of] breakneck urban growth that once super-charged its economy”. Output of the heavily polluting steel, cement and glass industries fell in June, driven by China’s ongoing housing industry slump, according to Bloomberg, although it noted “hot weather” had limited construction activity.

Captured

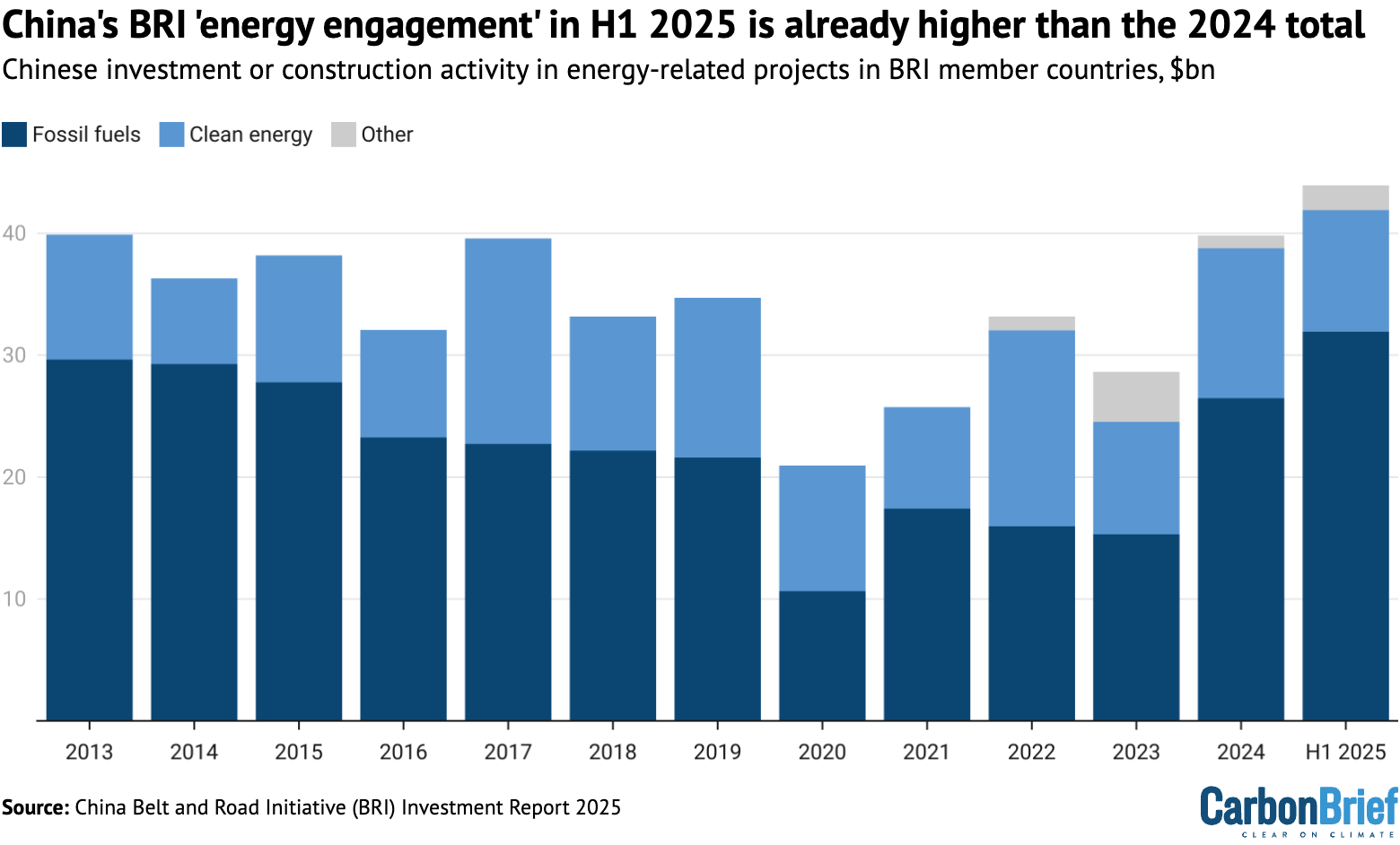

China’s energy-related investment and construction in “belt and road initiative” member states during the first half of 2025 (H1 2025) has already exceeded similar “engagement” in the whole of 2024, according to a new report. Clean-energy engagement in H1 2025 – particularly solar, wind and waste-to-energy – “reached new records” compared to the same period in previous years. Report author Prof Christoph Nedopil Wang told Carbon Brief that high oil and gas activity was “mostly explained by a single large gas-related construction project in Nigeria”, with clean-energy power outweighing fossil fuels in terms of newly added generation capacity.

Spotlight

Chinese clean-tech exports to cut emissions equal to Spain’s footprint

New analysis for Carbon Brief by Lauri Myllyvirta, senior fellow at the Asia Society Policy Institute, finds that the low-carbon technologies exported by China in 2024 alone could cut emissions overseas by 220m tonnes of carbon dioxide (MtCO2), roughly equivalent to Spain’s total annual CO2 output.

This issue features an abridged version of the analysis, which is available in full on Carbon Brief’s website.

China’s output of clean-energy technologies is enabling rapid deployment around the world, but their production is energy- and carbon-intensive.

Nevertheless, these clean-tech exports are having immediate global climate benefits – contradicting many commentaries linking China’s clean-tech boom to the sharp rise in its emissions.

Specifically, manufacturing clean-energy equipment for export resulted in an estimated 110MtCO2 of emissions in 2024, or just 1.1% of China’s CO2 from fossil fuels. Yet the solar panels, batteries, electric vehicles (EVs) and wind turbines exported in 2024 will avoid an estimated 220MtCO2 annually when put into operation overseas.

Moreover, these products will continue to generate emissions savings for as long as they continue operating, avoiding a cumulative total of 4bn tons of CO2 across their lifetime.

Looking beyond direct equipment exports, overseas clean-energy investments announced by Chinese companies in 2023-24, such as solar panel manufacturing plants, will generate another 90MtCO2 of avoided emissions per year, once the projects have been built.

In addition, overseas clean-power generation projects announced by Chinese investors in 2023-24 would save another 40MtCO2 per year.

Overseas footprint

China’s clean-energy footprint spans essentially the entire world, but in terms of resulting emission reductions, the largest destinations for China’s overseas clean-energy activity are south Asia and the Middle East and north Africa (MENA) region.

This reflects both the large volumes of Chinese clean-technology activity reaching these countries and their highly carbon-intensive power grids, which means that installing new solar panels offsets high-emissions generation, for example.

On the manufacturing side, Saudi Arabia is the main destination, with a major EV production facility, two solar factories and one for wind turbines. There are also a total of five battery manufacturing projects in Morocco and Oman.

OECD Europe is the largest destination for China’s exports and overseas manufacturing investments by value. However, relative to the volume of exports, the resulting CO2 savings are smaller than in other major destinations, due to lower carbon intensity of power generation.

Another way to look at China’s clean-energy exports and investments is to consider where they have the biggest emissions impact, relative to the total CO2 output in each region.

On a relative basis, sub-Saharan Africa stands out, in addition to MENA.

China’s clean-energy exports in 2024 alone, as well as 2023-24 investments, are set to cut annual emissions in sub-Saharan Africa by around 3% per year. This indicates a rapid uptake of solar power in the region, relative to the size of the region’s electricity systems.

Downstream opportunity

In 2024, clean-energy industries contributed more than 10% of China’s GDP for the first time, underscoring the country’s dominant role in the global manufacturing of certain low-carbon technologies and reinforcing its strategic interest in the continuation and acceleration of the global clean-energy transition.

On the surface, this dominance may suggest that other countries have limited economic opportunities in clean energy.

However, China’s involvement in global supply chains is still largely limited to exports and manufacturing, while most of the value is downstream – in project development, system integration, installation and end-user services.

For example, in 2024, China exported $177bn worth of solar panels, EVs, batteries and wind turbines.

By contrast, the downstream value of overseas clean-energy products and projects relying on Chinese components is an estimated $720bn annually, four times the value of the exported raw components.

Watch, read, listen

AIR-CON DEMAND: China’s “two new” programme could encourage more consumers to trade in their air conditioners for more energy-efficient units, reducing cooling demand by 4.1% this summer, according to a new report by thinktank Ember.

WINNING STRATEGY: Volt Rush discussed how China – and other countries – made solar energy “one of the cheapest sources of power on Earth”.

MERZ’S CHOICE: A comment by three policy experts for Dialogue Earth said Germany could become a “vital broker between Europe and China”, but must “step up” engagement with China on climate.

ENERGY SECURITY: Bashir Bayo Ojulari, head of the Nigerian National Petroleum Corporation, spoke with Xinhua about how other developing countries are “leveraging” China’s model of clean-energy growth coupled with a “reasonable mix of hydrocarbons”.

$7.6bn

The total economic losses caused by “natural disasters” in China in the first half of 2025, Reuters said, adding that “floods caused the most damage”. Regions across China have continued to suffer from extreme heat and deadly torrential rains over the past two weeks.

New science

Unveiling deployable rooftop solar potential across Chinese cities

Nature Cities

A new study on rooftop solar photovoltaics (RPV) in China found that “only 42% of the national technical potential is realistically deployable”. The paper assessed where RPV is deployable across 367 Chinese cities, considering factors including building type, “regional characteristics” and “policy limitations”. It found that, due to “regulatory factors”, deployable RPV is mainly found in urban public and industrial buildings, particularly in western, northern and central regions. They added that “to maximise value, initial deployment should prioritise public and industrial buildings in central and southern cities”.

Role of pumped hydro storage in China’s power system decarbonisation

The Electricity Journal

Developing 120GW of pumped hydro storage (PHS) – in line with China’s target for 2030 – will be “sufficient to balance electricity supply and demand by 2050” in the country, given expected growth in energy storage battery capacity, a new study said. The authors used a “high-resolution power system planning model” to assess the role of PHS in China’s power system. They argued that batteries are “emerging as a more economical solution” for energy storage compared to PHS, adding that “over-investment in PHS could lead to unnecessary electricity price inflation”.

China Briefing is compiled by Wanyuan Song and Anika Patel, with contributions from Ushika Kidd. It is edited by Wanyuan Song and Dr Simon Evans. Please send tips and feedback to [email protected]