G7 ‘falling behind’ China as world’s wind and solar plans reach new high in 2025

Molly Lempriere

02.10.26Molly Lempriere

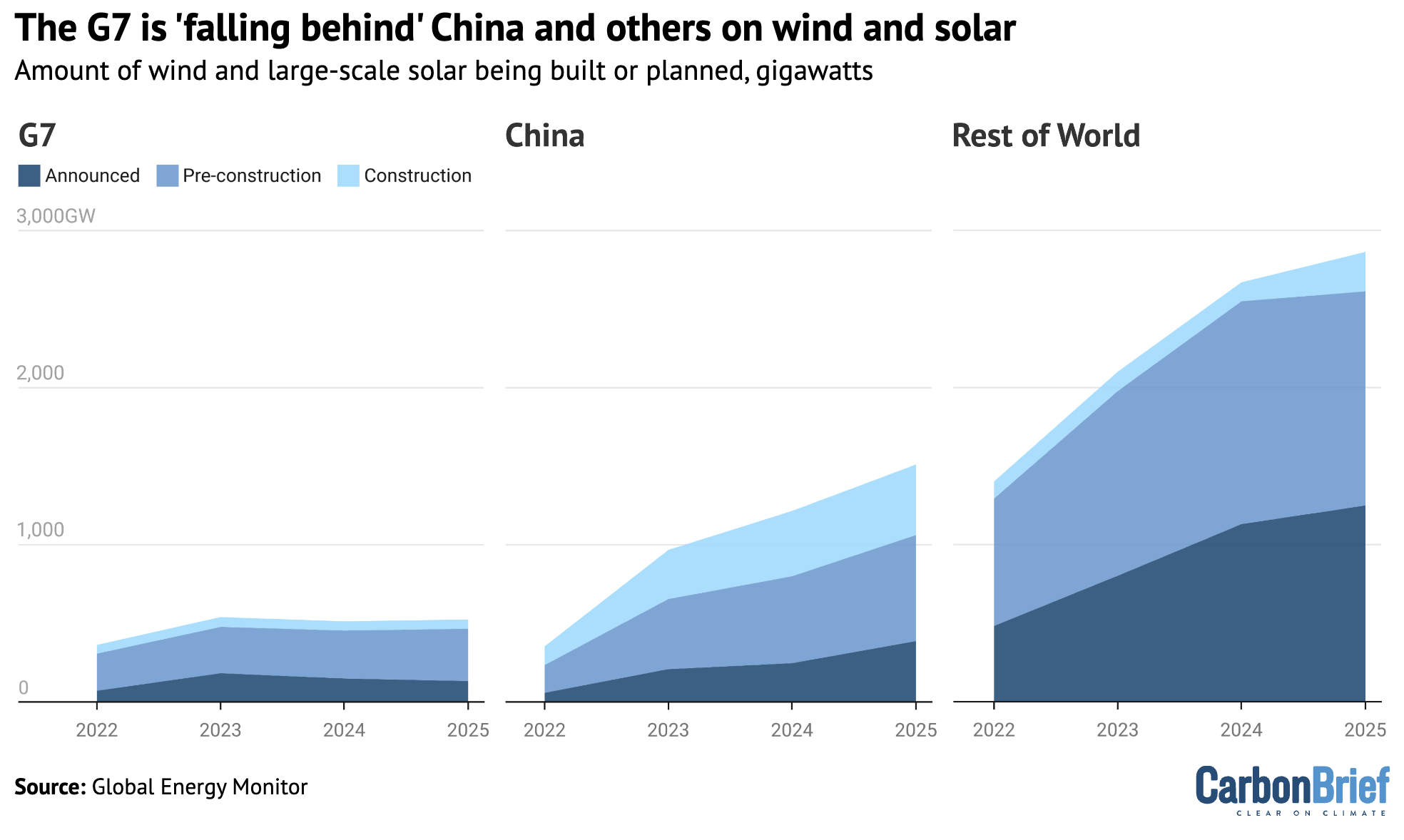

10.02.2026 | 12:01amThe G7 major economies “f[e]ll notably behind China and the rest of the world” in 2025 as the amount of wind and solar power being developed reached a new high, according to Global Energy Monitor (GEM).

A new report from the analysts says that the amount of wind and large-scale solar capacity being built or planned around the world reached a record 4,900 gigawatts (GW) in 2025.

This “pipeline” of projects has grown by 500GW (11%) since 2024, GEM says, with the increase “predominantly” coming from developing countries.

China alone has a pipeline of more than 1,500GW, equivalent to that of the next six countries combined: Brazil (401GW); Australia (368GW); India (234GW); the US (226GW); Spain (165GW); and the Philippines (146GW).

In contrast, GEM says that G7 countries – the US, UK, France, Germany, Italy, Canada, Japan – represent just 520GW (11%) of the wind and solar pipeline, despite accounting for around half of global wealth.

Diren Kocakuşak, research analyst for GEM, said in a statement that G7 countries risk “ced[ing] leadership” in what is a “booming growth sector”. He added:

“The centre of gravity for new clean power has shifted decisively toward emerging and developing economies. [In 2025] G7 countries, despite their wealth, fell notably behind China and the rest of the world in year-over-year prospective capacity growth.”

Moreover, while others have surged ahead, wind and solar plans in the G7 have remained largely unchanged since 2023, as shown in the chart below.

Of the 4,900GW of projects being built or planned and tracked by GEM, 2,700GW is wind and 2,200GW is large-scale solar.

However, the rate of expansion of the global pipeline for new wind and solar has slowed from 22% in 2024 to 11% last year, GEM says, with a more pronounced drop for wind projects. It adds that this was due to political barriers and a string of failed auctions.

For example, offshore wind subsidy auctions in Germany and the Netherlands in 2025 did not attract any bids, while an auction in Denmark was officially cancelled last year after there were no bidders at the end of 2024.

The report notes that the “growth trend of the prospective wind and [large]-scale solar pipeline is critical for meeting the COP28 commitment to triple renewable energy capacity by 2030, as the world enters the final five years of the implementation period”.

At COP28 in 2023, countries committed to tripling renewable energy capacity globally by 2030 from an unspecified baseline, generally assumed to be 2022.

According to the International Renewable Energy Agency (IRENA), the world would need to complete an average 317GW of wind and 735GW of solar capacity every year to reach this target.

Some 758GW of wind and large-scale solar was under construction in 2025, GEM says, with around three-quarters of this in China and India.

Both countries saw a reduction in the amount of electricity generated from coal last year, according to a separate recent analysis for Carbon Brief.

Note that GEM’s report predominantly uses data from its Global Solar Power Tracker and the Global Wind Power Tracker, the first of which only includes solar projects with a capacity of 1 megawatt (MW) and the latter with a capacity of 10MW or more.