HSBC outlines four ways to divest from fossil fuels

Sophie Yeo

04.24.15Sophie Yeo

24.04.2015 | 4:12pmThe divestment movement is gathering steam, with universities, cities, charities and pension funds under increasing pressure to move their money out of the fossil fuel industry.

Those behind the push have sold it as both an ethical and financial imperative. In the first case, investors should not be propping up an industry that divestment advocates say is responsible for the bulk of human-caused emissions.

In the latter, they argue that climate change regulations could lead to investments in the fossil fuel industry losing their value, since the majority of reserves cannot be burnt if the world is to avoid exceeding 2C of warming.

HSBC released a report on divestment last week, confirming that it sees the risk of stranded assets as a genuine threat for investors in the fossil fuel industry.

But the threat is not spread equally, it said, and nor is there one blanket solution to deal with it.

Carbon Brief looks at which investors are most at risk from the possible devaluation of the fossil fuel industry, and the different strategies that they can take to protect themselves.

What’s at risk?

Different types of oil come with different price tags. And the more it costs to get the oil out of the ground, the higher the risk of stranding, says the HSBC report.

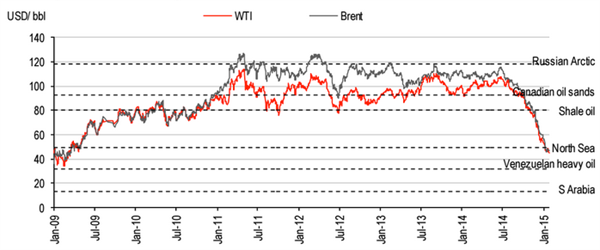

The chart below looks at the breakeven price of various types of oil, and how they measure up against the actual price of oil. Expensive extraction projects – such as the Russian Arctic, Canadian oil sands and shale oil – have become less economically attractive as the price fetched by a barrel of oil has plummeted.

The price at which oil breaks even, compared to actual price per barrel of oil. Source: Resources to Reserves, IEA 2013, Thomson Reuters Datastream/HSBC

At today’s prices, only Venezuelan heavy oil and Saudi Arabian oil are viable. The report predicts that, while expensive deepwater, US shale oil and Arctic ventures could be abandoned, the biggest threat to investors’ cash comes from oil sands. This is because it combines a high breakeven price with a particularly high carbon footprint.

According to another HSBC report published in March, this is already being played out with high-cost oil projects facing cuts in capital expenditure and widespread deferrals of new projects.

Research by Carbon Tracker Initiative shows that 92% of Canada’s future oil sands production would require a market price of $95 per barrel of oil in order to be sanctioned – and that, for some small players in the oil sands industry, 100% of capital expenditure is earmarked for this type of oil.

Subcritical coal plants also face a high risk of becoming stranded, as they use 75% more fuel and 67% more water than the most efficient coal plants. The report draws the following conclusion:

“As the most inefficient, they are most susceptible to climate and environmental regulation or, as they are typically the oldest stations in the fleet, to cost-efficient closure.”

It adds that Indian and Chinese power stations are most at risk from new regulation, due to water scarcity and poor air quality in these countries. In March, Carbon Brief looked at the rate at which coal plants were being cancelled compared to those being built, reporting that, for example, in India from mid-2012 to mid-2014, cancellations were occurring at a ratio of 6:1.

Managing the risk

The way in which investors can handle the risk of stranded assets is generally presented as a choice between two options: shareholders can either use their influence within the company to persuade it to manage the risk itself, or they can divest their holding in the company altogether.

But the choice for investors is not black and white, says HSBC. The bank recommends that investors devise a strategy to manage their exposure to potentially stranding assets, and sets four options on how they could potentially divest.

1. 100% divestment

The first option is 100% divestment, where investors shun all companies producing fossil fuels. The Guardian Media Group, the Dutch town of Boxtel and the Church of Sweden have chosen to divest in this way. “This removes downside risks attached to coal, oil and gas companies from portfolios,” says the report.

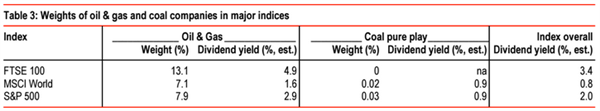

However, this type of divestment carries the greatest risk of an overly concentrated portfolio of investments, with fossil fuel companies constituting a large proportion of major indices, including the FTSE 100 (13.1%), MSCI World (7.1%) and S&P 55 (7.9%). The table below shows that fossil fuels still pay a higher average dividend yield than the average for the indices in which they sit.

Weighting of fossil fuel companies across major indices. Source: Thomson Reuters Datastream/HSBC

2. Partial divestment

The second option is partial divestment, or tilting. This means investors sell off the assets that they consider to be at greatest risk. HSBC sets out three ways to go about this.

An investor could broadly exclude all oil and gas companies by looking at stock market classification categories, although HSBC warns that this could make it difficult to manage the return on the investment.

The second option is to look at how much the revenue of an individual company relates to fossil fuels, and make a call based on what level the investor decides is acceptable.

The third is to assess individual projects and decide their likelihood of stranding, based on their breakeven price.

For instance, on the basis that they were likely to become stranded, Sweden’s Second AP Fund divested from 12 companies that made the majority of their turnover from thermal coal, and eight oil and gas companies that were substantially exposed to high-cost projects, including oil sands.

3. Supply chain based

Targeting large consumers of fossil fuels is a particularly effective way of managing the risk of stranded assets, says HSBC. This means moving money away from not only the companies who produce and extract fossil fuels, but also sectors such as power stations. The report says:

“We believe this strategy for divestment could be more effective because pressure is placed on a sector responsible for more emissions than any other and which can consider substitution to a low- or zero-carbon alternative.”

This method also makes it easier to target coal specifically, it adds, as divesting from mining companies often means divesting from the metals that they regularly produce.

Norway’s Storebrand Pension Fund is one investor that decided to divest from coal-heavy utilities.

4. Exclude worst offenders

The final approach outlined by HSBC is based specifically on the emissions levels of the projects undertaken by the companies. While coal is generally worse than oil, and oil is generally worse than natural gas, different methods of extracting and consuming fossil fuels lead to various levels of emissions.

The chart below shows that, in some cases, the cleanest coal is less polluting than the dirtiest natural gas.

Lifecycle greenhouse gas emissions for electricity generation (gCO2/kWh). Source: World Nuclear Association/HSBC

One approach, therefore, could be to exclude the “worst in class” natural gas, while keeping the least polluting coal.

Does it work?

The amount of money divested so far is a drop in the multi-trillion dollar ocean of the fossil fuel industry. The Guardian Media Group made the largest total divestment decision so far, yet its holdings in fossil fuels still fell at the low end of its £800 million investment fund. In August 2014, Bloomberg New Energy Finance priced the fossil fuel industry at $5 trillion (although the drop in oil prices means this has since fallen).

Nonetheless, HSBC believes that the movement could end up hitting fossil fuel companies, putting their projects into a financial stranglehold. The report says that the movement is currently at the beginning of a trend where:

“Less demand for shares and bonds ultimately increases the cost of capital to companies and limits the ability to finance expensive projects, which is particularly damaging in a sector where projects are inherently long term.”

The diagram below shows how this could play out in more detail.

The parth from divestment from reduced emissions. Source: HSBC

However, the number and value of fossil fuel industries that are publically listed is relatively small in comparison to those owned and funded by states, such as Saudi Aramco. This puts a structural limit on how hard the divestment movement can strike at the fossil fuel industry.

For the growing number of investors wishing to make an impression on the fossil fuel industry and protect their own financial future, the decision is not as simple as divest or engage. HSBC shows in its new report that there are options available to investors who may wish to manage their risk of stranded assets, but are not yet ready to say a final farewell to coal, oil and gas.