London imports climate change risks, warns capital’s Economy Committee

Robert McSweeney

07.23.15Robert McSweeney

23.07.2015 | 7:30amUpdated at 14:55 with a response from a spokesman for the Mayor of London.

Financial services and other businesses in London are increasingly vulnerable to climate change through their investments and supply chains that stretch across the globe, a new report from the London Assembly warns.

More than half of companies do not have an adaptation strategy to cope with climate change, says the report, led by Baroness Jenny Jones, Green Party member of the London Assembly. The report says this leaves London’s businesses “ill-prepared, and employees insufficiently skilled, to respond to the risks as they arise”, it says.

Among its recommendations, the report urges Mayor Boris Johnson to “commit to the principle of a transition away from investment in certain fossil fuels, namely coal”.

Climate risks

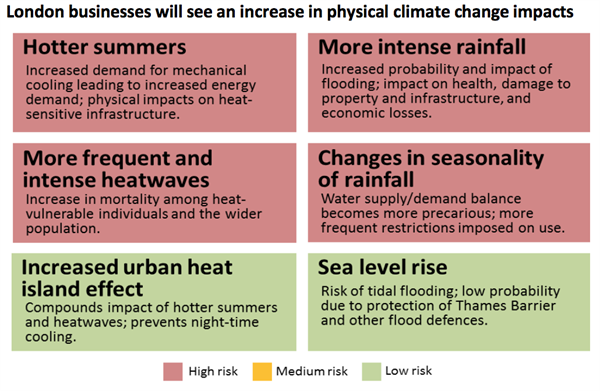

Sitting on an estuary with £200bn of property in the Thames floodplain, London already has its fair share of climate-related risks, such as tidal flooding, heatwaves and intense rainfall events. The graphic below shows some of the impacts that businesses in the the nation’s capital will need to cope with as global temperatures rise.

But a new report warns that the global reach of London’s economy means it’s also vulnerable to climate change impacts on the other side of the world.

Climate risks facing London’s businesses. Source: London Assembly Economy Committee (2015). Based on data from: Carbon Disclosure Project Cities 2013 report: Greater London Authority, 2013.

The report is produced by the Economy Committee of the London Assembly – a body of seven London Assembly members that “scrutinises the work of the mayor and investigates matters of importance to Greater London”.

Imports to London in 2014 totalled around £68bn in value, the report says. If the countries where these goods originate are hit by a severe weather-related event, London could be affected as well.

For example, Thailand manufactures around half of the world’s supply of computer hard drives. But flooding in 2011 left factories unable to run, leading to a 30% drop in global production and pushing hard drive prices up by 10%.

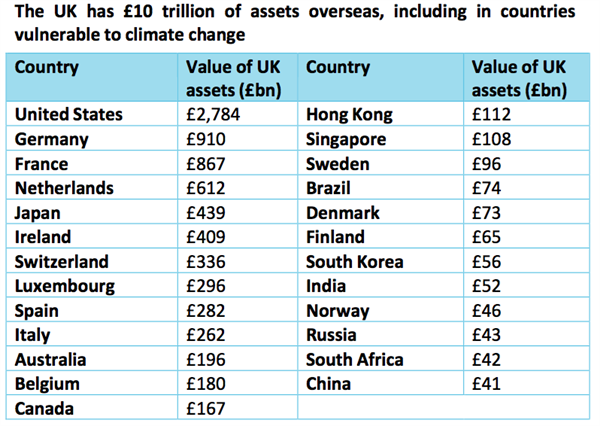

London’s financial services have around £10tn of investments held overseas, the report says, and many of these assets will be in countries more vulnerable to climate change than the UK.

Overseas investments held by UK firms. Source: London Assembly Economy Committee (2015). Based on data from: PwC, International threats and opportunities of climate change to the UK, 2013.

Many banks, insurers and pension funds hold investments in fossil fuels, says the report, exposing business to the risk of a “carbon bubble”:

In her foreword to the report, Baroness Jones warns that London is currently unprepared for these risks:

The report cites recent research from the Carbon Tracker Initiative, which found that 54% of FTSE 100 companies have not incorporated climate change adaptation into their business strategy. Small and medium firms are even less likely to have adaptation plans in place, despite being at greater risk from climate impacts, the Economy Committee says.

Recommendations

In producing the report, the committee collected evidence on London’s climate risks. This included holding two public hearings with experts and stakeholders, and receiving direct submissions from individuals and organisations – including Mayor Boris Johnson.

The committee’s report puts forward a series of recommendations to help ensure London is resilient to the risks that climate change poses. Many of these are laid at the Mayor’s door.

The committee suggests the mayor’s next Climate Change Adaptation Strategy for London should consider impacts on supply chains, markets and investments, for example. It also recommends the mayor launches an award for successful adaptation initiatives by London businesses.

More boldly, perhaps, the committee also suggests the mayor puts his support behind diversifying London’s economy away from fossil fuels:

The committee also recommends the London Pension Fund Authority does likewise:

Response

In a statement to Carbon Brief, a spokesman for the Mayor of London responded to the Economy Committee’s report:

The response outlines various steps that London is taking to adapt to climate change, including an infrastructure plan that includes measures for green infrastructure and sustainable energy, and the Drain London programme to help cope with surface water flood risk. The mayor is also supporting London’s businesses, the statement says:

The statement does not respond to the recommendation for London to diversify its economy away from fossil fuels.

The committee argues the recommended measures are necessary for London and its businesses to “develop a far-sighted, risk-based, adaptation plan to safeguard our future economy”.

With the international climate talks in Paris coming up in December, the committee says continued environmental commitments from the mayor “will ensure London continues to establish itself clearly as a world leader in the race to combat climate change”.

-

Financial services and other businesses in London are increasingly vulnerable to climate change through their investments and supply chains that stretch across the globe