Q&A: How countries are using biofuels to meet their climate targets

Aruna Chandrasekhar

10.08.25Aruna Chandrasekhar

08.10.2025 | 2:04pmFrom canola farmers in Canada to car owners in India, biofuels have become the subject of everyday debate across the world.

Liquid biofuels feature heavily in the climate plans of many countries, as governments prioritise domestic energy security amid geopolitical challenges, while looking to meet their climate targets and bolster farm incomes.

Despite a rapid shift towards electrified transportation, biofuels continue to play a leading role in efforts to reduce road-transport emissions, as they work well with many existing car engines.

At the same time, biofuels are expected to play an important role in decarbonising sectors where emissions are particularly challenging to mitigate, such as shipping, trucking and aviation.

Heated debates continue around using food sources as fuel in the face of record hunger levels, given competing demands for land and crops.

Despite these arguments, biofuels are seeing heightened demand bolstered by a strong policy push, particularly in developing countries.

They are expected to feature heavily on the COP30 agenda this year as a key feature of the host Brazil’s “bioeconomy”.

Below, Carbon Brief unpacks what biofuels are, their key benefits and criticisms, plus how they are being used to meet climate targets.

- What are biofuels?

- What are the most common biofuels being used today?

- What are the main arguments for biofuels?

- What are some of the main criticisms of biofuels?

- How are countries using biofuels to meet their climate targets?

- How could climate change impact biofuel production?

What are biofuels?

Bioenergy refers to all energy derived from biomass, a term used to describe non-fossil material from biological sources. Biofuels, in turn, are liquid fuels that are produced from biomass.

These sources are wide-ranging, but commonly include food crops, vegetable oils, animal fats, algae and municipal or agricultural waste, along with synthetic derivatives from these products.

Glossary

Biomass

Non-fossil material of biological origin

Biofuel

Fuels produced directly or indirectly from biomass

Feedstock

Types of biomass used as sources for biofuels, such as crops, grasses, agricultural and forestry residues, wastes and microbial biomass

Bioenergy

All energy derived from biofuels

Bioethanol

A biofuel used as a petrol substitute, produced from the fermentation of biomass from plants like corn, sugarcane and wheat

Biodiesel

A biofuel used as a diesel substitute, derived from vegetable oils or animal fats through a process called transesterification

The different types of biomass are referred to as “feedstocks”. They are converted to fuel through one or more processes, such as fermentation or treating them with high temperatures or hydrogen.

Biofuels are frequently blended with petroleum products in an effort to reduce emissions and reliance on fossil-fuel imports.

Experiments to test whether vegetable oils could run in combustion engines began in the early 1900s. In a 1912 paper, Rudolf Diesel – the inventor of the diesel engine – presciently noted that these oils “make it certain that motorpower can still be produced from the heat of the sun…even when all our natural stores of solid and liquid fuels are exhausted”.

Biofuels are divided into four “generations”, based on the technologies and feedstocks used to synthesise them.

| Type of biofuel | Source |

| First-generation | Food crops (eg, sugarcane, corn, wheat, rice) |

| Second-generation | Non-edible crops and materials (eg, straw, grasses, used vegetable oil, forest residues, waste) |

| Third-generation | Aquatic materials (eg, algae) |

| Fourth-generation | Genetically modified algae, bacteria and yeast, as well as electrofuels, synthetic fuels and e-fuels |

First-generation biofuels

The first – and earliest – generation of biofuels comes from edible crops, such as corn, sugarcane, soya bean and oil palm. Large-scale commercial production of these fuels began in the 1970s in Brazil and the US from sugarcane and corn, respectively.

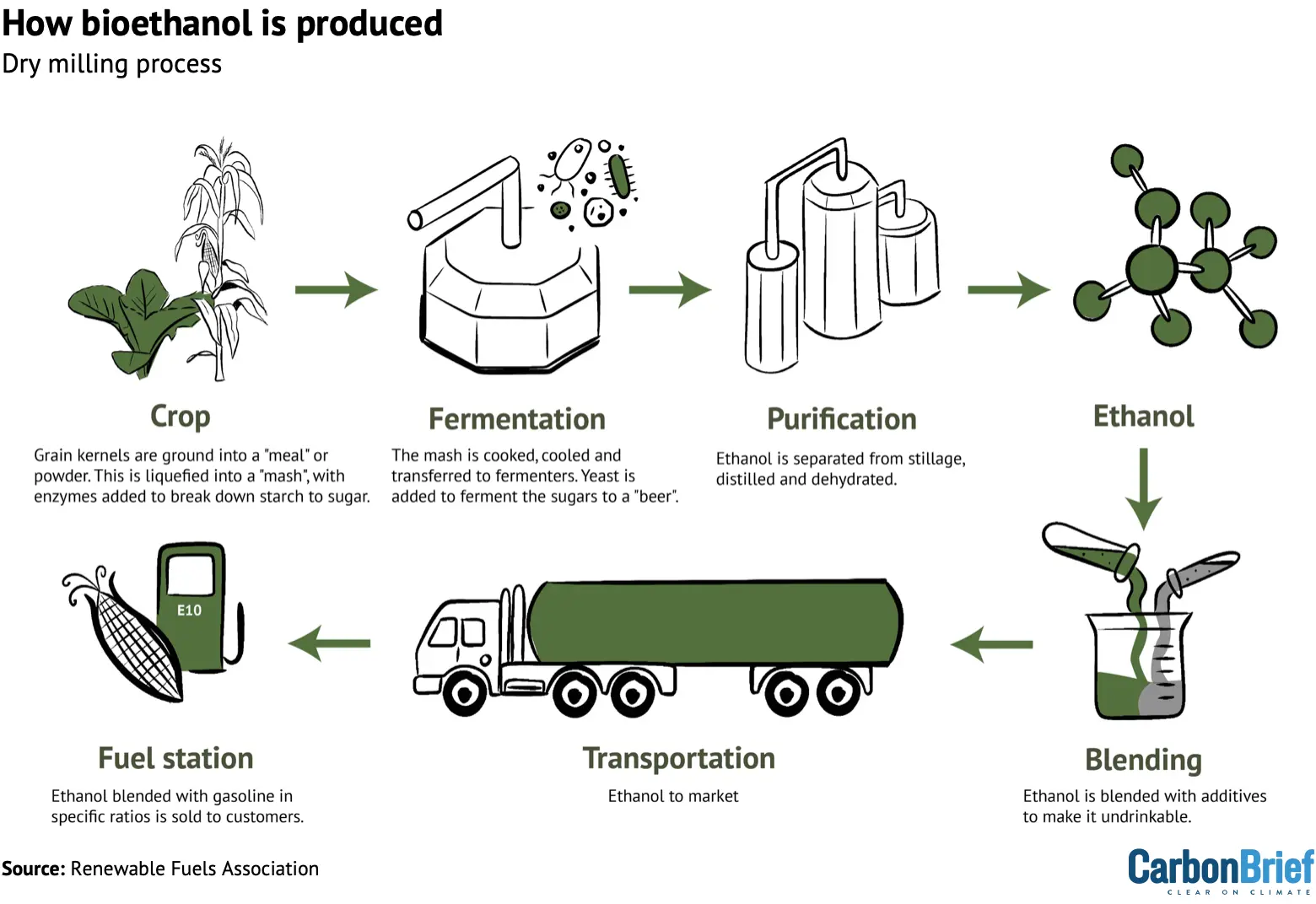

Bioethanol, for instance, is drawn from the fermentation of sugars in corn, sugarcane and rice. Biodiesel is derived from vegetable oils – such as palm, canola or soya bean oil – or animal fats, through a process called transesterification, which makes them less viscous and more suitable as fuels.

Because they are derived directly from food crops, experts and campaigners have expressed concerns over the impacts of first-generation biofuels on forests, food security and the environment, as well as indirect land-use change impacts. (See: What are some of the main criticisms of biofuels?)

Several studies have found that the land-use emissions of first-generation biofuels are severely underestimated, but other experts tell Carbon Brief that this depends on how and where the crops are grown, processed and transported.

According to Dr Angelo Gurgel, principal research scientist at the Massachusetts Institute of Technology (MIT) Center for Sustainability Science and Strategy, the “big image that biofuels are bad” is not always accurate. Gurgel explains:

“Some biofuels can be better than others, varying from place to place and feedstock to feedstock. It depends on where you produce them, how much farmers can increase yields, how effectively a country’s regulations help avoid land-use change and how closely it is connected to international markets.

“Some options may be very, very good in terms of reducing emissions and other options probably will be very bad.”

Second-generation biofuels

Second-generation biofuels are extracted from biomass that is not meant for human consumption.

Feedstocks for these biofuels are incredibly varied. They include agricultural waste, such as straw and corn stalks, grasses, forest residues left over from wood processing, used vegetable oil and solid waste. They can also be made from energy crops grown specifically to serve as biofuels, such as jatropha, switchgrass or pongamia.

Derived from “waste” or grown on “marginal” land, second-generation biofuels were developed in the early 2000s. These fuels aimed to overcome the food security and land-use issues tied to their predecessors, while increasing the amount of fuel drawn out from biomass, compared to first-generation feedstocks.

These feedstocks are either heated to yield oil or “syngas” and then cooled, or treated with enzymes, microorganisms or other chemicals to break down the tough cellulose walls of plants. They can be challenging to process and present significant logistical and land-use challenges.

Third-generation biofuels

Third-generation biofuels are primarily derived from aquatic organic material, particularly algae and seaweed. While the US Department of Energy began its aquatic species programme in 1978 to research the production of biodiesel from algae, algal biofuel research saw a “sudden surge” in the 1990s and “became the darling” of renewable energy innovation in the early 21st century, says Mongabay.

Because algae grows faster than terrestrial plants, is high in lipid (fatty organic) content and does not compete with terrestrial crops for land use, many scientists and industry professionals consider third-generation biofuels an improvement over their predecessors.

However, high energy, water and nutrient needs, high production costs and technical challenges are key obstacles to the large-scale production of algae-based biofuels. Since the early 2010s, many companies, including Shell, Chevron, BP and ExxonMobil, have abandoned or cut funding to their algal biofuel development programmes.

Fourth-generation biofuels

Genetically modified algae, bacteria and yeast engineered for higher yields serve as the feedstock for fourth-generation biofuels. These fuels have been developed more recently – from the early 2010s onwards – and are an area of ongoing research and development.

Some of these organisms are engineered to directly or artificially photosynthesise solar energy and carbon dioxide (CO2) into fuel; these are called solar biofuels.

Others – called electrofuels, synthetic fuels or e-fuels – are produced when CO2 captured from biomass is combined with hydrogen and converted into hydrocarbons through other processes, typically using electricity generated from renewable sources.

Fourth-generation biofuels are technology- and CO2-intensive and expensive to produce. They also run up against public perception and legal limitations on genetically modified organisms, as well as concerns around biosafety and health.

What are the most common biofuels being used today?

Bioethanol is the most commonly used liquid biofuel in the world, followed by biodiesel.

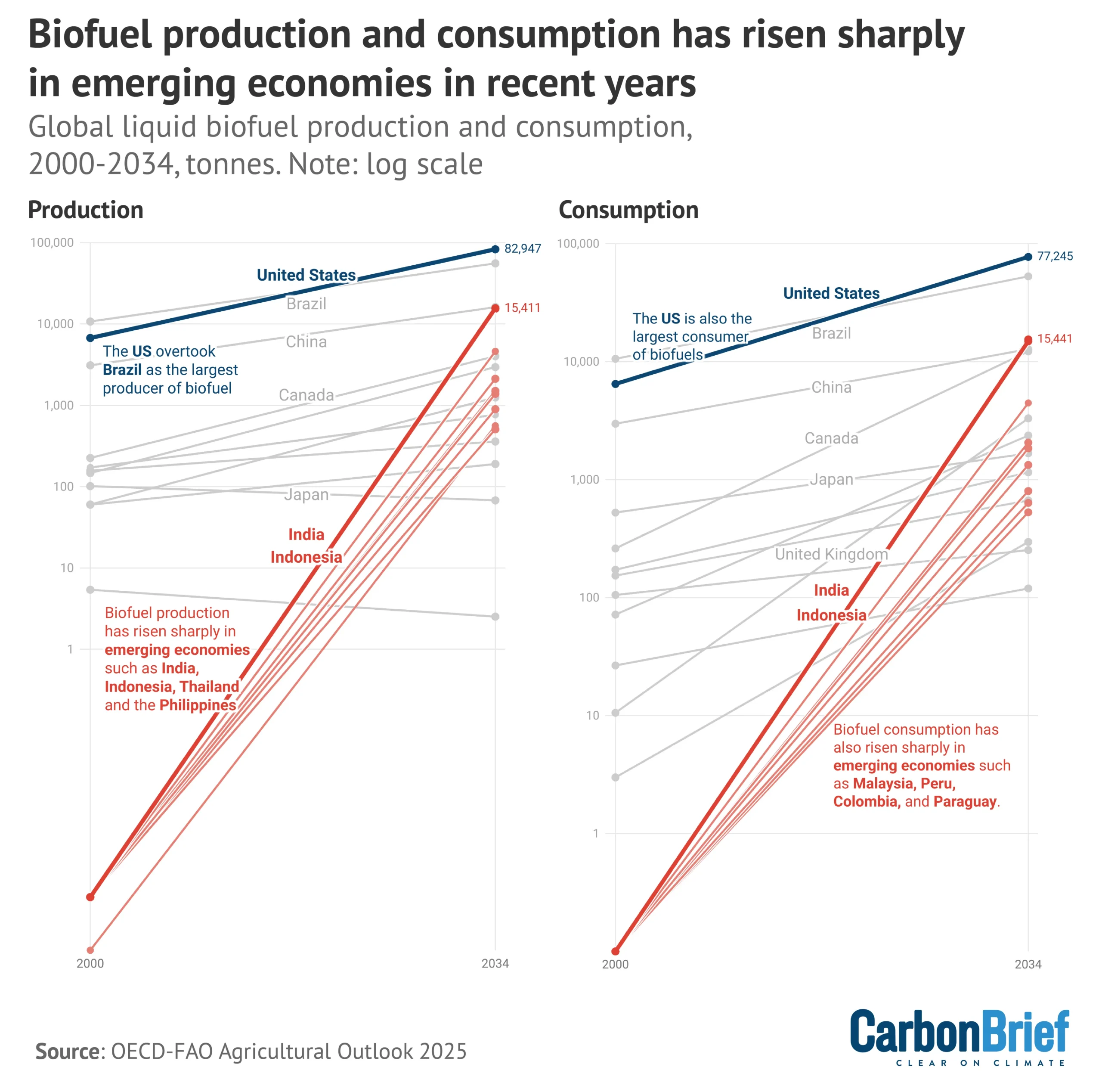

In 2024, global liquid biofuel production increased by 8% year-on-year, with the US (37%) and Brazil (22%) accounting for the largest overall share of production, according to the 2025 Statistical Review of World Energy from the Energy Institute.

Other countries that saw a notable increase in production between 2023-24 were Sweden (62%), Canada (39%), China (30%), India (26%) and Argentina (24%).

Bioethanol is the most commonly used biofuel in the world, with a consumption rate of 1.1m barrels of oil equivalent per day in 2024, according to the report. This is closely followed by biodiesel, at 1m barrels of oil equivalent per day.

In 2024, the US, Brazil and the EU accounted for nearly three-quarters of all biofuels consumed globally. However, while India’s biofuel demand grew by 38%, demand for biofuels in the EU fell by 11% in 2024, according to the review, echoing outlooks that show that middle-income countries are driving biofuel growth.

The chart below shows how biofuel production and consumption have changed since 2000, and how they are projected to change through 2034.

What are the main arguments for biofuels?

From lowered oil imports and emissions through to boosting farm livelihoods, countries that have boosted biofuels programmes cite several benefits in biofuels’ favour.

‘Renewable’ energy and lowered emissions

Biofuels are often described as “renewable” fuels, since crops can be grown over and over again.

In order to achieve this, crops for biofuels must be continuously replanted and harvested to meet energy demand. Growing crops – particularly in the monoculture plantations typically used for growing feedstocks – can require high use of fossil fuels, in the form of machinery and fertiliser. Furthermore, in the case of wood as a feedstock, regrowth can take decades.

While some biofuels offer significant emissions reductions, others, such as palm biodiesel, generate similar or sometimes higher emissions as fossil fuels when burned. However, ancillary emissions for biofuels are much smaller than for oil and gas operations.

One of the main cited benefits of biofuels is that plants capture CO2 from the atmosphere as they grow, potentially serving to mitigate emissions. However, several lifecycle-assessment studies have questioned just how much plants can offset emissions. These studies come up with varying estimates based on feedstock types, geography, production routes and methodology.

This divergence is echoed in the UN Intergovernmental Panel on Climate Change’s (IPCC) Sixth Assessment Report (AR6), which points to “contrasting conclusions” even when similar bioenergy systems and conditions are analysed.

Per the report, there is “medium agreement” on the emissions-reduction potential of second-generation biofuels derived from wastes and residues by 2050.

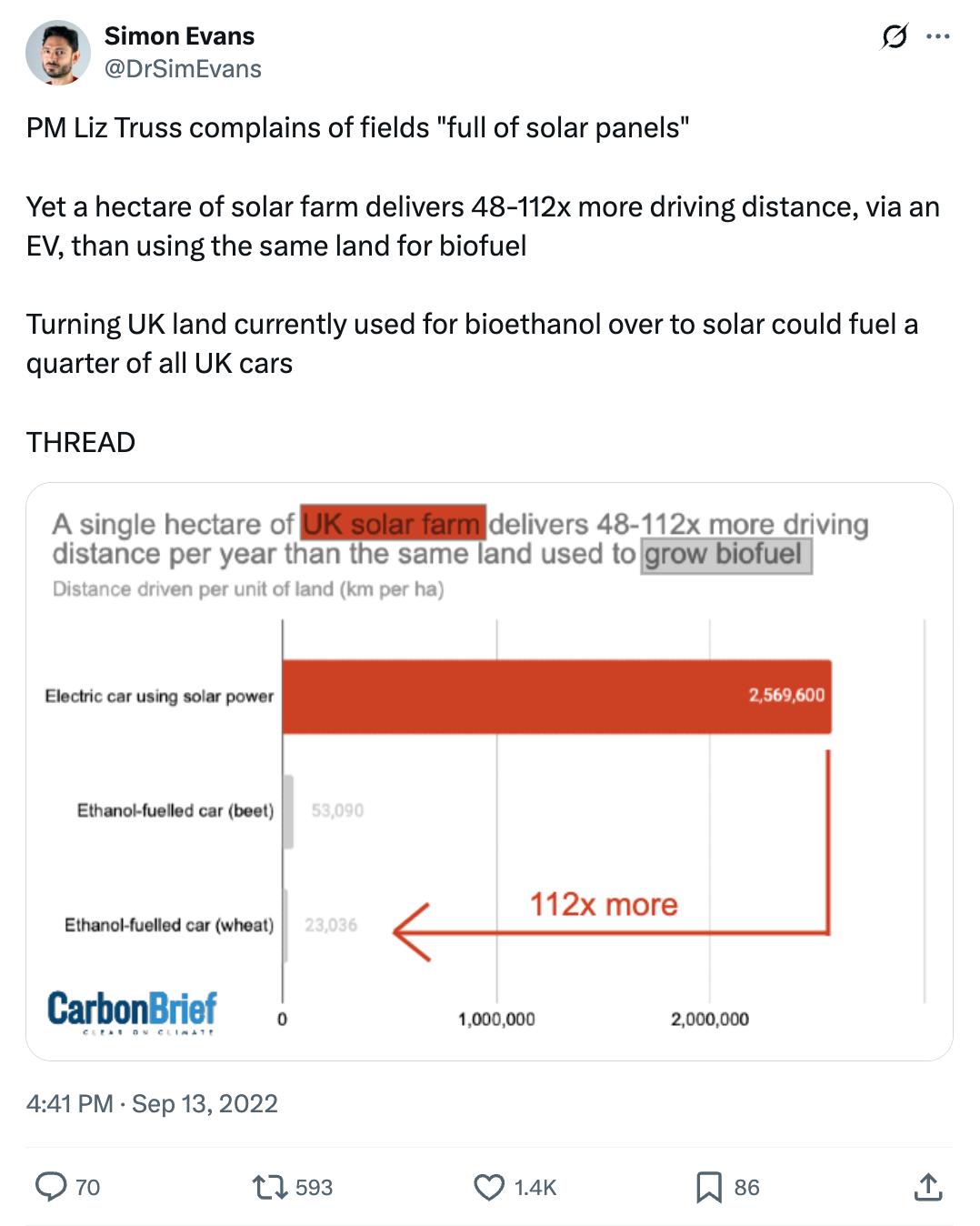

At the same time, the IPCC adds that “technical land availability does not imply that dedicated biomass production for bioenergy…is the most effective use of this land for mitigation”.

It also warns that larger-scale biofuel use “generally translates into higher risk for negative outcomes for greenhouse gas emissions, biodiversity, food security and a range of other sustainability criteria”.

Along with the IPCC, many other groups and experts – including the UK’s Climate Change Commission – have called for a “biomass hierarchy”, pointing to a limited amount of sustainable bioenergy resources available and how best to prioritise their use.

Use in hard-to-abate sectors

In many countries, such as the US and UK, biofuels are part of a standard grade of diesel and petrol (gasoline) available at most fuel pumps.

Biofuels have also been the leading measure for decarbonising road transport in emerging economies, where electric vehicle systems were not as developed as in many western nations.

According to the International Energy Agency (IEA), most new biofuel demand is coming from these countries, including Brazil, India and Indonesia.

Biofuels are also one of the key options being explored to decarbonise the emissions-heavy, but “hard-to-abate”, sectors of aviation and shipping.

The AR6 report notes that the “faster-than-anticipated adoption of electromobility” has “partially shifted the debate” from using biofuels primarily in land transport towards using them in shipping and aviation.

At the same time, experts question how this can be done sustainably, given the limited availability of advanced biofuels and the rising demand for them.

Government reports – such as those released by the EU Commission – recognise that, in some circumstances, so-called sustainable aviation fuels (SAFs) could produce just as many emissions as fossil fuels when burned in order to power planes.

However, SAFs do generally – although not always – have a lower overall “lifecycle” carbon footprint than petroleum-based jet fuel. This is due to the CO2 absorbed when growing plants for biofuels, or emissions that are avoided by diverting waste products to be used as fuels.

Unlike the road sector, where “electrification is mature…aviation and shipping cannot be electrified so easily”, says Cian Delaney, fuels policy officer at the Brussels-based advocacy group Transport & Environment (T&E).

According to a 2025 T&E briefing, the 2030 demand for biofuels from global shipping alone could require an area the “size of Germany”. Delaney tells Carbon Brief:

“In aviation in particular, where you still need some space to transition, you still need a certain amount of biofuels. But these biofuels should be advanced and waste biofuels derived from true waste and residues, and they are available in truly limited amounts, which is why, in parallel, we need to upscale the production of e-fuels [synthetic fuels derived from green hydrogen] for aviation.”

In February this year, more than 65 environmental organisations from countries including the US, Indonesia and the Netherlands wrote to the International Maritime Organization, urging its 176 member states to “exclude biofuels from the industry’s energy mix”.

The organisations cited the “devastating impacts on climate, communities, forests and other ecosystems” from biofuels, cautioning that fuels such as virgin palm oil are often “fraud[ulently]” mislabelled as used cooking oil – a key feedstock for SAF.

Meanwhile, the AR6 report has “medium confidence” that heavy-duty trucks can be decarbonised through a combination of batteries and hydrogen or biofuels. And despite growing interest in the use of biofuels for aviation, it says, “demand and production volumes remain negligible compared to conventional fossil aviation fuels”.

Energy security and reducing import dependence

In many countries, such as India and Indonesia, biofuels are seen as a part of a suite of measures to increase energy security and lessen dependence on fossil-fuel imports from other countries. This imperative received increasing emphasis after the Covid-19 pandemic and Russia’s war on Ukraine.

In developing countries, the “main motivation” behind biofuel policy is to find an alternative to excessive dependence on imported fossil fuels that are a “major drain” on foreign exchanges and subject to volatility and price shocks, says Prof Nandula Raghuram, professor of biotechnology at the Guru Gobind Singh University in New Delhi.

Raghuram, who formerly chaired the International Nitrogen Initiative, tells Carbon Brief that, in order for developing countries to “earn those precious dollars to finance our petroleum imports”, they have to export “valuable primary commodities”, such as grain and vegetables, at the cost of nutritional self-reliance. He adds:

“And so we have to see the biofuel approach as not so much a proactive strategy, but as a sort of reactive strategy to use whatever domestic capacity we have to produce whatever domestic fuel, including biofuels, to reduce that much burden on the exchequer for imports.”

Boost to agriculture

Many governments also see biofuels as an alternative income stream for farmers and a means to revitalise rural economies.

An increasing demand for biofuels could, for example, offer farmers higher returns on their crops, attract industry and services to agrarian areas and help diversify farm incomes.

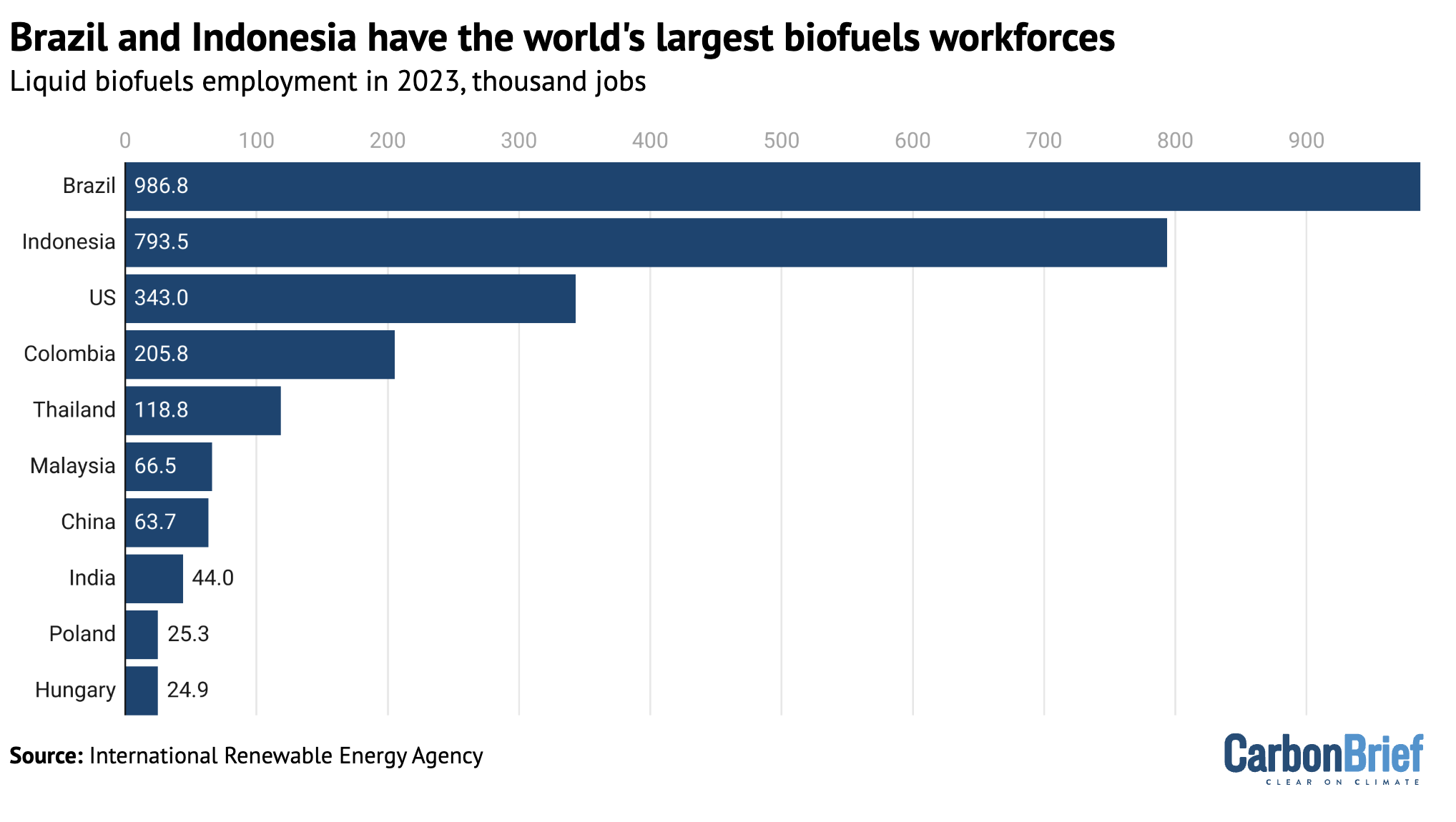

In 2023, a report by the International Labour Organization (ILO) and the International Renewable Energy Agency (IRENA) estimated that the liquid biofuel industry employed approximately 2.8 million people worldwide.

The bulk of these jobs were in Latin America and Asia, where farming is more labour-intensive and relies on informal and seasonal employment. Brazil’s biofuel sector alone employed nearly one million people in 2023, according to the report.

Meanwhile, North America and Europe accounted for only 12% and 6% of biofuel jobs in 2023, respectively, according to the report.

The chart below shows the number of jobs in the biofuel sector in the top 10 biofuel-producing countries.

Delaney points out that biofuel-related jobs account for less than 1% of all jobs in the EU, adding that the “most-consumed biofuel feedstocks” in the bloc are vegetable oils that are imported from countries such as Brazil and Indonesia. (See: How are countries using biofuels to meet their climate targets?)

He tells Carbon Brief:

“Despite strong biofuels mandates in the EU, the sector didn’t create as many jobs in the end for EU farmers, but, instead, benefited the big fuel suppliers and industry players.”

What are some of the main criticisms of biofuels?

Despite their widespread use and increasing adoption, experts recognise that biofuels “may also carry significant risks” and cause impacts that can undermine their sustainability, if not managed carefully.

Production emissions, land-use change and deforestation

The different chemical processes involved in making biofuels require varying amounts of energy and, therefore, the associated emissions depend on how “clean” a producer country’s energy mix is.

At the same time, growing biofuel crops often relies on emissions-intensive fertilisers and pesticides to keep yields high and consistent. (See Carbon Brief’s detailed explainer on what the world’s reliance on fertilisers means for climate change.)

Biofuel production processes, such as fermentation, also release CO2 and other greenhouse gases, including methane and nitrous oxide.

MIT’s Gurgel tells Carbon Brief that it is “relatively straightforward” to measure these direct emissions from biofuel production.

However, given how different countries account for deforestation, tracking direct land-use change emissions related to biofuel production is slightly more challenging – although still possible, Gurgel says. These emissions can come from clearing forests or converting other land specifically for growing energy crops.

For example, in many tropical forest countries, native rainforests and peatland have been cleared to grow oil palm for biodiesel or sugarcane for bioethanol.

According to one 2011 study by the Centre for International Forestry Research and World Agroforestry (CIFOR-ICRAF), it could take more than 200 years to reverse the carbon emissions caused by clearing peatland to grow palm oil.

Gurgel tells Carbon Brief:

“What is really very hard – I would say impossible – to measure are the indirect impacts of biofuels on land.”

Indirect land-use change occurs when a piece of land used to grow food crops is used instead for biofuels. This can, in turn, require deforestation somewhere else to produce the same amount of crops for food as the original piece of land.

Indirect land-use change can mean a loss of natural ecosystems, with “significant implications for greenhouse gas emissions and land degradation”, according to a 2024 review paper.

Gurgel explains:

“If you provoke a chain of reactions in the market, that can lead to expansion of cropland in another region of the world and then this can push the agricultural frontier further and cause some deforestation…It’s quite hard to know exactly what’s going to happen and those things are interactions in the market that are impossible to measure.”

The “best that scientists can do” to determine if such a “biofuel shock” could indeed cause land-use change in a forest or grassland elsewhere “is try to project those emissions using models, or do very careful statistical work that will never be complete”, he adds.

Delaney, from Transport and Environment, contends that there is enough scientific research to “show that indirect land-use change is real” and to quantify the expansion of “certain food and feedstocks into high-carbon stock” areas, such as forests.

While this is “not easy” to do, he points to the European Commission’s indirect land-use change directive, the accompanying methodology and its scientific teams who study agricultural expansion rates. Delaney continues:

“What we all agree with at this point is that indirect land-use change exists, that it’s a problem, that certain feedstocks like palm and soya are particularly problematic from this perspective and that it is an issue that we need to tackle and capture in the best possible way.

“You cannot just be vague and descriptive without having proper figures behind it – and I think that’s something that at least the EU have tried and that they continue trying to implement. And I hope that, at the global level as well, this will be more recognised.”

Impacts on food, biodiversity and water security

Biofuel-boosting policies have been subjected to intense scrutiny during periods of global food-price spikes in 2008, 2011 and 2013.

Following the spikes, critics attributed increasing biofuel production as a major factor in the near-doubling of cereal prices. Studies have shown that they played a more “modest” role in some of these spikes and a more substantial one in others.

Severalexperts have linked food-price spikes to protests in north Africa and the Middle-East, including the Arab Spring.

In more recent years, the “food vs fuel debate” has come back to the fore since the start of the war in Ukraine in 2022.

This was in part due to the world’s reliance on Ukraine and Russia’s food and energy systems – particularly some of the most food-insecure countries, who had to contend with record-high food prices that peaked in March 2022, but still persist. The war also saw heightened calls for the US and EU to overturn biofuel-boosting policies to free up land to increase domestic food production and bring down food prices.

In developing countries, such as India, the use of cereals and oils to make biofuels while large sections of the population still lack access to adequate nutrition has attracted criticism from experts.

While first-generation biofuels rely on fertilisers to guarantee consistently high yields, second-generation biofuels could directly compete with feed for livestock or their return to soil as nutrients.

According to a 2013 report by the panel of scientists that advises the UN Committee on World Food Security (CFS):

“All crops compete for the same land or water, labour, capital, inputs and investment, and there are no current magic non-food crops that can ensure more harmonious biofuel production on marginal lands.”

This competition, along with clearing forests and other ecosystems for cropland, has consequences not just for emissions, but also for biodiversity, water and nutrients.

According to one 2021 review paper, local species richness and abundance were 37% and 49% lower, respectively, in places where first-generation biofuel crops were being grown than in places with primary vegetation. Additionally, it found that soya, wheat, maize and palm oil had the “worst effects” on local biodiversity, with Asia and central and South America being the most-impacted regions.

Biofuels’ impact on water resources, similarly, is highly crop- and location-specific.

For instance, growing a “thirsty” crop such as sugarcane in Brazil could have minimal impacts on local water resources, due to the region’s abundant rainfall. But in drought-prone India, experts have estimated that a litre of sugarcane ethanol requires more than 2,500 litres of water to produce and relies entirely on irrigation. Research has also found that nearly half of China’s maize crop requires irrigation to grow.

According to agricultural economist Dr Shweta Saini, meeting India’s 2025-26 biofuels target will require 275m tonnes of sugarcane, 6m tonnes of maize and 5.5m tonnes of rice. According to one 2020 study cited by Bloomberg columnist David Fickling, increasing sugarcane production to meet India’s biofuel targets “could consume an additional 348bn cubic metres of water…around twice what is used by every city” in the country.

Prof Raghuram tells Carbon Brief:

“Water resources are drying up everywhere in the country and by incentivising, through policy, a water-guzzling industry like this, we are inviting a sustainability crisis.”

‘Feedstock crunch’

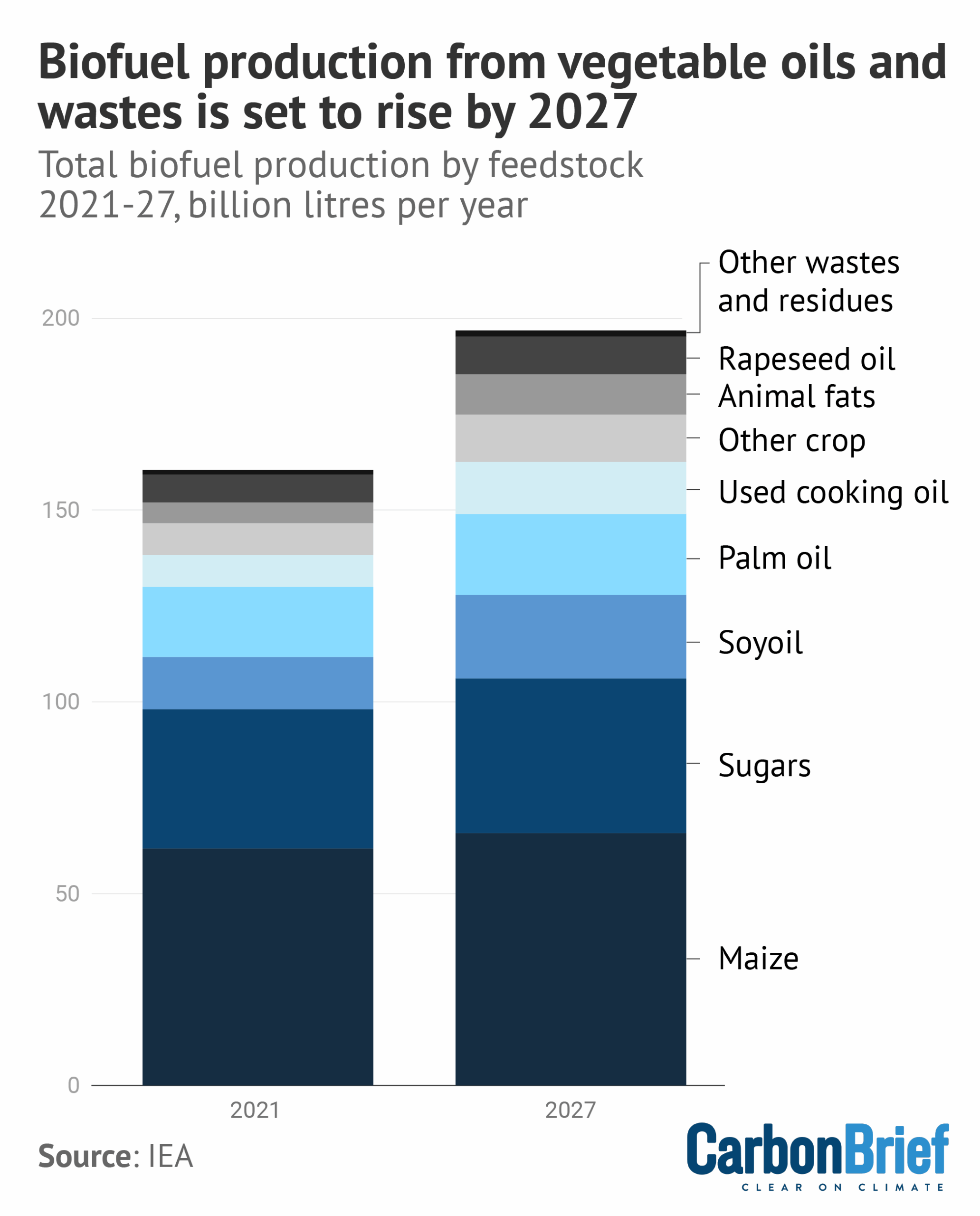

Another concern surrounding biofuels is that there may not be enough supply to go around to meet rising demand. The IEA described the potential shortfall as a “feedstock supply crunch” in a 2022 report.

Fuels derived from the most commonly used waste and residues, in particular, could be approaching supply limits, the IEA warns, as these fuels satisfy both sustainability and feedstock policy objectives in the US and EU.

Consumption of vegetable oil for biofuel production is expected to soar by 46% over 2022-27, the report says. Meanwhile, the world is estimated to “nearly exhaust 100% of supplies” of used cooking oil and animal fats within the decade.

For the world to stay on a net-zero trajectory, “a more than three times production increase” would be required, the report adds. It warns that if the limited availability of second-generation feedstocks continues unchanged, “the potential for biofuels to contribute to global decarbonisation efforts could be undermined”.

The chart below shows the biofuel demand share of global crop production from 2022-27.

How are countries using biofuels to meet their climate targets?

Broadly, biofuel policies are divided into two categories.

Technology “push” policies focus on the research and development of new technologies and include measures such as research funding, pilot plants and government support for commercialising nascent technologies.

Meanwhile, market “pull” policies drive demand for existing and emerging biofuels through measures such as “biofuel blending mandates” – where countries prescribe a certain percentage of biofuel with fossil fuels – and tax breaks for producers and vehicle owners.

US

The US Renewable Fuel Standard (RFS) is the world’s largest existing biofuel programme. Its mandates are keenly watched and contested by the country’s farm and petroleum lobbies.

Under RFS, the US Environmental Protection Agency sets out minimum levels of biofuels that must be blended into the US’s transport, heating and jet fuel supplies.

Under the policy, oil refiners can either blend mandated volumes of biofuels into the nation’s fuel supply or buy credits – called Renewable Identification Numbers (RINS) – from those that do.

While the programme sets out emissions reduction targets, the environmental impacts of cropland expansion and monoculture driven by the policy have been cause for concern by experts.

According to one 2022 study, the RFS programme increased US fertiliser use by 3-8% each year between 2008-16 and caused enough domestic emissions from land-use change that the carbon intensity of corn ethanol was “no less than that of gasoline and likely at least 24% higher”. Additionally, the programme’s impacts on biodiversity have not yet been fully assessed.

In June 2025, the Trump administration announced plans to expand the biofuel mandate to a “record 24.02bn gallons” next year – an 8% increase from its 2025 target – while seeking to discourage imported biofuels.

EU

In the EU, policymakers have promoted biofuels since 2003 to reduce emissions in the transport system. As part of the EU’s Renewable Energy Directive (RED), biofuels have been explicitly linked to emissions targets.

Under the current iteration of RED (REDIII) – revised as part of the EU’s Fit for 55 package – EU countries are required to either achieve a share of 29% of renewable energy in transport or to reduce the emissions intensity of transport fuels by 14.5%. Additionally, it sets out a sub-target for “advanced biofuels” of 5.5% and excludes the use of food and feed-based biofuels in aviation and shipping.

In 2015, the European Commission acknowledged that the indirect land-use change emissions of first-generation biofuels could “fully negate” any emission savings by biofuels. The commission capped the use of first-generation biofuels in each member country at 7% of all energy used in transport by 2020, but did not announce plans to phase them out.

As of 2021, nearly 60% of all biofuels used in the EU were still made from food and feed crops, according to analysis by Oxfam. While the latest RED legislation continues to push for the use of advanced and waste biofuels, campaigners warn that a lack of clear definitions could increase the risk of “loopholes” and fraud, exacerbated by increased demand.

T&E’s Delaney tells Carbon Brief:

“You’re putting a lot of pressure on the land – you might require a lot of pesticides and irrigation – and there is not even enough land in Europe for this. How can you make sure true sustainability safeguards are in place so that you’re not actually driving additional demand for land in [biodiverse countries such as] Brazil?”

Brazil

Brazil has the world’s oldest biofuels mandate, dating back to the 1970s, established in a bid to insulate the country from expensive oil imports.

In 2017, Brazil announced a state policy called RenovaBio that set out national carbon intensity reduction targets for transport, decided biofuel mandates and created an open market for biofuel decarbonisation carbon reduction credits called CBIO.

In October 2024, Brazil enacted a “Fuels of the Future” law that replaced RenovaBio, with president Lula declaring that “Brazil will lead the world’s largest energy revolution”. The law aims to boost biofuel and sustainable aviation fuel (SAF) use, increasing biodiesel blending mandates by 1% every year starting in 2025 until it reaches 20% by March 2030.

Biofuels now account for 22% of the energy that fuels transport in Brazil and its ethanol market is “second in size only” to the US.

In June this year, Brazil announced that the country was increasing its biofuel blending mandates from 1 August in a bid to make the country “gasoline self-sufficient for the first time in 15 years”, reported Reuters.

Indonesia

As the world’s biggest palm oil producer, Indonesia has continued to raise its biodiesel blending mandates to meet its domestic energy needs.

The country first introduced mandatory biodiesel blending in 2008, at 2.5%. The mandate is currently at 40% in 2025 and, starting next year, could go up to 50% with an eventual goal of 100%.

While Indonesia’s president Prabowo Subianto has stated that implementing 50% blending could save the country $20bn in reduced diesel imports, the move would need an estimated 2.3m hectares of land, including protected forests, resulting in the “country’s largest-ever deforestation project”, according to Mongabay.

It could also compete with palm oil meant for domestic and international food markets, impacting already soaring prices and signalling the “end of cheap palm oil”.

India

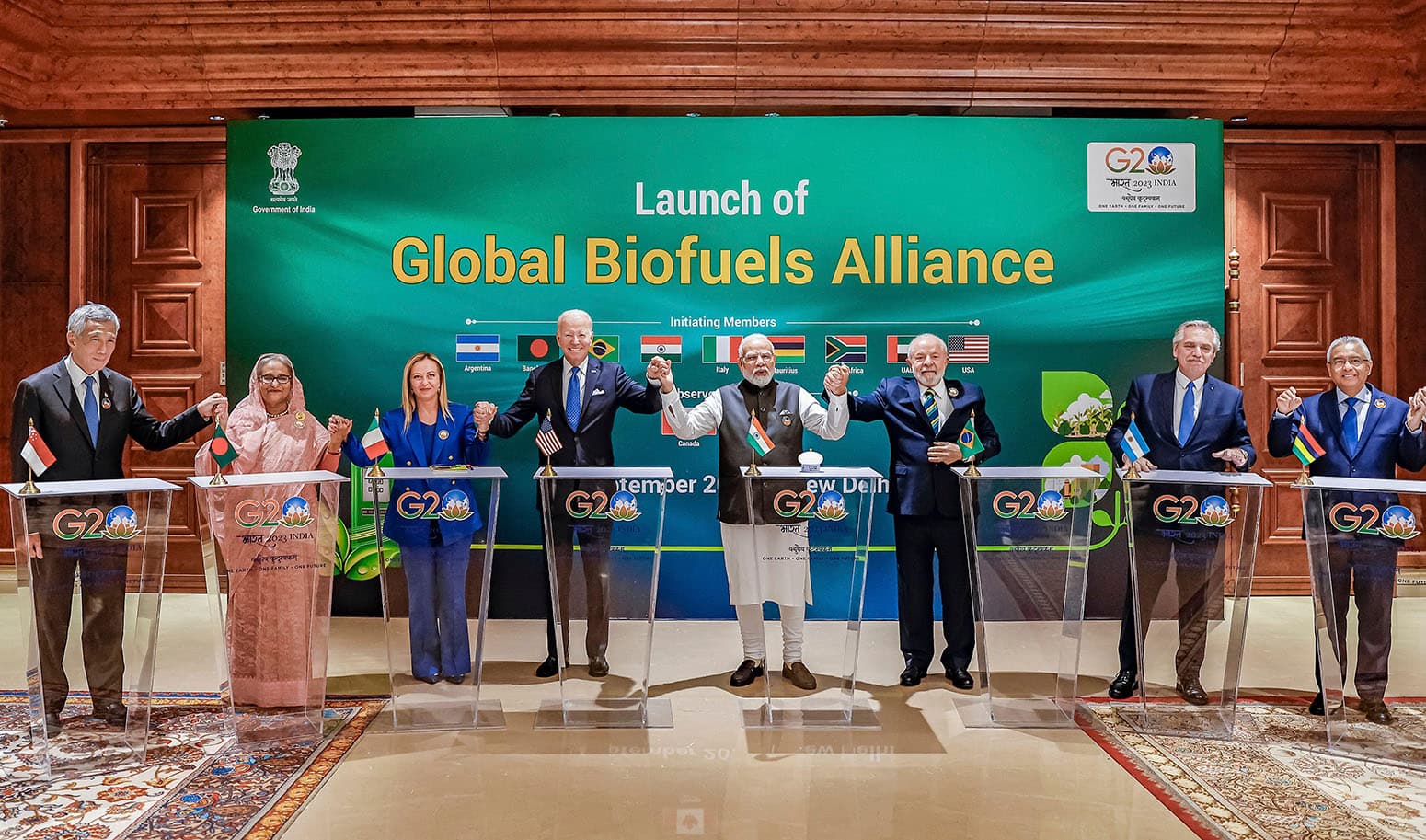

India has quickly joined the ranks of major biofuel producers, due to high-level political support, policies and a diversity of feedstocks. In 2023, India launched the Global Biofuels Alliance as one of its key priorities of its G20 presidency.

Biofuel mandates are outlined in the country’s National Policy on Biofuels, first published in 2009 and subsequently amended in 2018 and 2022. In 2022, India achieved its 10% ethanol blending target ahead of schedule and is pursuing a 20% blending target by 2025, as well as a 5% biodiesel blending target by 2030.

India’s rapid biofuel push, however, has been criticised by food security experts as hunger levels rise, for its impact on endemic rainforests and, most recently, by vehicle owners for the impact of blended fuel on car engines.

Prof Raghuram says:

“From a sheer governance angle and sustainability angle, there are a lot of compromises being made to somehow push this whole thing. Even the land available in India is shrinking, as various reforms and dilution of environmental safeguards in the last 10 years have made it relatively easier to convert farm and forest land for non-agricultural purposes.”

China

China developed its first biofuel policies over 20 years ago and is one of the world’s biggest biofuel producers.

In 2017, China announced a new mandate expanding the use of fuel including bioethanol from 11 trial provinces to the entire country by 2020. However, Reuters and South China Morning Post reported that this was suspended in 2020. Only 15 provinces still maintain biofuel mandates, according to the US Department of Agriculture, which notes that a “lack of meaningful support for domestic biofuel consumption while aggressively promoting electric vehicles indicates a strategic choice to pursue transportation decarbonisation through electrification rather than liquid biofuels”.

At the same time, biofuel production in China grew by 30% in 2024, according to the Energy Institute’s Statistical Review.

While most of China’s biofuel production is grain-based, tax incentives for ethanol production have been gradually phased out and alternative biofuels have been incentivised, according to the IEA. China is currently piloting a scheme to increase biodiesel consumption at home, even as it exports biodiesel and used cooking oil to the EU and US.

How could climate change impact biofuel production?

Despite the well-documented impacts of climate change-induced extreme weather on land, agriculture and forests, there is currently little scientific literature examining how continued warming will impact global biofuel production.

One 2020 study found that bioethanol availability globally could drop – by 23% under a “very high emissions scenario” and by 4.3% under a “low emissions” scenario by 2060 – “if climate change risk is not adequately mitigated” and corn continues to be the dominant feedstock.

The study “encourages” changing out corn for switchgrass as a key source of bioethanol.

Another 2021 study examining the viability of China’s planned biofuel targets estimated that energy crop yields in China in the 2050s will decrease significantly compared to the 2010s, due to the impacts of climate change.

It found that climate change is expected to have a “substantial impact” on the land available for biofuel production in the 2050s, under both scenarios used in the study.

Gurgel, from MIT, tells Carbon Brief that it is “very hard to take into account how much climate change will damage bio-energy production” at this point, given the uncertainty of what emissions pathway the world will follow.

While most climate models “do a very good job” at forecasting average temperature change in the future, they do an “average job” at projecting rainfall change, or how many extreme weather events countries will see in the future, he says.

This is important because many biofuel crops, such as sugarcane and palm oil, are water-intensive and thrive in regions with abundant rainfall, but yields may fail in drier parts of the world that could see more drought.

Given this “cascade of uncertainties”, he continues, “we don’t have a clear picture of how bad the future [of agriculture] will be – we just know it will be more challenging than today”.

Delaney, meanwhile, asks whether investing in biofuels, which will be impacted by climate change, is a “good investment” for the long term. He tells Carbon Brief:

“I think these are the questions that we need to ask ourselves when we see – not just in India, but Indonesia, Brazil, everywhere around the world right now – this growing appetite for biofuels. Can we really keep the promises that we made at the end of the day?”

Words by Aruna Chandrasekhar. Graphics by Tom Prater and Kerry Cleaver.