Simon Evans

04.06.2014 | 3:00pmDemand for fossil fuels would fall dramatically if the world gets serious on climate change, according to projections from the International Energy Agency.

That would leave major oil firms unable to recoup money invested in new supplies, the IEA says. Their fossil fuel assets could lose all value and become ‘stranded’.

Smaller slice of the (energy) pie

Fossil fuels’ share of the global energy mix will fall from the current 82 per cent to 76 per cent in a 4 degree world, the IEA says. That is a world the IEA calls its ‘new policies scenario’. Fossil fuels’ share of the global energy mix would fall still further to 65 per cent if we avoid dangerous climate change of 2 degrees – the IEA’s 450 scenario.

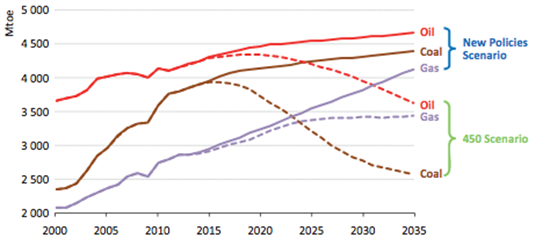

Gas consumption would be higher than it is today in either case (purple line, below). But serious action to tackle climate change would see oil consumption peak before 2020 (red line). And coal use (brown line) would drop particularly sharply after peaking around 2015, the IEA scenario suggests.

This means that in a 2 degree world – according to the IEA – around $300 billion of investment in fossil fuel assets could be “stranded”. This figure could increase further if there is a lack of clear policy in the interim which leads to investment in exploration or generating capacity that is not needed.

Stranded assets – the biggest losers

The IEA estimates that the total amount stranded by decarbonisation would be divided between money spent on fossil-fuel power stations that have to close due to emissions limits (dark blue), money spent exploring for oil but not paid back because the oil can’t be sold (light grey), spending on gas exploration (light blue) and a small amount of lost investment in coal mines (dark grey).

Source: IEA World Energy Investment Outlook

Oil majors like Shell and Exxon say they do not think their assets will become stranded because they don’t expect the world to take the 2 degree path. Shell tells Carbon Brief its position hasn’t changed following the IEA report.

It may say the same to the 767 investors represented by global not-for-profit group the Carbon Disclosure Project. These investors want oil and gas firms to reveal the true extent of their exposure to potentially stranded assets.

Of course, whether assets become stranded or not depends on whether the world enacts ambitious climate policy. Shell is still telling investors that it doesn’t fear a carbon bubble, based on the company’s own scenarios which predict up to six degrees of global warming this century.

If it is wrong the IEA analysis suggests it has a lot to lose.