The UK’s energy industry is in trouble with the public. The reasons seem pretty simple: energy prices continue to skyrocket, while media reports claim profits are skyrocketing. So what can polling tell us about trust in the energy industry – and how could the companies that provide our heat and light regain it?

Low trust

According to the most recent polling, trust in the industry has fallen significantly over the past year according to consultancy Edelman’s Trust Barometer 2014 – a six percentage point drop on last year. Just 32 per cent of people said they trusted the energy industry, putting it in last place behind the banking sector. The survey, out today, asked respondents which groups in society they trusted most, and what attributes are key to driving that trust. It showed that in an environment where trust in business is increasing – and trust in government is falling – the energy sector is bucking the trend, falling far behind other groups and industries.

The result is hardly surprising: following the announcement of price rises almost across the board last year, politicians and the media have accused the UK’s ‘big six’ energy companies of a lack of transparency, and even profiteering. Labour judged the mood of the country well when it announced it would freeze energy bills for a limited time if it got into office – and ensured the story hasn’t left the news since.

Trust in regulation

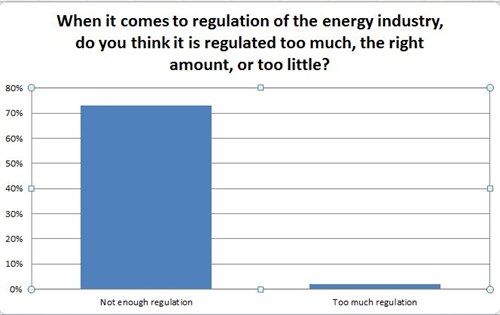

There seems to be little tolerance for the government’s accepted wisdom – often repeated by energy minister Ed Davey – that the market is the best mechanism for deciding energy prices fairly. Just over 70 per cent of respondents said the industry isn’t being regulated enough, as opposed to just two per cent who want to see more regulation. Indeed, there’s a chance trust in the energy industry would rise if the government were to bring more elements of the industry under control.

Data by Edelman; Graph by Carbon Brief

According to Edelman, the most common reason given for why trust in the financial sector has had a minor resurgence is because there is perceived to be more – or more effective – regulation now.

It’s not clear whether the lack of trust in the energy sector is uniform, however. A new survey out on Monday by consumer organisation, Which?, shows smaller energy companies companies far outstrip the big six when it comes to customer satisfaction. But despite their superior customer satisfaction scores, such providers still only count for less than 10 per cent of the market.

What could the smaller providers be doing right where their larger competitors are failing? Some clues may lie in responses to another question in the Edelman survey: Which actions are most important for building trust in a company? The most popular responses were that companies should listen to customers (61 per cent) and that they should put people before profits (59 per cent).

In contrast, the big six benefit from a market in which very few customers switch tariffs or energy companies – a problem the government and Ofgem see as key to current problems with transparency. and inefficiency in the market. As a result it could be argued that at least until recently, there’s been little incentive for energy companies to start dealing more fairly with customers.

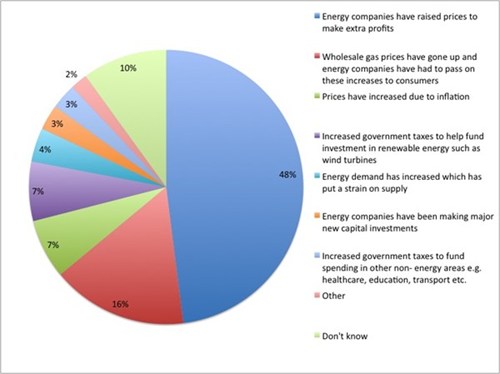

Making up the lost ground now may be an uphill struggle. Carbon Brief’s polling last year indicated that regaining trust will be a particularly big task for the energy sector – especially when it comes to putting people before profits. When asked last March why they thought energy bills had gone up over the past year, 48 per cent of our respondents said they thought it was because energy companies had increased their profit share. 16 per cent said it was due to rising wholesale gas prices, while just seven per cent blamed so-called green taxes.

Question: What do you think is the main reason for the increases in consumer gas and electricity prices over the last 12 months?

These answers also give some idea of how people see the government’s decision to move green levies off energy bills and into general taxation in response to the furore over rising costs. First, people don’t seem to regard green levies on bills as a major contribution to the price hike – so it doesn’t deal with the larger problem in their eyes. And second, the episode may in fact have dented public trust when the levy cut did not bring the immediate reductions in bills energy companies appeared to promise.

Trusted individuals

So who else do people trust? On an individual level, academics are considered the most trusted spokespeople, with 67 per cent saying they trusted their information. Unfortunately for Carbon Brief, bloggers came last at 20 per cent.

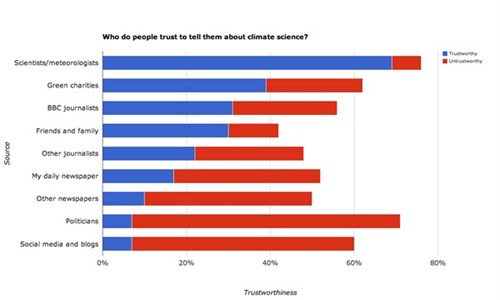

Continued trust in academic spokespeople is good news for climate scientists who want to communicate their research to the public, Carbon Brief’s polling shows. 69 per cent said they trusted scientists and meteorologists to give them information about climate change. Again, social media and blogs came in last place, tied with politicians.

Question: How trustworthy do you think the following information sources are in providing you with accurate information about climate change?

It’s worth noting that trust in governments and institutions has dipped all over the world, Edelman’s survey reveals – but mistrust in the energy sector has a much longer history. Efforts to rebuild relations so far – such as the green levy cut – appear to have failed because they don’t address the problems people identify. For government and the big six to start making headway with people, they could do worse than listening to what people want.