The UK government paid Shell $123m in 2015, new figures reveal. Of 24 countries where Shell reported, the UK was the only net contributor to the oil and gas major.

The surprising revelations are contained in Shell’s Report on Payments to Governments, produced under mandatory new UK regulations for extractive industries.

The report shows Shell paid a total of $22bn to governments across those 24 countries in 2015. The largest recipients were Nigeria ($5.0bn), Malaysia ($4.4bn) and Norway ($4.2bn). The payments include royalties, fees and taxes paid on profits, production or income.

The figures are net of tax refunds and only relate to upstream oil and gas extraction activities, not downstream processing or sales. In the UK, Shell received $123m (£85m) in 2015 from taxpayers because it reclaimed the costs of decommissioning against tax paid in previous years.

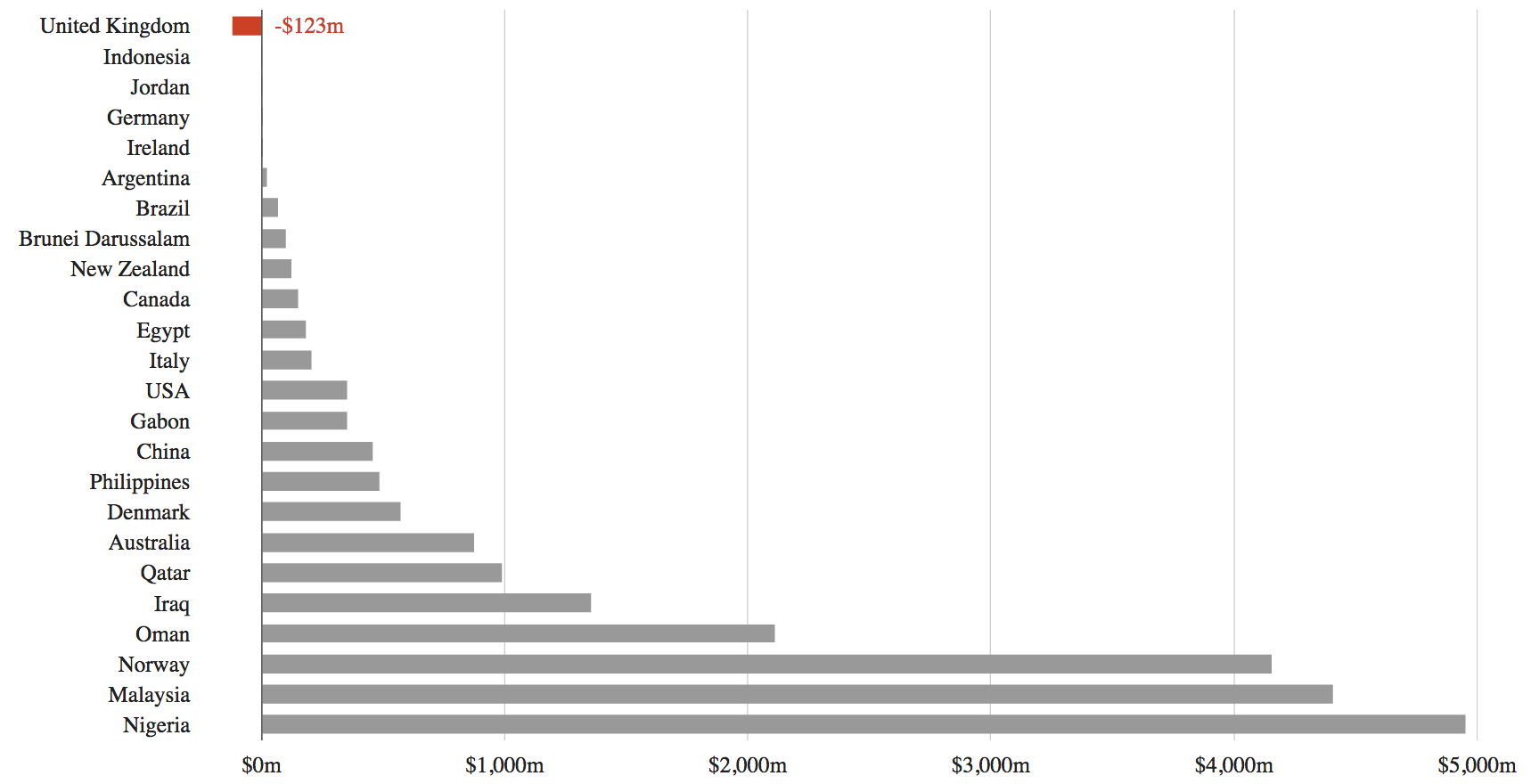

Shell payments to governments in 2015

Payments to governments in 2015 in 24 countries where Shell extracts oil and gas ($m). Source: Shell Report on Payments to Governments. Chart by Carbon Brief.

Shell has voluntarily reported payments to governments since 2011. These reports show that Shell paid significant amounts of UK tax in 2011, 2012 and 2013. However, the company was paid by UK taxpayers to the tune of $334m (£232m) in 2014 and $128m (£89m) in 2015. (The $123m figure above includes a $5m payment by Shell in regulatory fees).

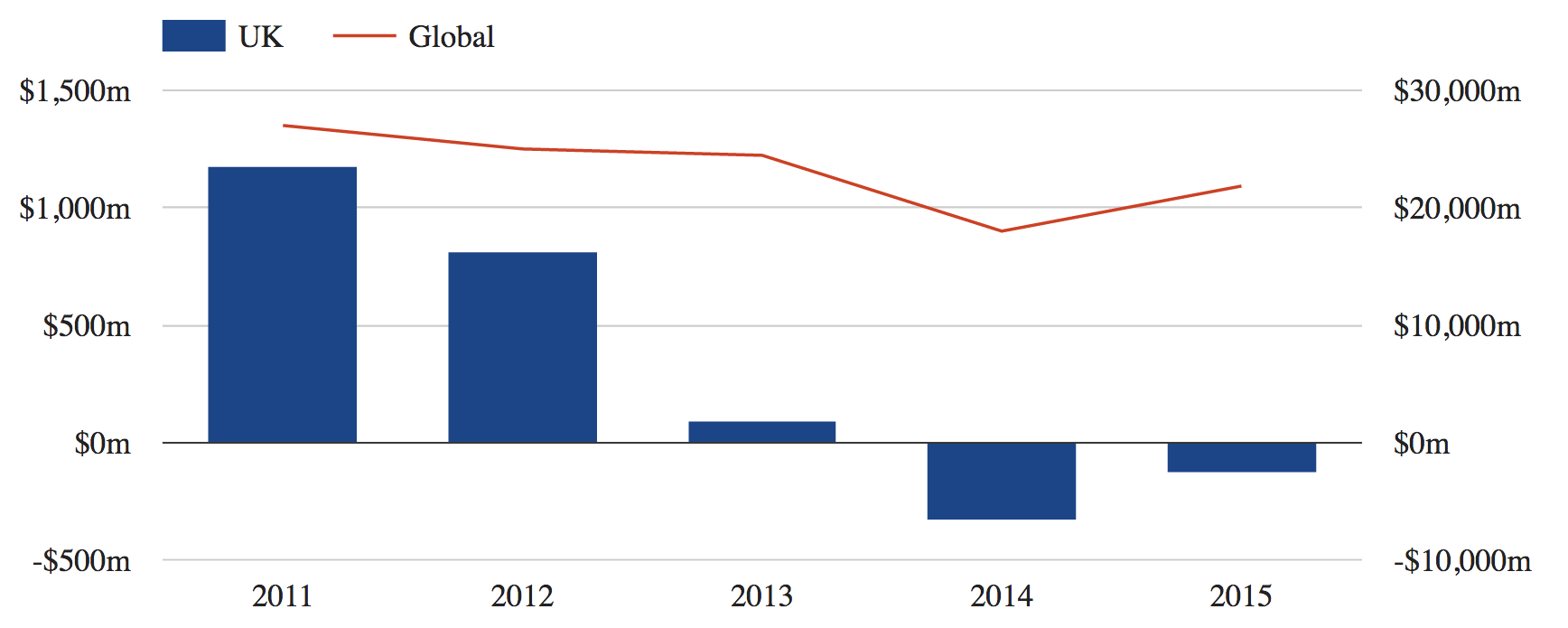

Shell payments to the UK and other governments

Shell payments to the UK and other governments around the world between 2011 and 2015, $m. Note that earlier figures are not exactly comparable to the 2015 data. Source: Shell reports on payments to governments. Chart by Carbon Brief.

The $334m paid to Shell by the UK in 2014 largely relates to a tax overpayment in previous years, a spokesperson for the company tells Carbon Brief.

The UK trend echoes Shell’s global payments to governments (red line, above), which have been affected by low oil prices. Note that the 2015 figures are reported on a slightly different basis to earlier reports, following the introduction of the UK reporting regulations.

George Osborne, the UK’s chancellor, has made a series of changes to the tax regime for North Sea oil and gas. In his 2016 budget, Osborne reduced the petroleum revenue tax (PRT) from 35 to 0%, a move expected to cost the exchequer £1bn over the course of this parliament.

The 2015 budget had already cut the PRT from 50 to 35% as part of a package of tax breaks worth £1.3bn.

However, a spokesperson for Shell tells Carbon Brief that Shell’s tax repayments in 2014 and 2015 were not related to these changes. The spokesperson says:

The spokesperson adds that Shell has invested heavily in the UK and has paid around £1.2bn in taxes since 2011. The spokesperson refused to be drawn on how Shell’s future payments to or from government would be affected by Osborne’s tax breaks for the industry.

A spokesperson for the Treasury tells Carbon Brief: “We cannot discuss the details of tax payments paid by – or repayments to – individual companies”. The spokesperson adds:

The fall in oil prices has had a significantly adverse impact on tax receipts. This is because many companies are making losses in the current low oil price environment. Any such losses can be carried back and offset against an oil company’s taxable profits in earlier years.

In order to incentivise investment, virtually all capital expenditure may be written off for tax purposes. Any excess expenditure which cannot be written off in an accounting period can also be carried back and offset against a company’s taxable profits in earlier years. Since repayments are calculated by reference to the tax paid in the period to which the loss is carried back rather than the period in which the loss arose, in practice, this means that repayments are only made if tax has been paid in the first place.

A full list of allowances that could reduce taxes chargeable on an oil company’s upstream profits is summarised in chapter 3 of the EITI [Extractive Industries Transparency Initiative] report.

In addition, decommissioning costs are allowable expenditure for tax purposes and if they create losses those can also be carried back against past taxes paid and result in repayments of tax. Companies undertaking large decommissioning programmes can therefore get large refunds of tax they paid in earlier years.

It is important to note that payments from oil and gas companies reported under EITI are limited to upstream activities so will not necessarily reflect the full tax liability of a company. For instance, corporation tax on downstream activities, such as the retail sale of petrol at the pump, is not reported under EITI.

A January 2016 article for the Independent says Shell paid no UK corporation tax in 2014.

The House of Commons Library has produced an excellent briefing explaining the North Sea tax regime. Note however that it was written prior to Budget 2016, when PRT was zero-rated. This zero-rating means firms that paid PRT in the past can continue to reclaim tax to offset the costs of future decommissioning.

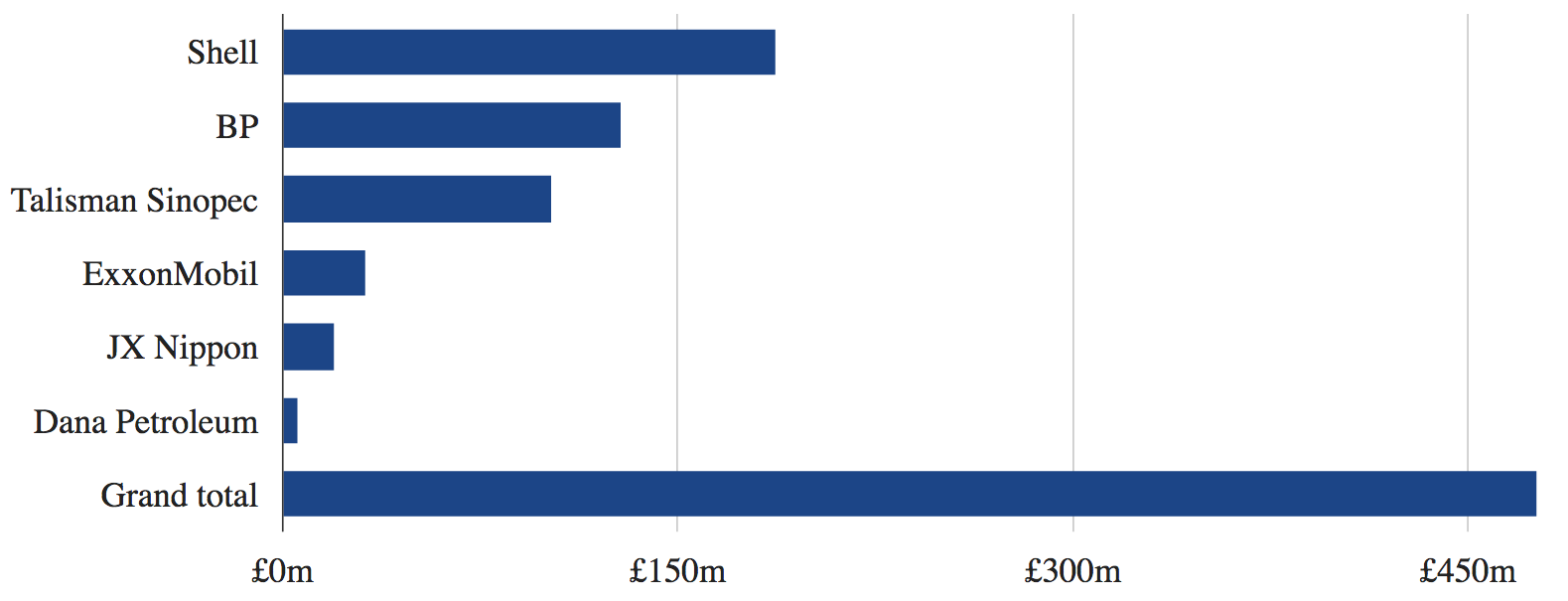

The Treasury spokesperson also points to a report, published on 15 April 2016, covering payments to government by extractive companies in 2014. This shows that Shell was not alone in receiving significant payments from UK taxpayers that year.

A series of other oil and gas firms netted a total of £476m in 2014, though the sector as a whole contributed more than £3bn in taxes. See the full report for details.

Payments to oil and gas firms in the UK in 2014

Payments from UK taxpayers to oil and gas firms in 2014, £m. Source: Extractive Industries Transparency Initiative report for 2014. Chart by Carbon Brief.

These revelations undermine the popular notion that the oil and gas industry contributes to the UK exchequer. The news also plays into the long-running debate on whether North Sea tax breaks count as fossil fuel subsidies.

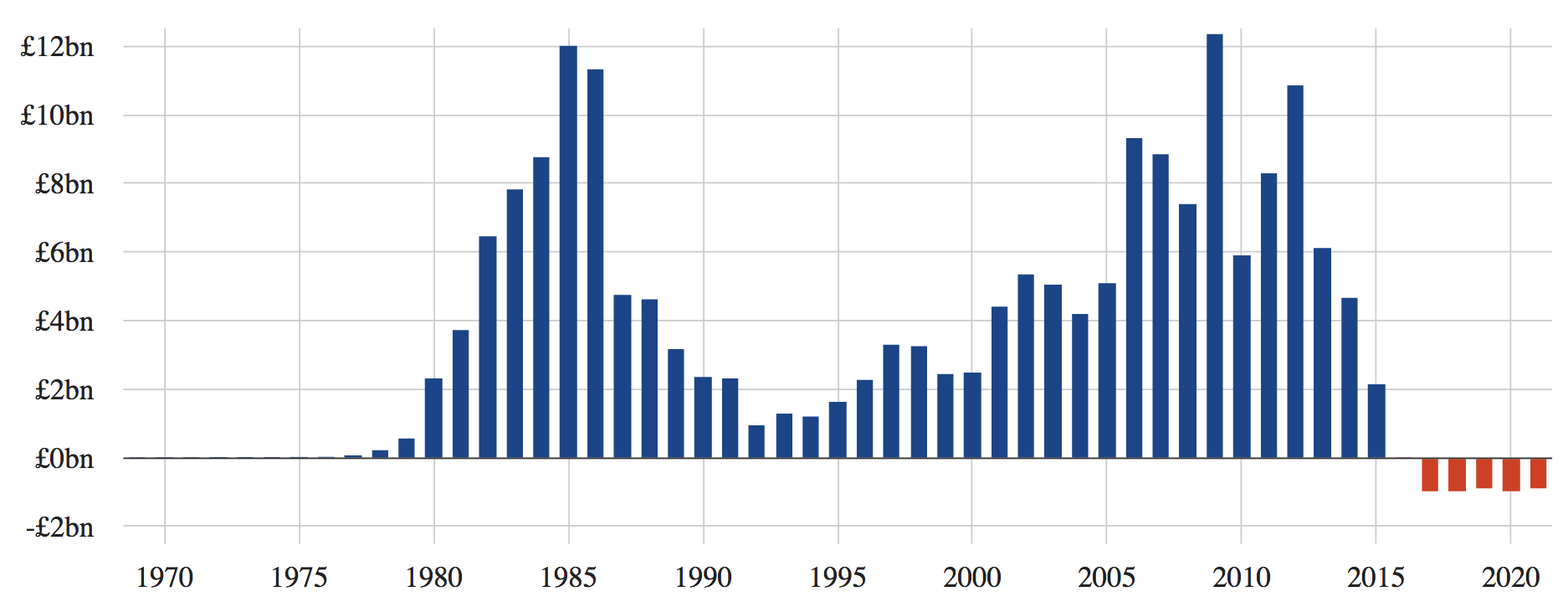

In the past, the North Sea has been a source of large tax revenues (blue bars, below). However, official forecasts now expect revenues from the sector to turn negative (red bars).

UK government revenues from oil and gas production

UK government tax revenues from oil and gas production (£bn) between 1968 and 2015. Figures cover tax years whereas the dates shown are for the tax year end. Figures for 2016/17-2020/21 are forecasts. Sources: Department of Energy and Climate Change and the Office of Budget Responsibility. Chart by Carbon Brief.

The forecasts show that oil and gas firms are expected to cost the exchequer £4.8bn over the next five years. The total amount of tax paid since 1969 is £190bn. Decommissioning is expected to cost as much as £70bn.

Shell’s report on payments to government meets its obligation under UK regulations, which enact chapter 10 of the EU Accounting Directive 2013/34EU. Under the UK rules, firms have 11 months in which to report on payments made during financial years commencing on or after 1 January 2015. This translates into a reporting deadline of 30 November 2016, for those running financial years aligned to the calendar year.

Update 21/4 – We added a chart for historical and forecast government tax revenues from oil and gas production with contextual text.