Analysis: Fuel-duty freezes have increased UK CO2 emissions by up to 7%

Simon Evans

03.16.23Simon Evans

16.03.2023 | 3:48pmThe cuts and freezes in fuel duty since 2010 means the UK’s carbon dioxide (CO2) emissions are as much as 7% higher than they would have been, Carbon Brief analysis shows.

The analysis comes after a spring budget that once again froze fuel duty instead of increasing it in line with inflation, as well as maintaining a supposedly-temporary 5 pence-per-litre cut.

The latest “£5bn budget giveaway” for drivers means duty is now 37% lower than planned in real terms, at a cost of at least £80bn. even as public transport fares rose faster than inflation.

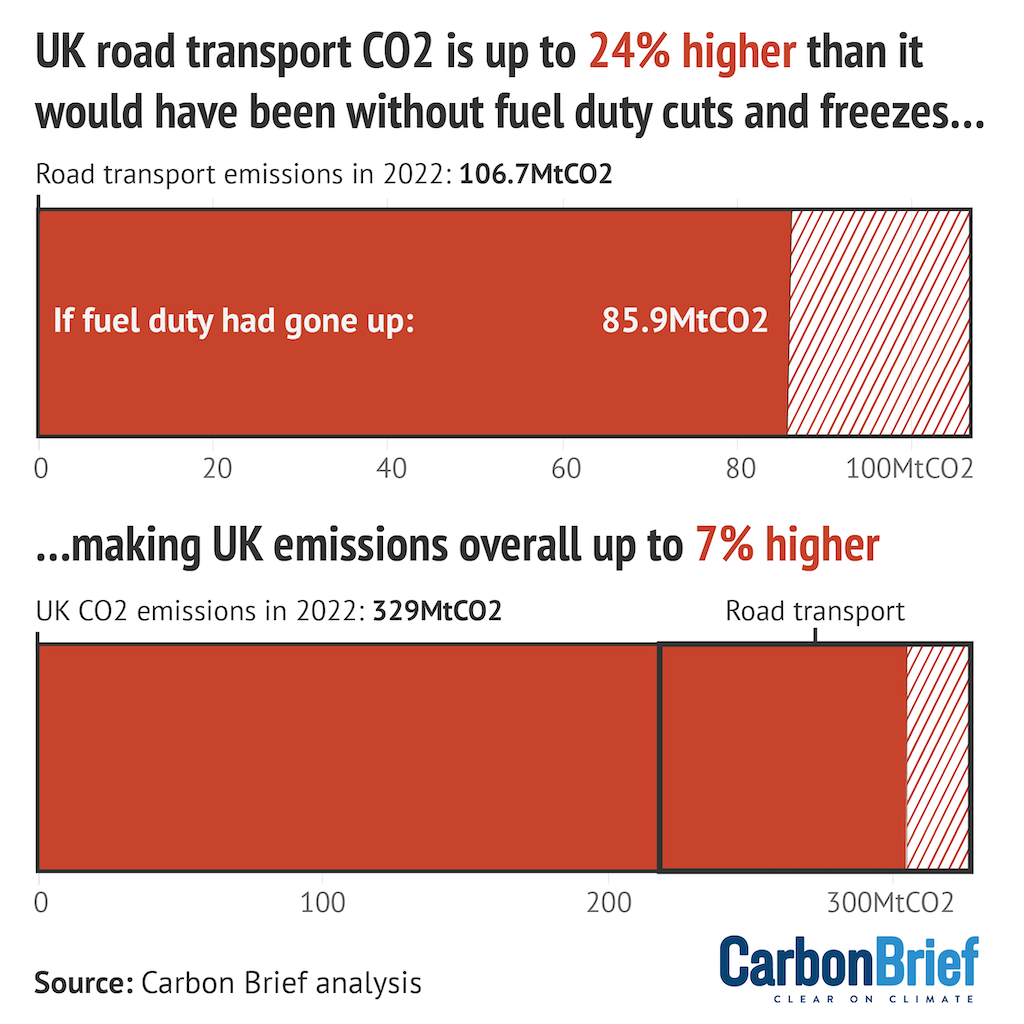

As a result, UK road transport emissions are now as much as 21m tonnes (MtCO2, 24%) higher than they would have been without fuel duty cuts, according to the new Carbon Brief analysis.

This means the UK’s CO2 emissions, overall, are up to 7% higher than they would have been.

Repeated cuts

Fuel duty is a tax levied on petrol and diesel sold for road transport use. The previous Labour government’s “fuel duty escalator” would have raised the levy each year, by 1p above inflation.

(Update 12/04/2023: The escalator was first introduced by the Conservatives under John Major, in 1993.)

However, successive Conservative-led governments have cancelled these increases every year since 2010, meaning motorists have enjoyed a significant tax cut in real terms.

Last year’s spring statement went even further, cutting fuel duty by 5p per litre, supposedly as a temporary response to the global energy crisis.

Yesterday’s spring budget 2023 extended this cut for another year and once again cancelled any inflationary increase.

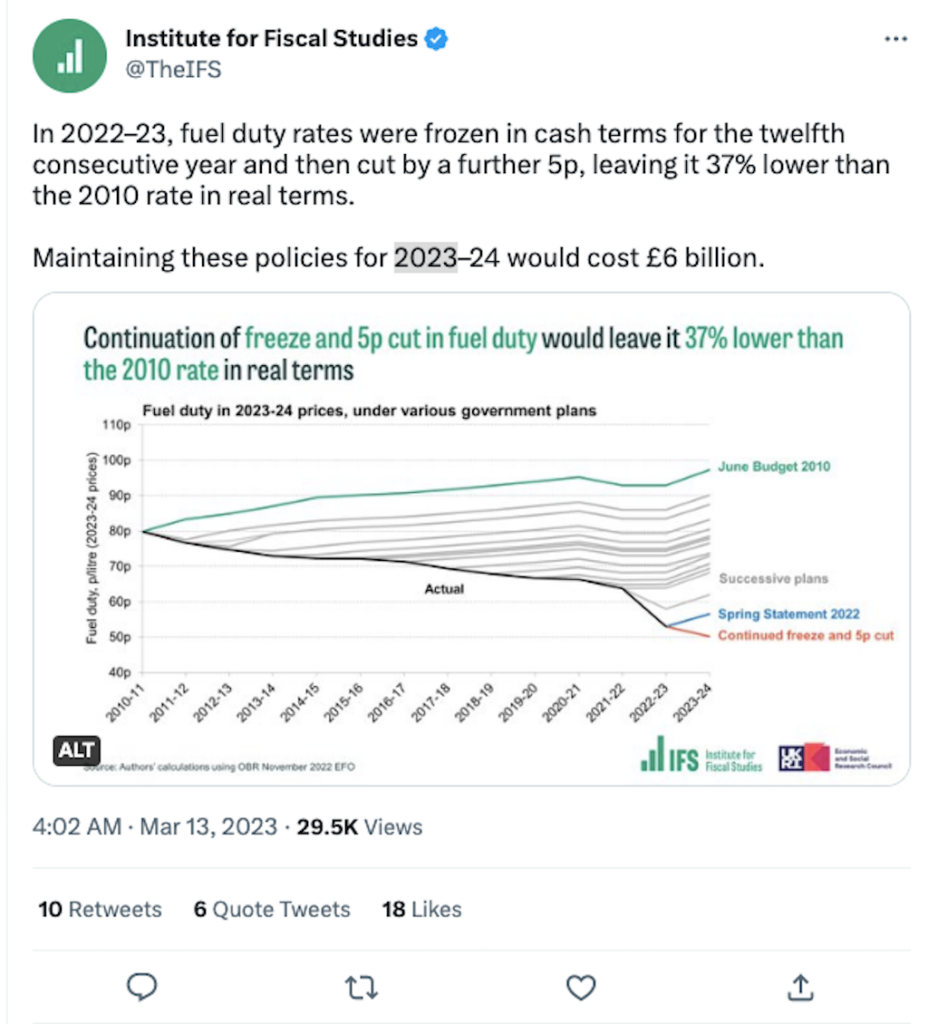

All told, fuel duty is now 37% lower in real terms than the rate planned in 2010, according to the respected economic thinktank the Institute for Fiscal Studies (IFS).

Repeated fuel duty cuts in real terms have now cost the public finances a total of £80bn, according to the independent advisory Office for Budget Responsibility (OBR). This figure takes account of the reduction in fuel demand, if duty rates had been higher. It says in its latest outlook:

“We estimate that the cumulative cost of freezing fuel duty rates between 2010-11 and 2023-24 relative to increasing them in line with RPI inflation has risen to around £80bn, after factoring in the expected negative impact on demand for fuel from higher duty rates.”

This cumulative cost to the exchequer is set to rise by another £15bn over the next five years, the OBR outlook notes.

Elastic demand

If fuel duty had increased in line with inflation since 2010, instead of being cut repeatedly, then pump prices over the past 12 months would have been an average of 28% higher (48p per litre).

This would have encouraged drivers to seek alternative forms of transport, choose more fuel-efficient cars or make the switch to electric vehicles.

Although the impact in a single year would have been limited, these effects would have been accumulated and amplified over time, by sustained inflationary increases in fuel duty.

Car manufacturers might have shifted production towards more efficient models, while governments might have been under more pressure to boost public transport.

Demand for and use of public transport might have increased, while the stock of cars on UK roads might have evolved differently. Instead of the trend towards ever-larger cars and SUVs, motorists might have been encouraged to choose more fuel-efficient models.

All of this would have reduced UK demand for petrol and diesel, leading to lower CO2 emissions.

Economists estimate the impact of higher prices using what is known as the “elasticity of demand”. This measures how sensitive consumers are to changes in price. For example, an elasticity of -1 means that a 10% increase in prices would translate into a 10% reduction in demand.

Estimates from HMRC suggest the short-term elasticity of demand for road fuels is only -0.07, meaning high prices will not change consumption very much if they are temporary. This makes sense – consumers have few immediate ways to cut car use for their commute, for example.

However, HMRC agrees that elasticity of demand rises over time. Indeed, estimates from consultancy Cambridge Econometrics suggest elasticity rises to -0.7 in the longer term.

(For a longer discussion of elasticity of demand for road fuels, see this 2020 Carbon Brief article.)

Lower emissions

Carbon Brief’s new analysis uses a range of figures for the elasticity of fuel demand to estimate the impact on emissions, if duty had gone up in line with inflation as planned over the past 13 years.

It uses the same methodology as developed for Carbon Brief’s 2020 analysis, where the approach is set out in detail. This methodology is coupled with estimates of road transport CO2 in 2022, based on Carbon Brief’s recent analysis of UK emissions.

CO2 emissions from cars, vans, trucks, buses and motorcycles amounted to 107MtCO2 in 2022, Carbon Brief’s analysis shows. This means road transport was once again the biggest contributor to the UK’s CO2 emissions, accounting for one-third of the national total.

If fuel duty had increased in line with inflation and assuming the longer-term elasticity of demand, then road transport emissions would have reached just 86MtCO2 in 2022, the analysis shows.

As a result, road transport emissions in 2022 were as much as 21MCO2 (24%) higher than they would have been, if fuel duty had not been cut repeatedly.

This is illustrated in the top panel of the figure below. The bottom panel puts road transport CO2 emissions in context against the UK total.

Similarly, this means overall UK CO2 emissions in 2022 were up to 7% higher than they would have been, without 13 years of fuel duty cuts in real terms.

Despite claims to the contrary, higher fuel duty rates would not be regressive overall. This is because low-income households are much less likely to own a car.

Indeed, fuel duty cuts disproportionately benefit high-income households.