Spring statement 2022: Key climate and energy announcements

Josh Gabbatiss

03.23.22Josh Gabbatiss

23.03.2022 | 5:37pmUK chancellor Rishi Sunak has delivered an array of new budget announcements against a backdrop of soaring household energy bills and fuel prices.

The chancellor had reportedly wanted to restrict this “spring statement” to economic forecasts and broad ideas for tax changes, leaving major announcements for the autumn budget.

However, the Treasury has been under growing pressure to deal with the fallout from Russia’s invasion of Ukraine and the wider global energy crisis.

Early in his speech to parliament, the chancellor laid out a handful of measures that he said would help to alleviate these issues for British people, including reduced taxes on vehicle fuel, home insulation and solar panel installation.

As the government prepares a broader energy security strategy – reportedly due to be delivered next week – some factions of the Conservative party have been using the energy crisis as an excuse to push back against the UK’s net-zero target.

For his part, Sunak is widely seen as lukewarm on climate action, but in recent speeches and press statements the government has broadly supported low-carbon measures as a pathway to energy independence in the current crisis.

Nevertheless, climate change is not a priority in the spring statement, with “net-zero” mentioned just once in the 52-page document, and “climate” mentioned three times.

Below, Carbon Brief summarises all the key climate and energy announcements from today’s budget:

Energy crisis

The Treasury notes that “global energy prices were volatile even before Putin’s invasion of Ukraine and remain much higher than pre-pandemic levels”, leading to a significant increase in the cost of living.

It attributes this to a range of factors including rising global demand for energy, supply disruptions in oil-exporting economies, weather patterns affecting the supply of renewable energy and heating demand, and lower gas storage balances.

(More than 90% of the increase in household energy bills is due to high wholesale gas prices, with another 5% or so due to the cost of resulting supplier failure.)

Prices have risen even further “amid disruptions to the supply of Russian energy to global markets,” it adds.

Between mid-February and mid-March, global oil prices rose 9% and UK and European wholesale gas prices increased by more than 30%.

The Treasury notes that while the existing price cap by energy regulator Ofgem is protecting consumers from rises in wholesale energy, petrol pump prices are at record highs after increasing by around 12% over the past month.

While the government has already announced some measures to help households with energy bills and includes more in the spring statement, it says that:

“The best way to support households in the long run is through encouraging strong and sustainable growth across the UK, by promoting investment and innovation; and then sharing more of the proceeds of growth by reducing the tax burden for working people.”

The Treasury also references the upcoming government energy security plan, which it says will build on existing net-zero plans while “raising its delivery ambitions across energy technologies to end the UK’s dependency on hydrocarbons from Russia”. It notes that this will entail “measures across hydrocarbons, nuclear and renewables”.

One policy that is notable for its absence from the spring statement is a windfall tax on oil-and-gas companies, which have profited enormously from spiking global fossil fuel prices. Ahead of today’s spring statement, firms were reportedly confident that the Treasury would not target their profits, on the understanding that they would instead step up their investment in domestic UK oil and gas fields.

The opposition Labour Party is among those to have called for such a tax – and its absence was the first criticism shadow chancellor Rachel Reeves levelled at Sunak in her response to his speech.

Fuel duty

A widely anticipated measure was the reduction in fuel duty applied to petrol and diesel, which Sunak had trailed heavily in interviews ahead of his speech.

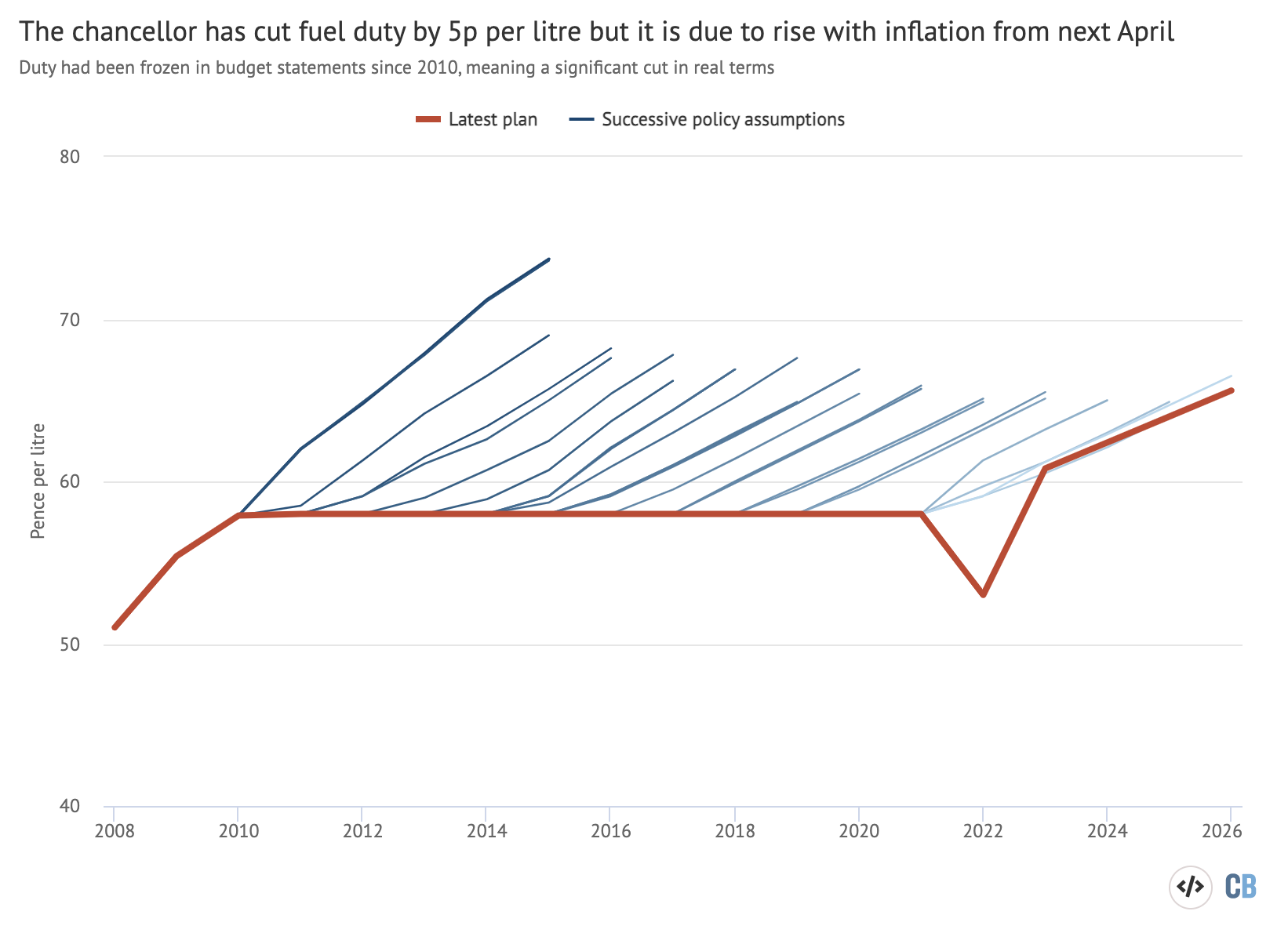

The Treasury says there will be a temporary cut of 5p per litre of petrol and diesel for 12 months, taking effect from 6pm on the day of the announcement. This brings fuel duty, which has remained static since 2011, down to 53p per litre.

The chart below shows the past and future trajectory of fuel duty (red), assuming the levy is increased in line with inflation from next April. In practice, the Treasury has repeatedly frozen planned inflationary increases at every budget since 2010 (blue lines).

This cut in fuel duty will not be enough to cancel out the recent increases in fuel costs, which have risen by roughly 40-50p since spring 2021.

The government nevertheless says it marks the “largest cash-terms cut across all fuel duty rates at once ever” and only the second time that such a cut has taken place in 20 years.

Treasury analysis suggests that this represents savings of £100 for the average car driver, £200 for a van and £1,500 for a lorry. However, this is based on a scenario in which fuel duty increases in 2022-23, which it has not done for years.

VERY disingenuous to claim a £5bn household saving on fuel duty. It’s actually £2.4bn with the rest covered by a mythical rise in fuel duty that was never going to happen anyway. pic.twitter.com/4Rjh7utYX4

— Sam Alvis (@SamAlvis2) March 23, 2022

In total, this cut will amount to savings of £2.4bn for households and businesses over the next year, the government says.

Prior to this, fuel duty has remained at a rate of 58p per litre, plus VAT, since 2011. This trend has seen consistent, vocal support from lobbyists and sections of the press, and is clearly a point of pride for Sunak who declared in a Sky News interview recently that “we are the party who has frozen fuel duty for over a decade”.

However, this policy has faced criticism because it disproportionately benefits the rich and runs counter to energy security and the UK’s climate goals. Carbon Brief analysis in 2020 suggested that the UK’s CO2 emissions were as much as 5% higher than they would have been due to the decade-long freeze on fuel duty.

Others have pointed out that while keeping fuel duty low is seen as a popular measure to benefit ordinary people, these measures are in fact regressive.

Analysis by the NGO Transport & Environment found that across Europe (not including the UK), the richest motorists would receive eight times more public money from fuel duty cuts than the poorest, as they spend so much more on fuel.

In a similar vein, Ryan Shorthouse of conservative environmental thinktank Bright Blue pointed out that repeated fuel duty freezes amounted to a cut in real terms, adding that there are better ways to support struggling households.

In a statement responding to the Treasury’s announcement, Stuart Adam, a senior economist at the Institute for Fiscal Studies (IFS), said:

“As long as it is genuinely temporary, the environmental and fiscal costs are bearable. But history suggests it would not be a surprise if the chancellor failed to restore fuel duties next year to their previously planned level.”

He added that If the lower level is kept next year, it would leave the duty rate in 2023-24 a third lower than if it had kept pace with inflation over the past decade, costing the government £15bn a year.

Last year, the Treasury indicated that there may be future increases in fuel duty, stating that the rate would be “considered in the context of the UK’s commitment to reach net-zero emissions by 2050”. There also remains a question mark over how fuel duty will be replaced as the nation transitions away from fossil fuels to electric vehicles.

Home insulation

The second key energy-related measure announced by the chancellor was a reduction in the VAT paid by people when having insulation and low-carbon technologies installed in their homes.

Sunak told parliament that “as energy costs rise, we know that energy efficiency will make a big difference to bills” and the budget document also notes that such measures will support “the UK’s long-term net-zero ambitions”.

The chancellor said that prior to this, only some materials qualified for a 5% VAT relief and “there are complex rules about who is eligible”, a situation he blamed on a 2019 European Court of Justice decision.

Therefore, he said that over the next five years households will pay 0% VAT on solar panels, heat pumps and insulation, as well as wind and water turbines, which were previously out of scope under EU rules.

The Treasury clarified that this 0% VAT applies both to the materials used and the cost of installation. It also noted that Northern Ireland Executive would receive a Barnett formula share of this relief until it can be introduced UK-wide.

The government states that, as a result of these changes, a typical family having rooftop solar panels installed will save more than £1,000 in total on installation, as well as £300 annually on their energy bills.

Commentators pointed out that while such savings are welcome, they will not help those who are immediately affected by the rising cost of living.

It is worth noting that while the Treasury document states that the government “has committed to spend over £9.7bn on decarbonising buildings” – and the chancellor alluded to “red tape imposed on us by the EU” – the Conservatives have consistently failed to scale up energy efficiency measures while they have been in power.

The cost of expanding this VAT relief for energy saving materials is estimated at around £50m, rising to £65m in 2026-27.

Other announcements

Sunak also announced an additional £500m for the Household Support Fund, on top of £500m that the government has already provided since October 2021.

This fund is designed to help the most vulnerable households with essentials including utilities.

Local authorities, which the chancellor said are “best placed to help those in need in their local areas”, will receive this funding from April.

While this comes on top of pre-existing measures such as the £200 energy bill loan, some commentators noted that more would be needed to help households with the expected energy bill increases.

Additional measures announced in the statement included the government bringing forward the implementation of business rate exemptions for on-site renewables and low-carbon heat networks. These will now be implemented in 2022, rather than 2023.

The government describes this action as part of its drive to “support the decarbonisation of non-domestic buildings”.