Leading economists: Green coronavirus recovery also better for economy

Guest authors

05.05.20

Guest authors

05.05.2020 | 6:54amIn the aftermath of the global coronavirus pandemic, governments are likely to mobilise significant spending to reinvigorate their economies.

Our new research, based on surveys of more than 200 of the world’s most senior economists and economic officials, suggests that spending this money on climate-friendly “green” policy initiatives could not only help shift the world closer to a net-zero emissions pathway, but could also offer the best economic returns for government spending.

The economic and human costs of the pandemic have been tragically high. It has also had huge short-term climate impacts, with the IEA predicting an 8% drop in CO2 emissions this year. If this were repeated every year this decade it would be roughly in line with a pathway to 1.5C.

However, while CO2 emissions also fell sharply during the 2008 global financial crisis (GFC), they quickly resurged on a wave of carbon-intensive stimulus spending, as governments moved to restart their economies. Numerous public figures have been urging governments to heed this lesson, pushing for post-coronavirus stimulus spending to accelerate climate action instead.

In a new study, forthcoming in the Oxford Review of Economic Policy, coauthored with Prof Nicholas Stern, Prof Joseph Stiglitz, and Dimitri Zenghelis, we explored the economic pros and cons of government spending on different post-crisis recovery policies, including some that would be climate-friendly and others that would not.

- IEA: ‘Green’ coronavirus recovery would keep global emissions below 2019 peak

- Coronavirus: Tracking how the world’s ‘green recovery’ plans aim to cut emissions

- Webinar: What impact is Covid-19 having on global CO2 emissions?

- Q&A: Could climate change and biodiversity loss raise the risk of pandemics?

- Analysis: Coronavirus set to cause largest ever annual fall in CO2 emissions

- Coronavirus: What could lifestyle changes mean for tackling climate change?

- Analysis: Coronavirus temporarily reduced China’s CO2 emissions by a quarter

We asked 230 leading economists to rate these policies according to speed of implementation, long-term economic benefit and climate impact, ranging from positive to negative.

The respondents, including academics, senior G20 finance ministry and central bank officials, gave some of their highest ratings for climate benefit and economic outcomes to “green” measures including clean energy investment and building retrofits. In contrast, unconditional airline bailouts were rated poorly across all metrics.

The findings suggest that a post-crisis green stimulus can help drive a superior economic recovery.

Crisis recovery

Government spending can be a highly effective way to accelerate economic recovery after a major crisis. This is likely to be particularly true in a deep “pancession” – a pandemic-induced recession – like the one most countries now face.

When designing stimulus packages, governments often look to two key metrics. First, how long it takes for policies to have an economic impact, and second, the effect of the investments on longer-term national income, measured by the “economic multiplier”. Investments with a higher multiplier have greater economic impact per dollar spent.

Ideal investments are those that put newly unemployed people to work quickly, delivering a high short-term multiplier, while producing valuable assets that meet the needs of the future so as to also deliver a high long-term multiplier. Given the magnitude of the current unemployment challenge, such investments would need to be large scale.

After previous crises, our research found that governments have tended to turn towards brown or “colourless” stimulus policies over those that are green. This has been, at least in part, due to a perception that the economy should trump climate action in times of crisis.

Stimulus surveyed

To understand the potential of green stimulus to address both problems at once, we defined a set of 25 archetypal stimulus policies that governments may be considering in response to the Covid-19 crisis.

Of these measures, 19 address the longer-term “recovery” phase after the acute phase of the crisis has passed. This set was based on an analysis of over 700 fiscal spending policies proposed or implemented since 2008.

We then identified a target group of senior economic experts on which to test the perceived impact of these archetypal policies. The group consisted of 1,019 experts at central banks, development banks, finance ministries, universities and thinktanks.

Some 230 of the experts responded to our survey, representing 53 countries including each of the leading economies in the G20. We asked survey respondents to rate each policy in terms of potential economic impact and climate impact, either positive or negative.

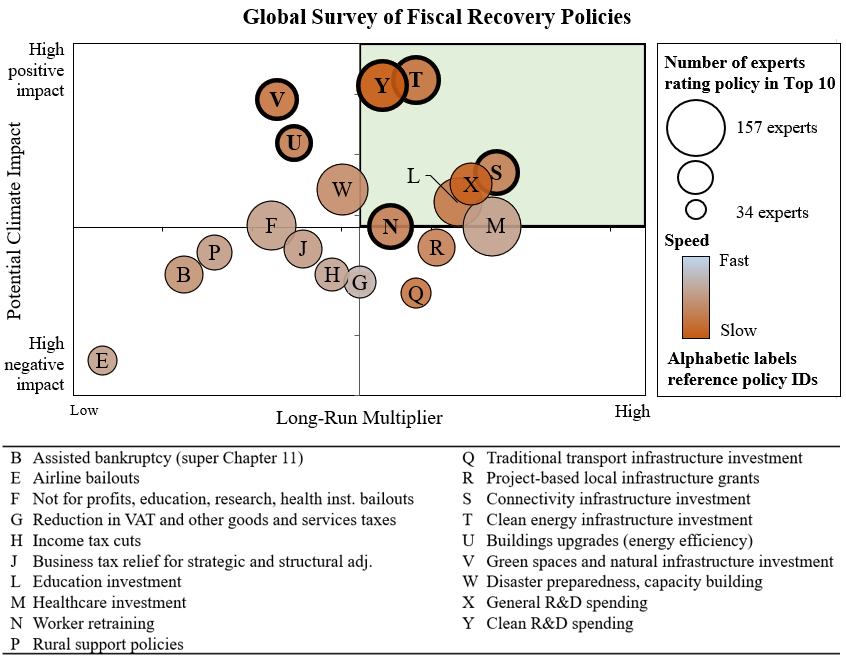

The survey results suggest a priority set of policies, in the top right-hand quadrant of the figure, below, that are each perceived to have a high economic multiplier and strong potential to decrease greenhouse gas emissions.

Results of our April 2020 survey of leading global economists, testing 25 fiscal policy types. Bubbles represent the 19 “recovery” policies only. Policies with higher long-run economic multipliers have greater economic impact per dollar spent. Faster policies achieve their desired economic impact more quickly. Policies with positive climate impact are likely to support efforts to achieve net-zero emissions. Bubbles in bold are loosely defined as green policies.

When combined with our review of past measures implemented in response to the GFC, five policy items stand apart from the rest.

These policies include:

- Clean physical infrastructure investment in the form of renewable energy assets, storage (including hydrogen), grid modernisation and carbon capture and storage (CCS) technology;

- Building efficiency spending for renovations and retrofits including improved insulation, heating and domestic energy storage systems;

- Investment in education and training to address immediate unemployment from Covid-19 and structural shifts from decarbonisation;

- Natural capital investment for ecosystem resilience and regeneration including restoration of carbon-rich habitats and climate-friendly agriculture; and

- Clean R&D spending.

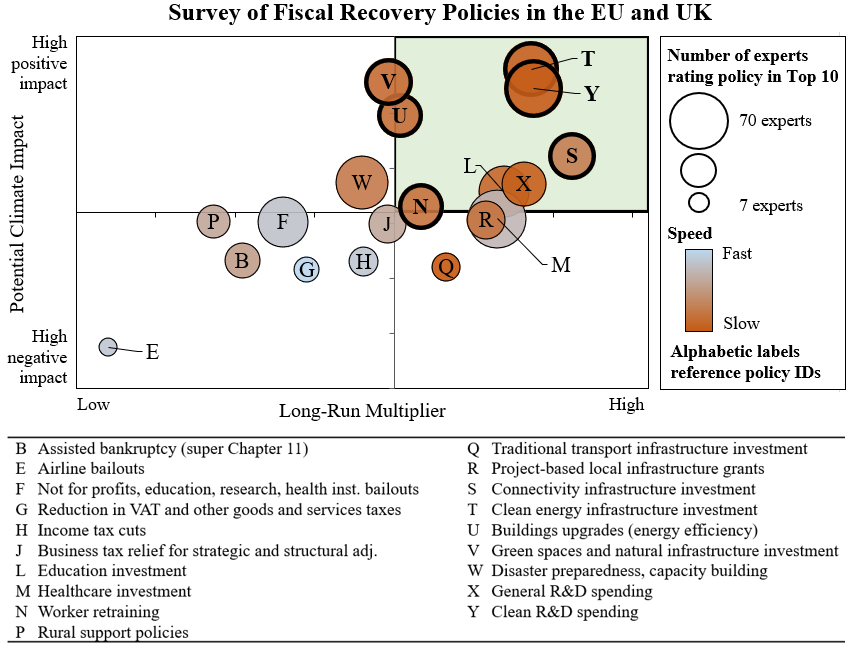

Among European survey respondents, the relative appeal of these policies was particularly stark. The first, second and third highest economic multipliers were all associated with green policies, as shown in the chart, below. Notably, meanwhile, unconditional airline bailouts fared particularly poorly.

Results of April 2020 survey for respondents in the European Union and the United Kingdom. Graph axes re-scaled for easy viewing.

Green recovery

Government responses to the coronavirus crisis will include “once-in-a-generation” stimulus measures worth trillions of dollars. Choices made will have large consequences for global emissions, intended or otherwise.

Our findings show that there is every reason for climate strategy to be top of mind for policymakers as they shape stimulus packages in the coming months. The senior economists we surveyed viewed green stimulus measures as among the most beneficial for the economy, as well as having strong potential to cut emissions.

Moreover, the climate crisis, much like Covid-19, is global in nature. People worldwide are being affected by both problems in inequitable fashion. The stimulus policies we identified can offer a variety of co-benefits and if implemented, specific policy design can incorporate lessons from the past.

Targeted green policies can be shaped to decrease inequality and meet additional environmental or social objectives.

For example, subsidies to support new home insulation could be directed towards lower-income households to reduce fuel poverty, keeping homes warm and bills low. In lower- and middle-income countries, new renewable energy supplies could bring electricity to under-served populations.

When it comes to policy design, however, the devil is in the detail. We found examples suggesting that throwing money at green initiatives is not enough, such as Australia’s 2009 Home Insulation Program, a well-intentioned post-GFC response that fell somewhat short due to a lack of proper planning. The response to Covid-19 therefore needs to be well-designed and learn from suboptimal policies of the past.

In the lead up to the delayed COP26 UN climate summit, which was due to have been held in Glasgow this November, some countries are coming together to plan for a green post-coronavirus recovery and to call on others to join them.

The UK’s first COP26 Universities Network Briefing, also published today, draws on our findings and proposes a “Sustainable Recovery Alliance” to bring nations together for a coordinated recovery that encourages a “race to the top”.

The briefing highlights the particular role that the UK, as host of COP26, could play in leading the world on green recovery.

A shift from the immediate Covid-19 public health and economic crisis towards longer-term recovery brings the potential to invest in productive assets for the long term. Our research shows that this investment could help decouple emissions from growth, avoid stranded assets – and stranded jobs – and redirect the global economy towards a more prosperous net-zero emissions pathway.