Multiple Authors

06.11.2017 | 8:00amIn 2009, countries meeting in Copenhagen for the 15th UN climate conference set a new monetary goal.

They agreed that, by 2020, developed countries should be jointly “mobilising” $100bn a year to help developing countries tackle climate change.

Multilateral climate funds, such as the Green Climate Fund (GCF), are one of several ways this finance is distributed. They distribute public money as both loans and grants, thus are often viewed as particularly important institutions for the $100bn goal.

Here, for the first time, Carbon Brief has mapped more than 1,000 projects being funded by the four main multilateral climate funds. (See below for details on what is and is not included.)

The interactive map, above, illustrates where around the world these funds are supporting climate projects. Analysis of the data shows:

- In 2016, multilateral climate funds approved $2.78bn of project support.

- Since beginning to approve projects in 2015, the GCF has rapidly become the largest source of grants and funds, overtaking the Climate Investment Funds (CIF) in 2016.

- Over the period 2013-2016, India received the highest level of single-country funding ($725m) approved by multilateral climate funds in absolute terms. This was followed by Ukraine ($278m) and Chile ($262m). However, viewed on a per capita basis, Tuvalu received the most funding per person ($3,947), followed by Samoa ($477) and Dominica ($313).

- The largest number of projects funded so far are in Mexico (25), followed by India and Cambodia (22 each) and South Africa (21). In total, the map contains 1,020 projects.

- The largest amount of funding for any project was $378m from the GCF for a private sector sustainable energy financing programme across 10 Asian and African countries.

- The US is currently the largest donor across the four funds, followed by, respectively, the UK, Japan, Germany and France. When viewed as per-capita funding, Norway comes top. However, Donald Trump has pledged to cease US funding of at least two of the funds from 2018.

Below, Carbon Brief takes an in-depth look at the data and looks at the significance of multilateral climate funds in the effort to reach the $100bn goal.

The map

The map above shows all the projects funded by the four main multilateral climate funds: the Green Climate Fund (GCF); Adaptation Fund; Climate Investment Funds (CIF); and Global Environment Facility (GEF). Projects included range from those funded in 2009 right up to last month.

The CIF and GEF are broken down into a number of smaller funds which are also indicated on the map. (See, “The different multilateral climate funds”, below for more details on these funds.)

By zooming in on the map, you can see the number of projects in each country. By clicking on each project, you can see its title, year of approval, value and funding institution. In some cases – most GCF and Adaptation Fund projects, for instance – there is also a short summary of the project.

Projects covering 2-10 countries are shown in each relevant country, along with the total value of the full project. Projects spread across more than 10 countries are labelled as “global” in the map and located together on the map – so they can still be viewed – in the Atlantic ocean.

The numbers shown on the clusters refer to the number of projects in that country. Zoom in to click on individual projects. Here, only the country is given, rather than the specific location in the country. (Note that, in some cases, projects have received more than one allocation of funding: these are shown as two separate projects on the map.)

![]()

As shown by the key on the bottom left, the colour of each cluster represents the number of projects within the cluster, ranging from more than 10 projects (yellow) to fewer than five projects (blue). The colour of each project point, meanwhile, indicates the level of funds going to that project, ranging from more than $100m to less than $10m.

Note that the amounts shown on the map are those which have received final approval by the fund, but may not have yet been fully distributed. They also exclude any co-funding from governments, or other public or private funds (see “Co-financing” below for more on this).

Carbon Brief has obtained the data either by downloading it from a fund’s websites (for the GCF), or requesting it from the funds themselves (for CIF and GEF). A combination of both routes was used for the Adaptation Fund. Note, therefore, that for CIF and GEF the labelling of projects as “climate finance” is by the bodies themselves; others might dispute this for certain projects.

Country funding

The chart below shows the funding approved by the multilateral climate funds for the 40 most highly funded countries between 2013 and 2016, inclusive. Carbon Brief has focused of this four-year period because this is the only period where comparative and full data is available for all four funds.

Funding for the remaining 98 countries is grouped under “Other countries”. Regional (involving 2-10 countries) and global (involving more than 10 countries) project funding is also shown.

Top 40 countries with multilateral climate funding approved for specific projects from multilateral climate funds from 2013 to 2016, based on data either freely available on their websites (for Adaptation Fund and GCF) or sent to Carbon Brief by the funds (for the CIF and GEF). The first chart shows the funding on a per-capita basis, with population data taken from the World Bank, 2016. Note that there was no WB data available for Eritrea. The second chart shows the funding in absolute terms. Chart by Carbon Brief using Highcharts.As the graph shows, India was given by far the highest amount of single-country funding, with $745m of projects approved over the four-year time period.

However, analysing the data on a per-capita basis – which is, arguably, fairer given the huge range of population sizes – it reveals very different results, with Tuvalu on top with $3,947. India, by comparison, received just $0.56 per person. (All the data for all countries is available in this read-only Google Doc.)

The majority of India’s funding was from CIF’s Clean Technology Fund (CTF) for four major allocations of funds: a renewable energy transmission investment programme in Rajasthan ($200m); a solar rooftop investment programme ($175m); a further grid-connected rooftop solar programme ($125m); and project promoting green growth in Himachal Pradesh ($100m).

All four of these were among the top 10 largest amounts of funding approved between 2013 and 2016, with the first two being the second and third largest, respectively. The biggest amount of funding for any project, however, was $378m from the GCF for a private sector sustainable energy financing programme across 10 Asian and African countries.

(Note that in September 2017, the GCF approved $265m for the renewables investment Geeref Next project, making it the second largest project overall. Projects approved so far in 2017 are not included in the chart above, but are included in the map for most funds, where the data is available.)

Ukraine, Chile, Indonesia, Turkey and Vietnam all received approval for between $200m and $300m in total funding during 2013 to 2016. A further nine countries – including Argentina, Mexico and South Africa – had between $100m and $200m approved.

The vast majority of Ukraine’s $278m in funding also came from the CTF, including for projects on district heating energy efficiency ($51m) and urban water infrastructure ($50m). (Note that these projects are labelled as “climate finance” by CIF, not by Carbon Brief.)

Likewise, most of Chile’s $262m in funding came from the CTF, including $67m for a concentrated solar power project and $30m for a geothermal risk mitigation programme. The GCF also approved $49m for a solar energy development programme in Chile’s Tarapacá Region in 2016.

International climate finance: the basics

Countries first agreed on the principle of international climate finance at the Rio Earth summit in 1992, when the United Nations Framework Convention on Climate Change (UNFCCC) was initially established.

The intense sunshine in the deserts of Rajasthan, India, is now being turned into solar power, thanks to a project by the Clean Technology Fund. Credit: Jitendra Parihar/Thomson Reuters Foundation/CIF Action (CC BY-NC-ND 2.0). Photo taken 14/04/2014.

The treaty said developed countries should provide extra financial resources to developing countries in order to help them meet the costs of tackling and adapting to climate change, as well as to support them to establish and report on national climate plans.

This initial concept of climate finance had been sharpened by the time the $100bn figure was agreed to in the Copenhagen Accord in 2009.

This said developing countries, especially those with low-emitting economies, should be “provided incentives to continue to develop on a low emission pathway”. This international finance would help countries take “meaningful” mitigation actions and increase their transparency in implementing UN climate deals.

The Paris Agreement adopted in 2015 says climate finance should be a 50:50 split between mitigation and adaptation.

Browsing through the hundreds of projects in the map above allows a comparison of the projects funded by multilateral climate funds against these criteria. Projects range from, for example, green energy access programs in Benin to a resilience program to support communities vulnerable to climate change in Jordan.

What are multilateral climate funds for?

Broadly speaking, international climate finance can include both public and private sources, as long as they flow from developed to developing countries.

Multilateral climate funds – as included in the map – are international institutions funded by several developed countries to distribute climate grants and/or loans. Other forms of climate finance include bilateral (country-to-country) funds, multilateral development banks (MDBs; for example, the World Bank) and private finance.

The four multilateral funds included in Carbon Brief’s map have been developed at different times and for different purposes. The interactive network diagram below shows how each of these funds break down into smaller funds, as well how they as interact with one another. It also includes where the fund headquarters are located and information about their donors.

Who funds the funds?

Carbon Brief has obtained data about donors from each of the four fund’s websites. The interactive chart below brings that data together to show that the US is currently the leading donor across all four funds, followed by the UK, Japan, Germany and France, respectively. (Click on each fund name to reveal more information.)

The Global Environment Facility (GEF) data only includes donations made to its three climate-specific funds – the Capacity Building Initiative for Transparency (CBIT) fund, Least Developed Countries Fund (LDCF) and Special Climate Change Fund (SCCF). The Adaptation Fund is treated here as a standalone fund, even though it is currently being administered by the GEF on an “interim basis” (see below).

Leading donors of the four main multilateral climate funds. Data for Green Climate Fund covers “pledges” across the 2015-2018 period and is accurate up to September 2017. Data for the Climate Investment Funds covers the “total amount pledged” across the 2008-2016 period. Data from the Global Environment Facility includes all the “contributions” made to its three climate-specific funds, namely, CBIT (2017-17), SCCF (2001-17) and LDCF (2001-17). Data for the Adaptation Fund covers “contributions” across the 2010-2017 period. Population data for the per-capita calculations is taken from the World Bank, 2016. Chart by Carbon Brief using HighchartsGEF

The oldest multilateral fund still in action is the Global Environment Facility (GEF). Formed on the eve of the 1992 Rio Earth summit, this is a partnership of 18 agencies (such as NGOs, MDBs and UN bodies) alongside 183 countries.

The GEF supplies funds under a number of global environmental conventions to tackle environmental challenges, such as persistent organic pollutants, but is also mandated under the UNFCCC to distribute grants and help countries build on skills and knowledge. It does this via several different funds.

The CBIT fund, for instance, acts specifically to help developing countries meet the enhanced transparency requirements of the Paris Agreement. Meanwhile, the LDCF aims to assist the least developed countries with their national adaptation programmes. The SCCF complements the LDCF by being open to all vulnerable developing countries.

Adaptation Fund

The Adaptation Fund (AF), the second oldest fund, was established in 2001 under the Kyoto Protocol. It is explicitly mandated to finance adaptation and resilience activities in developing countries which are vulnerable to climate change. It did not approve its first projects until 2010, but since then has approved $462m in 73 countries, most recently in October. Its recently developed new strategy sets a goal to mobilise $100m per year between 2018 and 2022.

The AF was initially set up to be run on a share of proceeds from the international carbon mechanisms under the Kyoto Protocol. However, these have so far yielded little revenue. Most of its money, therefore, comes from voluntary contributions, with EU member states so far providing around 95%.

While countries have agreed the AF should also serve as part of the Paris Agreement, there is an ongoing debate within the UNFCCC talks as to how it should be governed and operated.

The GEF is currently administering and providing secretariat services to the AF “on an interim basis”, according to its website.

CIF

The Climate Investment Fund (CIF) was set up in 2008 to pilot the distribution of climate finance and has been a major distributor of funds over the past four years. A “sunset clause” conceived at its establishment says it should close once a new climate finance architecture becomes effective under the UNFCCC.

Akabondo Mainais, left, the monitoring and evaluation officer for the Climate Investment Fund (CIF) projects in western Zambia. He talks here to the Nalunau family, who have been farming here for 3 generations. They explain that they are struggling because the flood waters on the Barotse plain are not receding like they used to. CIF is supporting projects within the Pilot Project for Climate Resilience in Zambia. Credit: Jeffrey Barbee/Thomson Reuters Foundation/Cif Action (CC BY-NC-ND 2.0).

CIF is the only fund which operates outside the UNFCCC framework, instead being hosted by the World Bank, which serves as its trustee (although the World Bank serves as either trustee or interim trustee for the three other funds as well). This has led to concerns that the funds CIF distribute are less accountable than others, potentially undermining the official UN process.

The CIF is divided into a number of sub-funds collectively known as the CIFs: the large-scale Clean Technology Fund (CTF), the Pilot Program for Climate Resilience (PPCR), Scaling Up Renewable Energy in Low Income Countries (SREP), and the Forest Investment Program (FIP).

GCF

Finally, the Green Climate Fund (GCF) was established at COP17 in Durban in 2011 with a mandate specifically to leverage climate finance towards the $100bn pledge.

It was set to be the key financing vehicle of the UNFCCC, with more than $10bn pledged in its initial funding drive in 2015. To date, it has announced $2.65bn of funding for a variety of recipients, most recently in October 2017. It is also explicitly mandated to give half its funding to adaptation measures.

The US is currently the GCF’s largest donor, although Donald Trump has said he will cease US funding of both the GCF and CIF from 2018. The UK is also a leading GCF donor. Last year, it contributed £60m, down from £160m a year earlier. (See Carbon Brief’s map of the UK’s climate finance published last month.)

It’s worth noting that most funds are authorised to distribute finance in the form of loans and equity, as well as grants, with only the Adaptation Fund and the LDCF and Special Climate Change Fund (SCCF) of the GEF limited to grants alone.

Multilateral funds and the $100bn goal

The chart below shows the total project funding approved by each of these four funds since 2013, according to Carbon Brief analysis.

Funding approved to projects by each of the four main multilateral climate funds from 2013 to 2016 inclusive, based on data either freely available on their websites (for Adaptation Fund and GCF) or sent to Carbon Brief by the funds (for the CIF and GEF). Chart by Carbon Briefing using Highcharts.As the chart shows, approved funding from the CIF was proportionately high in 2014, but has since reduced. The GCF only began funding projects in 2015, but quickly ramped up to become the largest source of funding in 2016. The Adaptation Fund continues to make up only a minor contribution to funding approved by multilateral climate funds.

While estimates of the levels of climate finance reached so far can be wide ranging, multilateral climate funds provide a relatively small proportion of total climate finance.

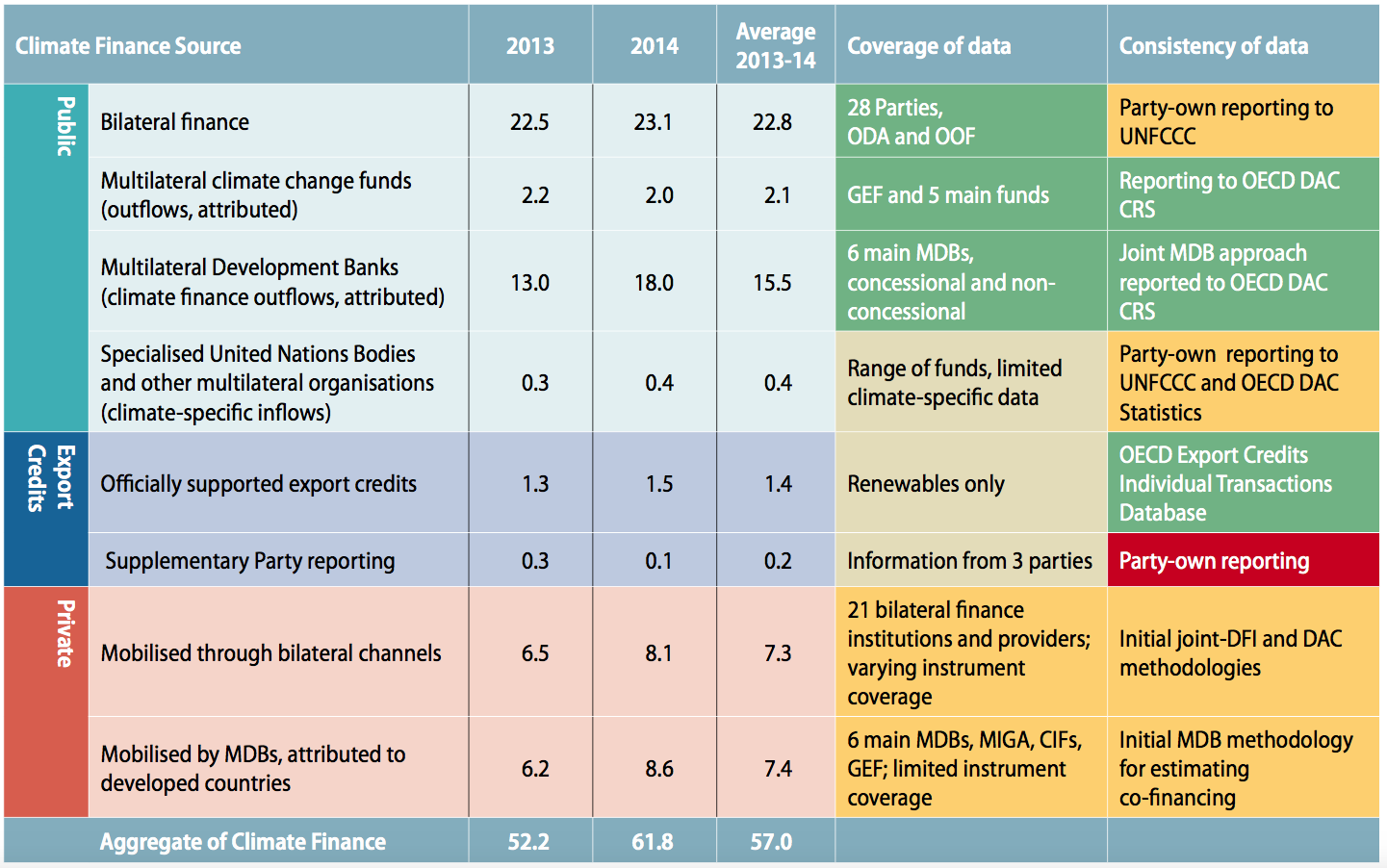

In 2014, between them, the GCF and CIF distributed only $2m of a total $62m in climate finance contributing to the $100bn goal, according to a report by the Organisation for Economic Co-operation and Development (OECD) and Climate Policy Initiative (CPI). (Note that this OECD/CPI figure assesses how much was transferred to projects in 2014, while our map shows the amount approved for a given project in a certain year, some or all of which will often be transferred in later years.)

MDBs and bilateral donations contributed a far larger share of public climate finance than multilateral funds: around 40% and 53%, respectively, of the $44bn in public finance distributed in 2014.

The grid below shows this in more detail.

Preliminary estimated climate finance (in $USD billions) mobilised from developed countries for developing countries. Source: OECD/CPI Climate Finance in 2013-14 and the USD 100 billion goal.

The report showed that funding from MDBs was also by far the largest source of new funds, rising by $5bn compared to a year before, while funding via multilateral funds actually fell by $200m compared to the previous year. A recent joint report from the six main MDBs said their collective climate finance reached over $27bn in 2016, up from $25bn in 2015.

However, others have applied a far more stringent definition of what should be included as climate finance, arguing it should mainly focus on public finance.

In its response to the “roadmap to $100bn”, published by a group of developed nations led by the UK and Australia at COP22 in Marrakesh last year, Oxfam estimated climate finance at just $17–$20bn per year in 2015.

The importance of multilateral funds

Multilateral funds are important due to their ability to fill gaps in finance that other sources of public finance may miss, since they are typically capitalised as grants.

As well as paying for projects that do not promise a financial return, such as community resilience, this is supposed to help them to stimulate shifts in other public and private finance investments. For example, they are thought to help to reduce risks for others investing in innovative clean technology projects.

While MDBs have the ability to raise additional funds from international capital markets through issuing bonds, they must also protect their credit rating and repay bonds. This can limit the amount of risk they take in their investments.

Locals load papayas into a truck on a road at the port of Arica district in Yurimaguas, Peru, 13/05/2014. Throughout the Amazon basin, deforestation and an influx of farmers and ranchers traditionally follow road construction. But the Shawi indigenous people hope that a new FIP forest conservation programme will help stem forest loss in this area of the central Peruvian Amazon. Credit: Ernesto Benavides/Thomson Reuters Foundation/CIF Action (CC BY-NC-ND 2.0).

MDBs have also frequently been accused of not greening their investments fast enough. One recent briefing by Oil Change International found that MDBs have channelled billions into fossil fuels since the Paris Agreement was agreed in 2015, doubling exploration-related finance for new oil and gas projects, for example.

In addition, MDB governance and voting power is based on the amount of funding countries contribute. In contrast, the governing bodies of most multilateral climate funds are balanced, with equal numbers of developing and developed countries holding seats. This is an important distinction to many developing countries and observer NGOs, who are clear that climate finance is not aid but compensation for damage caused by the past emissions from developed countries.

Their projects are also easier to track, whereas it can be hard to pinpoint climate finance within the reporting of MDBs.

Meanwhile, while bilateral funds are also often based on grant funding, multilateral funds are less directly linked to particular governments. Therefore, they do not wield as much direct donor influence over the recipient country.

Implementing the projects

While it is the funds which decide where the money will go, the projects are not implemented by the funds themselves.

Instead, projects will have at least one “accredited” or “implementing” entity, which are assessed by the fund to ensure they are capable of managing the finances and safeguarding funded projects. In reality, there is little difference in meaning between these two types of entity.

These partners can include UN agencies, MDBs, other banks, governments and other national entities, as well as international NGOs. They also sometimes provide co-financing (see below).

One GCF project approved this year, for example, was a water conservation project in Morocco. The European Bank for Reconstruction and Development (EBRD) is an accredited agency and Morocco’s ministry of agriculture and maritime fisheries is an implementing agency. Both of these are also providing co-funding, with the largest share coming as a loan from the EBRD of $128m. GCF itself provided a more modest $34m.

A man selects and throws wood to be cut and sold in Ouagadougou, Burkina Faso, 26/05/2014. The wood – much of it cut illegally – comes from surrounding forests. An effort by the Forest Investment Program to involve communities in forest protection aims to reverse that trend in places like Burkina Faso’s Tiogo Forest. Credit: Sam Phelps/Thomson Reuters Foundation/CIF Action (CC BY-NC-ND 2.0).

The GCF now has 59 accredited entities, while the Adaptation Fund has 44 national, regional or multilateral implementing entities which must be used to access its funds.

(The Adaptation Fund and GCF also distribute “readiness” grants – not included in Carbon Brief’s figures or map above – to current and aspiring implementing agencies to improve their ability to receive and manage climate finance.)

The GCF has been criticised by NGOs for accrediting a growing number of private banks, with worries that profit-driven institutions are increasingly dominating the fund. A majority of the GCF’s funds go to the private rather than the public sector. In addition, just 42% of its funds are given out as grants, with the rest distributed through loans, equity and guarantees.

Others have warned the GCF is increasingly skewed towards distributing money via large international financial institutions. Requirements for the smallest funding category are the same as for bigger projects, leading to a competitive disadvantages for smaller national or subnational entities, they argue.

Co-financing

Several of the multilateral climate funds aim to engage the private sector and attract additional private finance for their chosen projects.

The monetary values given in Carbon Brief’s map do not include such co-financing. However, this can be substantially higher than the amounts contributed by the funds themselves.

For instance, CIF expects its pledged funds of $8.3bn to attract an additional $58bn of co-financing. The GCF’s $2.2bn of spending so far on 43 projects has mobilised $5.3bn from other sources.

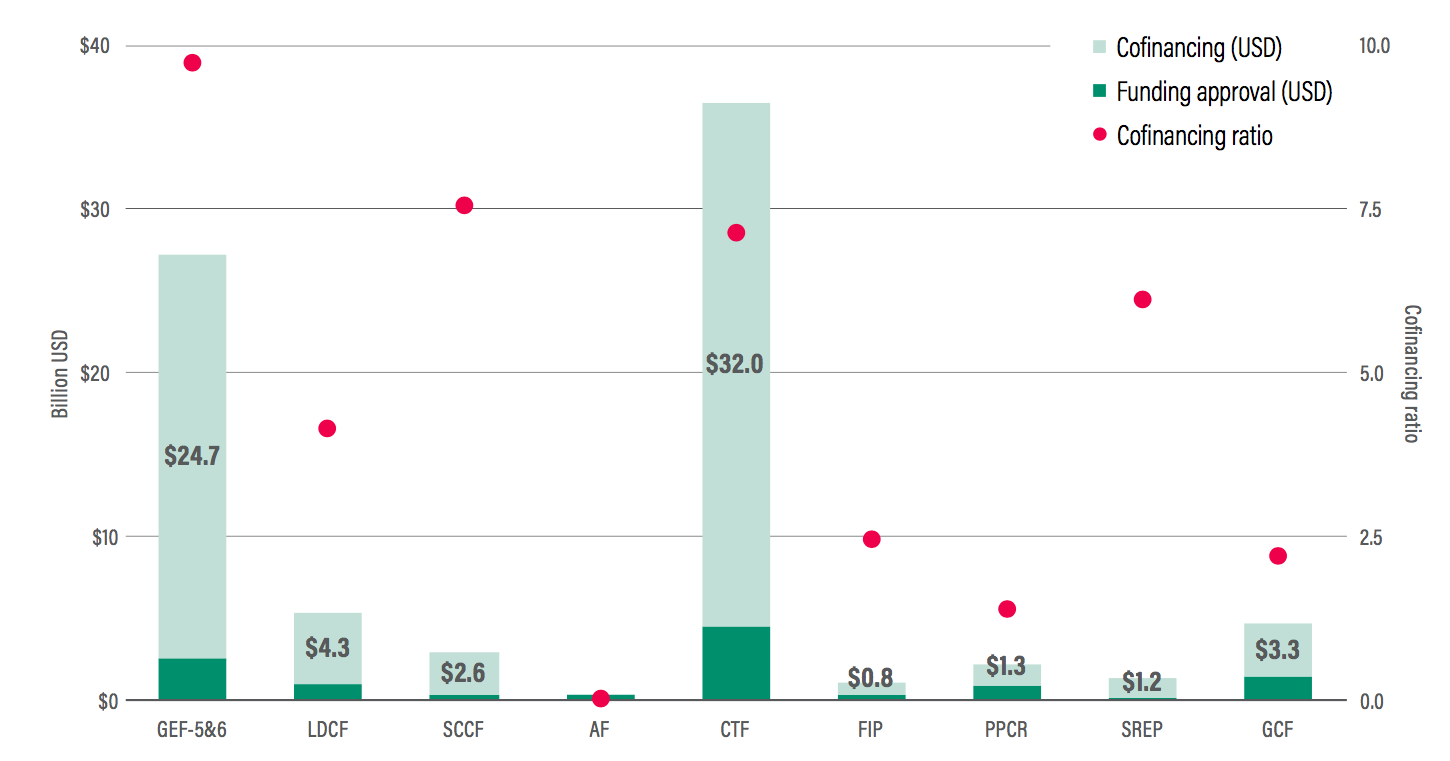

The co-financing leveraged by each fund varies substantially, as the chart below from the WRI report shows.

Funding approval, cofinancing and “cofinancing ratio” (the dollar of cofinancing generated by each dollar of finance provided by the fund), based on data from 2015 and 2016. Note that GCF data is based on expected cofinancing, while the Adaptation Fund (AF) does not report collated cofinancing data. Source: Future of the Funds: Exploring the Architecture of Multilateral Climate Finance, WRI March 2017.

As the chart shows, the Clean Technology Fund (CTF, a fund within the CIF) itself a large fund, leveraged $32bn, the largest amount of co-financing amongst the funds shown. Whereas, GEF showed the largest “co-financing ratio” – meaning the dollar of cofinancing generated by each dollar of finance provided by the fund.

Adaptation gulf

One pressing issue at the climate negotiations is the lack of funds going to projects helping people adapt to climate change.

The Paris Agreement says climate finance should be a 50:50 split between mitigation and adaptation. But efforts are ongoing to address the huge imbalance towards mitigation, with adaptation funding accounting for just a quarter of all public climate finance.

Of the nine funds shown in the graph above, the largest – CTF – only gives out money for mitigation. Meanwhile, the GCF explicitly mandates a 50:50 allocation between adaptation and mitigation. Its current distribution of funds sits at: 27% for adaptation; 41% for mitigation; and 32% for cross-cutting projects. Three of the small funds – the PPCR, Adaptation Fund and LDCF – only give out grants to adaptation projects.

According to the OECD/CPI analysis, the lack of balance in spending is driven by the dominance of mobilised private climate finance, which tends to drive funds towards mitigation. NGOs argue political leadership is, therefore, needed to ensure compliance with the 50:50 commitment, including by the EU.

In addition, while climate finance has largely been focused on the adaptation and mitigation perspective in the past, some actors are now increasingly pushing for extra finance for loss and damage from climate change to be provided.

Future of multilateral climate funds

As the number of different vehicles to deliver international climate finance has risen over the years, growing attention has been directed at whether the overall framework is the most efficient means of distribution.

The WRI report, for example, argued that multilateral climate funds should put a greater focus on supporting systemic shifts, improve coordination and be more willing to take on risk.

One ongoing question is whether the funds operated under the CIF – the only multilateral fund which exists outside the UNFCCC structure – should close down (in line with its “sunset clause”). And, if so, by when?

A letter signed last year by more than 100 NGOs argued funds should now instead go towards the more accountable GCF, which has a governance structure evenly split between developed and developing countries and was set up according to the principles of the UNFCCC. (The CIF is instead, accountable to MDBs, whose voting power is in turn dependent on funding from developed countries.)

However, others argue CIF should stay in place for now as the relatively new GCF gets up to speed, since closure could result in investment gaps. The decision on how to implement this sunset clause has been postponed until June 2019.

The GCF has now mobilised more than $10bn in commitments, overtaking the CIF’s $8.3bn as the largest multilateral climate fund based on pledges. However, as mentioned earlier, Donald Trump has pledged to stop future US payments to the fund, meaning $2bn of the $3bn pledged by the US will be lost. Barack Obama had sent $1bn before the end of tenure.

This would prove to be a huge hit to the GCF, if the money is not found elsewhere. The EU has indicated it does not plan to fill the funding gap. Trump also plans to pull promised US funding from the CIF.

Halting future funding does not necessarily mean the US would lose its seat on the GCF board, which it could keep for the next 2-3 years. In July, Bloomberg reported that the US plans to use its seat on the board to promote funding of coal plants and natural gas pipelines.

During the initial GCF funding round, the UK pledged to fund 12% of the GCF up to £720m over three years. Its current total pledge stands at $1.2bn. However, the UK was recently criticised for being the only GCF board member to block two South American bids for cash to support rural development at a recent GCF meeting in Cairo.

International climate finance negotiations at the UNFCCC are now focused on how to account for and track the climate finance given or received by different countries. This remains a fraught topic in climate negotiations, with developed countries arguing they are complying with their financial commitments and developing countries continuing to ask where the money is.

Meanwhile, WRI has suggested Emmanuel Macron, the new French president, could put a “modest but meaningful” public finance package on the table at his climate summit in December to renew the financial strength of several multilateral climate funds.

Notes

Projects approved by the GCF and Adaptation Fund are up-to-date at time of writing and include all projects funded by these bodies, both ongoing and completed.

The CIF projects are up-to-date as of the end of 2016 and include projects which date back to 2009. It’s worth noting that several of these projects have now reached completion.

The GEF data (provided by the GEF Secretariat) includes all projects approved between June 2012 and the end of June 2017. Any active projects approved prior to June 2012 are not shown on the map, while some projects approved since June 2012 may now be completed. Not all GEFs projects are relevant to climate finance – only climate projects are included in Carbon Brief’s map. These have been provided to Carbon Brief by the GEF which uses OECD Rio Markers methodology to decide what counts as climate finance. It includes some projects for which climate is not the only function.

Update 8/11/2017. The article was corrected to show the Adaptation Fund has so far approved €462m for all projects. It previously incorrectly said €503m.