UK spring budget 2023: Key climate and energy announcements

Multiple Authors

03.15.23Multiple Authors

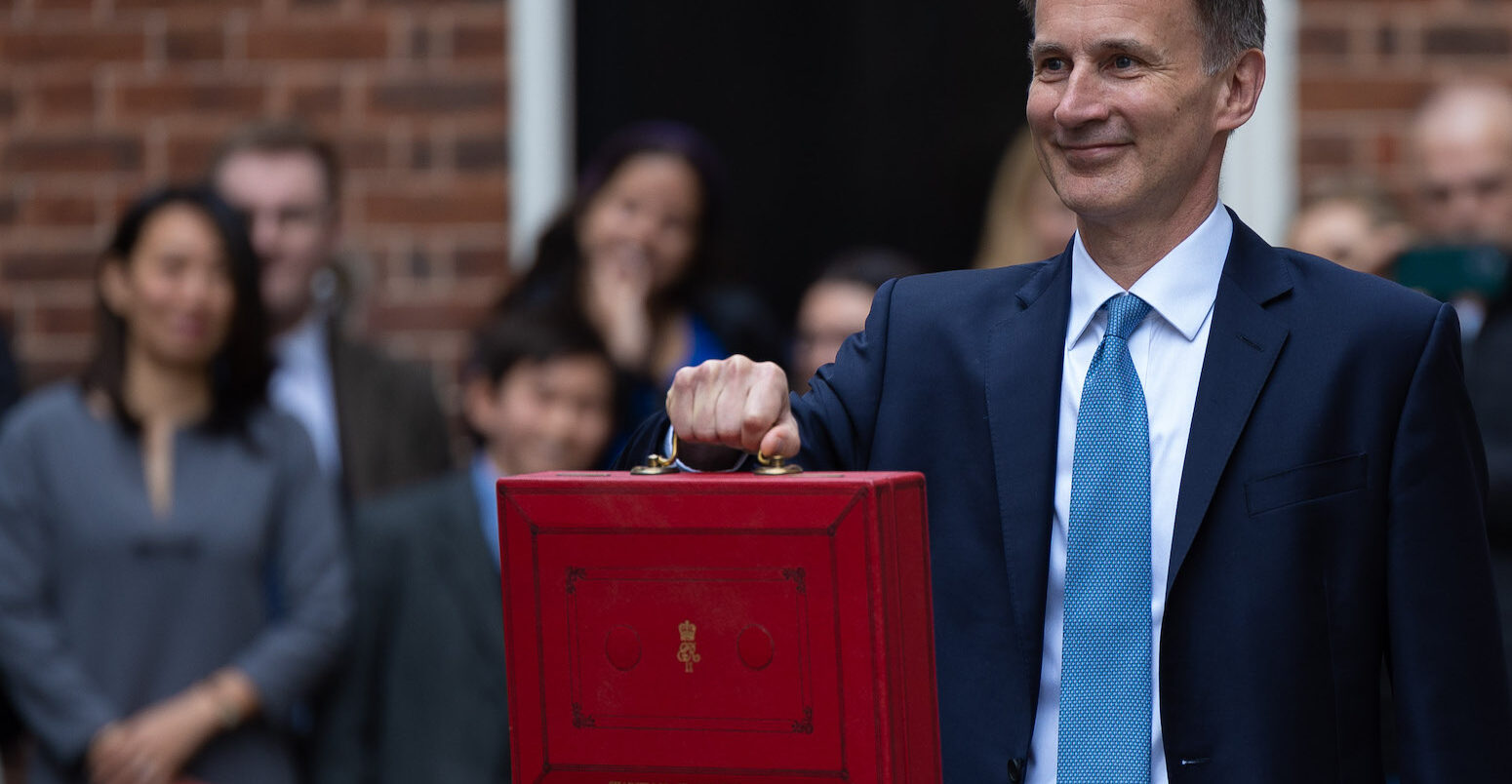

15.03.2023 | 6:09pmHeadline-grabbing announcements about nuclear power and carbon capture and storage (CCS) have featured prominently in Jeremy Hunt’s first budget address as UK chancellor.

The budget includes measures that the government says will ease the pressure on households. These include extended energy bills support and a controversial freeze on vehicle fuel duty.

Hunt delivered the “autumn statement” in November 2022, but, prior to that, the March 2022 “spring statement” was handled by then-chancellor Rishi Sunak, who is now prime minister.

The budget comes on the same day as one of the largest strikes in decades, which Hunt blamed on high inflation.

An estimated 700,000 teachers, junior doctors, university staff, civil servants and London Underground employees have been protesting over pay and working conditions.

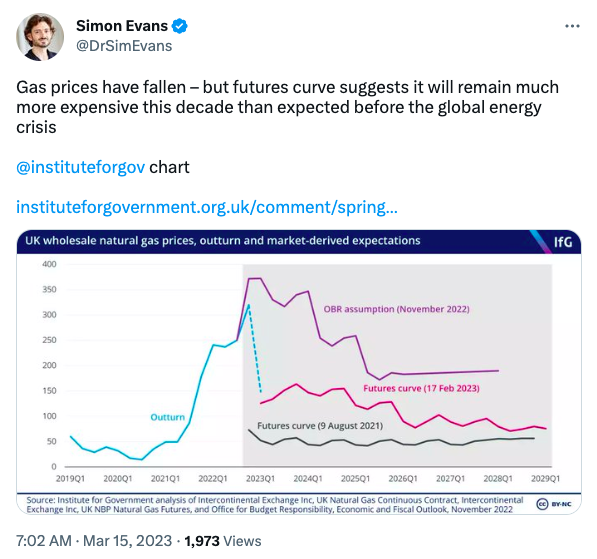

Inflation has been driven by the global energy crisis and record-high fossil fuel prices, which are now falling.

Fossil fuel prices are now much lower than expected just a few months ago, easing pressure on energy bills, pump prices and the cost of government energy support.

While Hunt used his speech to emphasise the need for greater energy security in response to the energy crisis, he did little to match the low-carbon subsidy schemes devised by the US and the EU. Ahead of the budget there had been growing pressure for a UK government response.

Hunt’s “growth strategy” focused on the “four key priorities” of “employment, education, enterprise and everywhere”. Not included in his list were “energy” and “environment”.

Similarly, energy, climate and net-zero were absent from the prime minister’s “five key priorities” for the UK.

However, today’s budget document – the Treasury “red book” – does use the phrase “net-zero” 26 times. This is in contrast to last year’s spring statement, which only mentioned “net-zero” once.

Crucially, the budget punted “further action” in this area until “later this month”, when the government will explain how it will ensure energy security and reach net-zero.

Later this year, the government will also review its controls on subsidies for low-carbon electricity supplies.

- Fuel duty

- Carbon capture and storage

- Nuclear

- Energy bills

- Energy efficiency

- Windfall tax

- ‘Investment zones’, capital allowances and EVs

Fuel duty

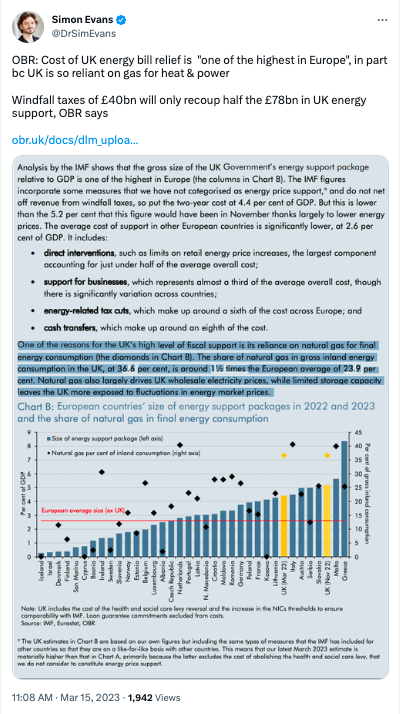

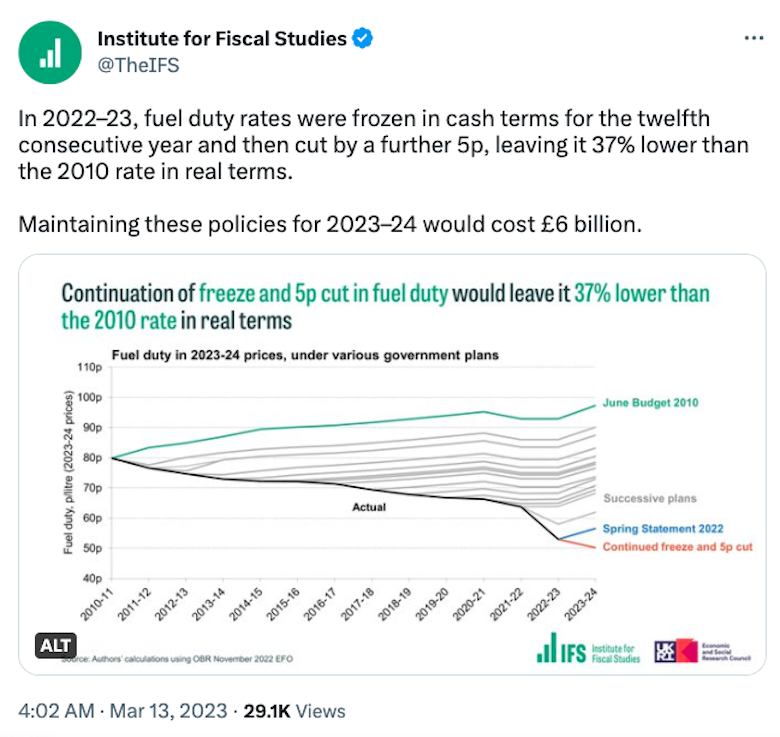

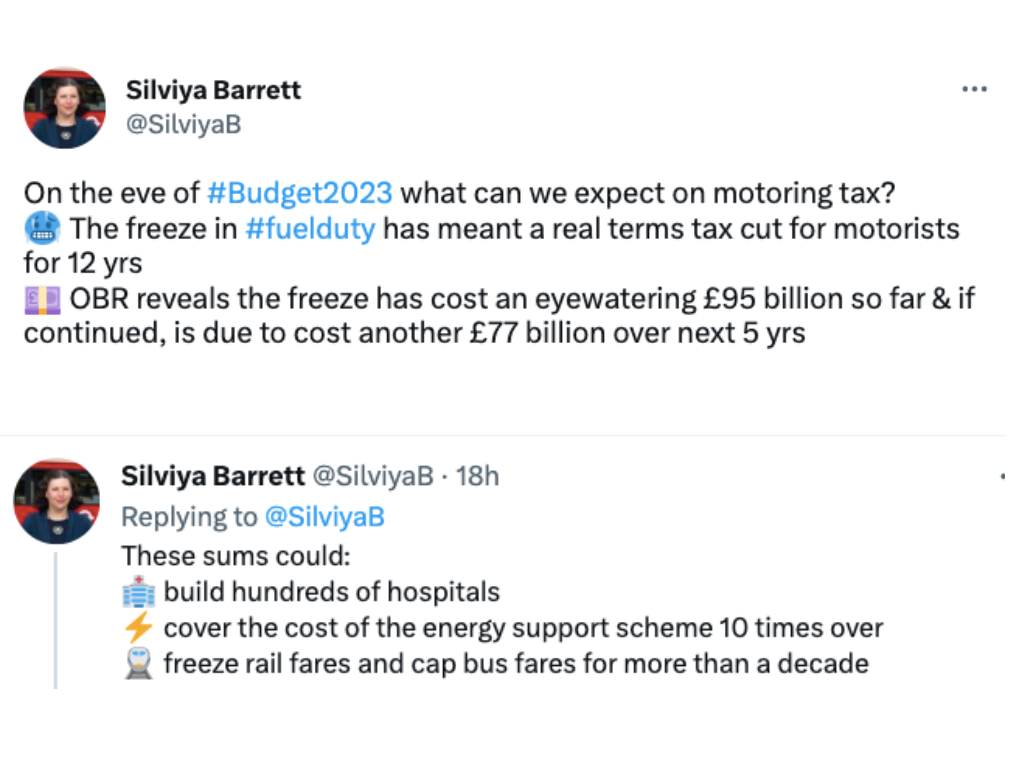

Fuel duty on petrol and diesel has been falling for more than a decade, in real terms, having repeatedly been frozen instead of rising with inflation. This persistent policy incentivises the use of fossil fuels and disproportionately benefits wealthy people.

Last year’s spring statement went even further, cutting rates by 5p per litre. It was described at the time as a temporary measure for 12 months. However, today’s budget extends the cut again.

Ahead of the budget, the Institute for Fiscal Studies (IFS) estimated that freezing fuel duty would cost the UK £6bn in 2023-24. The government’s own estimates place the cost at around £5bn.

The 13-year freeze will leave fuel duty 37% lower than planned in 2010, according to the IFS.

The first fuel duty freeze was implemented under prime minister David Cameron and chancellor George Osbourne in 2010. Since then, the Social Market Foundation (SMF) thinktank estimates that the policy’s persistence has cost the Treasury nearly £100bn in public money, in total. The Office for Budget Responsibility (OBR) puts the figure at £80bn, rising to £95bn by 2027-28.

According to the OBR, fuel duty as a share of GDP has roughly halved over the past two decades. In addition to the falling rate of duty in real terms, the OBR says revenue has shrunk due to fuel-efficiency improvements in cars and strong electric vehicle sales.

Moreover, Carbon Brief analysis in 2020 showed that the decade-long freeze on fuel duty meant the UK’s carbon dioxide (CO2) emissions were as much as 5% higher than they would have been.

Conservative governments have consistently argued that hard-pressed households in the UK need the fuel duty cuts to help ease their cost of living. This appeared even more pertinent last year, amid rising energy and fuel costs driven by Russia’s invasion of Ukraine.

This line of argument also led the opposition Labour party to throw its weight behind a freeze on fuel duty, with shadow chancellor Rachel Reeves citing “so many families and businesses reliant on their cars”.

However, as richer people tend to drive more and around two-fifths of the poorest households do not even own cars, the benefits of fuel-duty cuts are not spread evenly.

The SMF estimates that just 5% of the fuel duty freeze savings this year will go to the lowest-income people in the UK, compared to 13% which would go to the highest-income. It adds that if fuel duty was increased instead, the resulting public spending would result in the poorest households getting almost twice as much back.

The pressure on motorists has also eased in recent months. Since peaking at £1.92 per litre last year, petrol prices have fallen by 45p, nearly 25%

The Treasury states its fuel duty cut is “worth around £200 for the average car driver” over two years. However, this is based on an assumption that fuel duty would have risen, despite not doing so for more than a decade.

This point was picked up by the Treasury Committee in January, when it called on the government to “more accurately reflect the actual path of fuel duty”, in order to allow the OBR to make a “more credible forecast”.

The UK has a target of phasing out petrol and diesel car sales entirely by 2030. It will introduce electric car sales quotas from next year and the fuel duty freeze will make these harder to meet, the car industry warned, according to the Financial Times.

Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders (SMMT) pointed out in a statement that the budget did little to support the government’s low-carbon goals:

“The announced fuel duty freeze contrasts with an absence of measures to boost uptake of zero-emission vehicles, such as reducing VAT on public charging.”

Others noted that the cost of using public transport has risen far more over the past decade than the cost of driving a car. The Financial Times said rail fares were up 33%, citing campaigners.

There has been a concerted campaign from some backbench Conservative MPs, sections of the right-leaning press and motoring lobby groups to maintain the fuel duty freeze – or to cut it even further.

This was evidenced in Hunt’s speech as he announced the freeze. He said he had “heard representations” from “the Sun newspaper”, which has long run a “Keep it Down” campaign on this issue. He also acknowledged “my right honourable friend from South Thanet” – referencing Craig Mackinlay, chair of the climate-sceptic Net Zero Scrutiny Group.

The other two MPs mentioned by Hunt, Priti Patel and Jonathan Gullis, are both members of the Fair Fuel for UK Motorists and UK Hauliers All-Party Parliamentary Group (APPG), along with Mackinlay.

This APPG is supported by lobby groups including FairFuelUK, whose climate-sceptic founder Howard Cox is also deeply involved in the Sun’s long-standing campaign.

Carbon capture and storage

Ahead of the budget, the Times reported that the chancellor would announce a “clean-energy reset” including £20bn in funding for carbon capture and storage (CCS) over two decades.

BusinessGreen reported that the budget would include “a wide-ranging new clean-energy package designed to mobilise £20bn of investment”. It quoted Hunt saying in a statement:

“We don’t want to see high bills like this again, it’s time for a clean-energy reset. That is why we are fully committing to nuclear power in the UK, backing a new generation of small modular reactors and investing tens of billions in clean energy through carbon capture. This plan will help drive energy bills down for households across the country and improve our energy security whilst delivering on one of our five promises to grow the economy.”

BusinessGreen added: “The government has previously committed to providing £1bn of funding to deliver four CCS industrial hubs by 2030.”

In the event, there was no sign of any “reset” in the budget speech or supporting documents. Instead, Hunt said he wanted to “develop another plank of our green economy”, namely CCS.

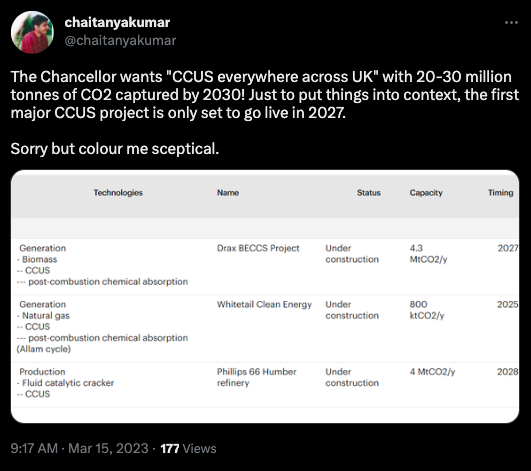

Speaking in parliament, Hunt repeated the aim, first announced in the government’s net-zero strategy in October 2021, of capturing 20-30m tonnes of carbon dioxide (MtCO2) per year by 2030.

The chancellor said he was allocating “up to £20bn” to support the deployment of CCS with up to £1bn per year. However, none of this money is reflected in the formal budget policy costings.

Moreover, none of the promised £20bn for CCS will be spent before the next election in 2024 and the government has yet to decide whether it would be funded via taxes or levies.

The lack of formal costings for the £20bn pledge suggests the government aims to fund it via levies, according to Adam Bell, former head of energy strategy at the Department for Business, Energy and Industrial Strategy, now head of policy at consultancy Stonehaven.

The commitment to review controls on levies later this year could also point in this direction, according to Colm Britchfield, policy adviser at thinktank E3G. He suggested the government might also use the review to add levies to fund new nuclear and hydrogen.

The government will this month announce a shortlist of projects for the first phase of CCS deployment. Further projects will be able to enter a “selection process” launched later this year.

The first potential projects are not due to come online until 2027 at the earliest. A previous government competition for £1bn in CCS funding was cancelled in 2015.

Earlier this week the government launched a consultation on requiring new or refurbished power stations to be “decarbonisation ready”, including by using CCS.

This follows a report from the Climate Change Committee (CCC), which said last week that gas CCS and hydrogen power are key options to fill gaps in electricity supply when it is not windy.

Nuclear

In his budget speech, the chancellor said nuclear power was “vital to meet our net-zero obligations”. He said it was a “critical source of cheap and reliable energy” that would be needed “because the wind doesn’t always blow and the sun doesn’t always shine”.

(In fact, while last week’s report from the CCC included a significant contribution from nuclear power, it said that other, more flexible technologies were needed to fill gaps from renewables. The report said nuclear power was “relatively expensive on a levelised cost basis”.)

Hunt said he wanted to encourage private investment in new nuclear power by classifying it as “environmentally sustainable”, subject to consultation. (The EU “green taxonomy” also includes nuclear investments, subject to certain conditions.)

The chancellor also said he would launch Great British Nuclear, already due to have been set up last year to help deliver new nuclear projects. He said this initiative would cut costs:

“Great British Nuclear will bring down costs and provide opportunities across the nuclear supply chain to help provide up to one quarter of our electricity by 2050.”

(The government ambition of “up to one quarter” of electricity to come from nuclear by 2050 is far beyond the levels envisaged by the CCC or National Grid Electricity System Operator.)

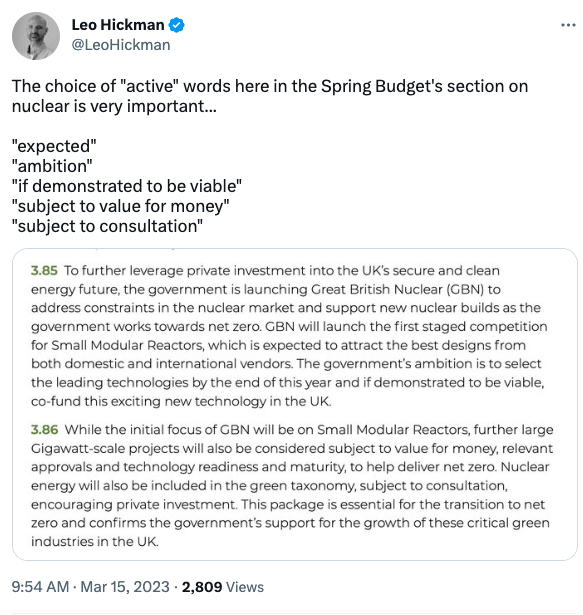

Finally, Hunt said he would launch “the first” competition for small modular reactors, which will be run by Great British Nuclear and “completed by the end of this year”. The red book states that leading technologies will then be selected and “co-funded”, if found to be viable:

“The government’s ambition is to select the leading technologies by the end of this year and if demonstrated to be viable, co-fund this exciting new technology in the UK.”

The government previously launched a £250m competition for small nuclear in 2015, but no winners were announced. Since then, it has offered various pots of money, including “up to” £210m for Rolls Royce to develop its reactor design and “up to” £170m for “advanced” modular reactors.

Small nuclear reactors will be the initial focus for Great British Nuclear, the budget document says, but further large sites “will also be considered in future”.

Hunt used his budget speech to mention the £700m in state investment pledged for the 3.2 gigawatt (GW) Sizewell C project in Suffolk, in his November 2022 autumn statement.

Energy bills

One of the major announcements in the budget was that the government plans to extend its “energy price guarantee” for bills for another three months. The guarantee is designed to protect households from increases in energy costs by limiting the amount suppliers can charge for each unit of gas and electricity.

The energy price guarantee will be kept at £2,500 a year for typical households from April to June, saving the average household around £160 on their energy bills, the government said.

The decision to extend the energy price guarantee was briefed to the media and officially confirmed ahead of the budget.

The Treasury said the scheme had so far cost much less than expected when it was announced in November 2022. The savings are due to energy prices falling more quickly than thought.

It added that the three-month extension to the guarantee would cost £3bn.

Speaking in parliament, Hunt said he decided to extend the scheme after speaking to popular “money saving expert” Martin Lewis and that it was designed to reduce “pressure on family finances”.

Hunt also confirmed that the government will adjust the guarantee so that households using prepayment meters – which tend to be the most vulnerable – will no longer pay more for their energy than those paying by direct debit from 1 July. This will last until April 2024.

The Office for Budget Responsibility (OBR) says the total expected cost of energy support schemes will reach £78bn. This includes the energy price guarantee, cost of living payments, similar schemes to support businesses and the cut in fuel duty (see above).

Only just over half of this spending will be recouped via windfall taxes, the OBR says. It notes that these energy support schemes have been among the most expensive in Europe, in part due to the UK’s unusually heavy reliance on gas for heat and power.

Energy efficiency

The budget announced little new in the way of energy efficiency.

Speaking in parliament, Hunt made reference to the government’s Energy Efficiency Taskforce, which was first announced in the government’s autumn statement in November 2022.

In 2022, the government said the taskforce would “support a new ambition to reduce energy demand from buildings and industry by 15% by 2030”, when compared to levels in 2021.

To support this, the government announced £6bn of funding for 2025-2028 in addition to the £6.6bn that it plans to spend during the current parliament.

The government laid out the taskforce’s terms of reference in February 2023. It said that the taskforce will “have a particular focus on the role of the private sector and the stimulation of investment”.

As part of today’s budget announcements, the government released new details on the members of the taskforce. The taskforce will be chaired by Tory minister Lord Callanan and NatWest CEO Alison Rose and includes experts such as infrastructure tsar Sir John Armitt.

Elsewhere in today’s budget, Hunt also made reference to plans to extend the “climate change agreements” scheme for a further two years. This scheme involves voluntary agreements between UK industry and the Environment Agency to reduce energy use and emissions.

Hunt said that extending the scheme would allow eligible businesses to access £600m of tax relief on energy efficiency measures. The government first announced it was extending the scheme on 2 March.

He also announced a £60m swimming pool support fund to help with cost pressures and to improve energy efficiency.

Ahead of the budget, the Federation of Small Businesses wrote a letter to Hunt, backed by 11 other business groups, calling for a “help to green” voucher scheme for businesses.

It suggested that businesses should receive a voucher of up to £5,000 to invest in green improvements such as heat pumps, insulation, solar panels or tools to cut emissions.

The trade association Energy UK was among the groups to back the call.

Several groups had also urged the chancellor to announce new measures for home energy efficiency as part of the budget.

In an analysis published ahead of the budget, climate thinktank E3G said that the government is yet to provide a third of the home energy efficiency funds promised in its 2019 election manifesto.

It added that, to keep on track with recommendations set out by the UK’s Climate Change Committee, the government needs to invest a further £5.3bn in home energy efficiency by 2025.

E3G also said that, as well as investing more, the government needs to implement policy changes to address the “postcode lottery” in energy efficiency fund availability.

Separately, the government launched a consultation on expanding the range of energy saving materials eligible for reduced-rate VAT.

In a statement released after the budget, Cara Jenkinson, cities manager at climate solutions charity Ashden, said that Hunt missed an opportunity to provide new jobs in improving energy efficiency of UK homes. She said:

“By laying out measures to boost retrofit demand and creating a generation of skilled retrofit workers, he could have not only generated savings for struggling households, but also given businesses the confidence needed to generate over 200,000 new energy efficiency jobs. A missed opportunity that UK households, workers and businesses will keenly feel in years to come.”

On Twitter, Chaitanya Kumar, head of environment and green transition at the New Economics Foundation, also raised concerns that the budget “isn’t addressing” home energy efficiency. He added that, according to his analysis, the total number of homes installing new insulation measures fell by 55% from 2021 to 2022.

Windfall tax

The budget did not contain any amendments to a tax on renewable energy company profits that has faced pushback from industry and “green” Conservative MPs alike.

Last autumn, as oil-and-gas majors continued to make enormous profits due to the elevated global price of fossil fuels, Hunt announced plans to increase the windfall tax on those companies from 25% to 35%.

Alongside this, he announced a new 45% levy on electricity generators, due to the excess profits that renewable and nuclear power companies had also been making.

This move was criticised at the time, with industry sources stating it would disrupt the expansion of low-carbon power in the UK.

Energy UK, the trade body for the energy sector, has been among those calling for the levy to include investment allowances – allowing generators to re-invest tax expenditures into low-carbon technologies.

Without this, a report from the trade body argued that oil-and-gas extraction would face “a lower rate of effective tax than low-carbon generators”, which would send the “wrong signal to investors”.

MPs in the Conservative Environment Network have also backed the idea. They argued that the UK would need such “tax breaks” for renewables in order to compete with the US and its Inflation Reduction Act.

However, the Treasury did not incorporate these suggestions into its budget.

In a statement released after the launch of the budget, Energy UK chief executive Emma Pinchbeck said the government “must now act to address growing concerns over…a poorly designed windfall tax”.

‘Investment zones’, capital allowances and EVs

Today’s budget also relaunches the concept of “investment zones”, first mulled by short-term chancellor Kwasi Kwarteng in September 2022.

The government says its “refocused” programme will identify 12 areas across the UK that will receive funds to drive growth in at least one of five “key future sectors”: “green industries”; digital technologies; life sciences; creative industries; and advanced manufacturing.

Areas in England will “have access to interventions worth £80m” over five years and specialised tax breaks, the government says. To receive this, the area will need to prove how it will use the funds to propel growth in the priority sectors. (There is no information for funding for the sites in Scotland, Wales and Northern Ireland.) The budget reads:

“Plans will [also] need to demonstrate how the investment zone will support the UK reaching net-zero by 2050 and the government’s new long-term targets to protect and enhance the natural environment, and be resilient to the effects of climate change.”

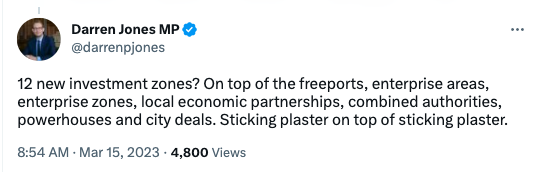

Responding to the idea on Twitter, Labour MP Darren Jones, who chairs the Business, Energy and Industrial Strategy Committee, described it as a “sticking plaster”.

Elsewhere in the budget, the government announced that it will temporarily introduce 100% capital allowances in a bid to stimulate business investments. (Capital allowances are a type of tax relief that allow businesses to deduct the costs of items such as machinery and equipment from their profits before they pay tax.)

On Twitter, Climate Change Committee chief Chris Stark said this was “perhaps the most meaningful move” for climate and energy, adding that it could “really improve the economics of all sorts of net-zero projects”.

However, a spokesperson from Energy UK was less enthused, telling Carbon Brief:

“Anything that helps encourage investment in low-carbon generation is, of course, welcome, but it’s a broad-brush approach that doesn’t match the scale of challenges faced by the sector.”

There were also question marks over the reduced 50% capital allowances that will apply to long-life assets. This applies for assets expected to last at least 25 years, meaning it is likely to include wind turbines and solar panels.

Ahead of the budget, Energy UK had called for the government to reduce VAT for public electric vehicle charging points, as it had previously done for low-carbon technologies, such as solar panels and heat pumps.

However, the budget did not heed this call. Indeed, it does not mention the term “electric vehicle” at all.

Also ahead of the budget, BusinessGreen noted large-scale cuts to England’s active transport budget. (Active transport budgets for Scotland, Wales and Northern Ireland are managed separately.)

At the bottom of a statement released by the Department for Transport on 9 March, the government acknowledged that it was reducing the active transport budget for England to £100m over the next two years. This represents a spending cut of £380m, according to BusinessGreen.