Analysis: China’s CO2 emissions fall by record 8% in second quarter of 2022

Lauri Myllyvirta

09.01.22Lauri Myllyvirta

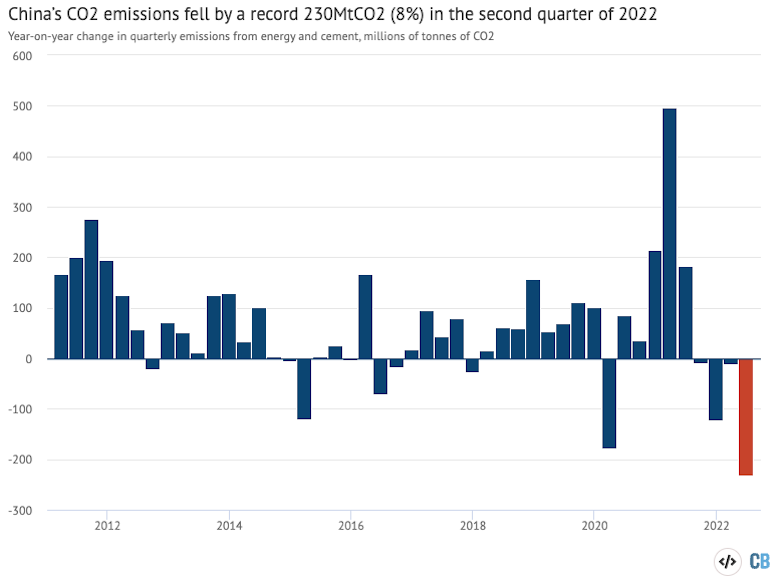

01.09.2022 | 9:00amChina’s carbon dioxide (CO2) emissions fell by a record 8% in the second quarter of 2022, a 230m tonne (MtCO2) reduction that is the largest in at least a decade.

The new analysis for Carbon Brief, based on official figures and commercial data, shows China’s emissions have now fallen year-on-year for four consecutive quarters, extending what was already the longest sustained decline in recent history.

The latest quarterly decline was driven by China’s ongoing real-estate slump, strict Covid control measures, weak growth in electricity demand and strong growth in renewable output.

China’s coal-fired power generation declined by 4% year-on-year in the first half of 2022, but saw an increase in July and August, due to record-breaking heatwaves and droughts in a large part of the country. This has not changed the more salient drivers of falling emissions.

The Chinese government is now responding to the economic headwinds the country faces with a new stimulus package that aims to revive real estate and speed up infrastructure projects, but will also benefit clean-energy investment.

This policy response will determine whether China’s emissions have already peaked or whether they will rebound before peaking later this decade.

Record drop

The new analysis shows that China’s CO2 emissions fell 8% in April to June, compared with the year before. In absolute terms, this is the largest quarterly reduction in at least a decade, amounting to some 230MtCO2, as shown in the chart below.

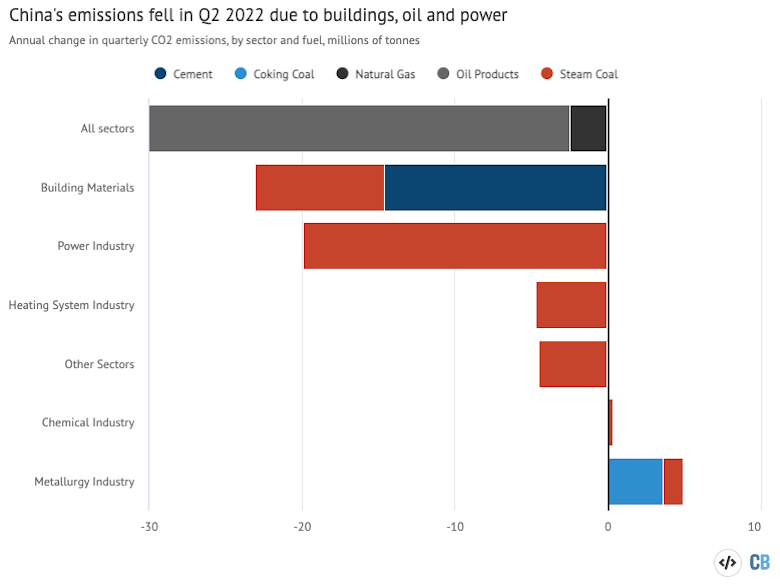

The drivers of the record drop in emissions from April to June 2022 are broken down by fuel and by sector in the chart below.

Reading from the top, there was a significant drop in transport oil consumption due to Covid control measures, with oil refinery throughput – a proxy for oil product usage – falling by 11%

Next on the chart is falls in steel and cement output due to the real-estate slump – with cement production falling 18%. Real-estate construction starts and completions fell by 44% and 33% in the second quarter, to the lowest level since 2009, as the financial distress of the sector intensified. (Year-on-year changes for the second quarter have been calculated from reported year-to-date numbers for March and June 2021 and 2022. See “data sources” section below.)

The other major contributor was a 6% fall in coal use in the power sector, as a result of slow electricity consumption growth and strong increases in renewable power generation.

Elsewhere, consumption of metallurgical coal increased by 4%, for a total reduction in use of the fuel of 5%. Import substitution was clear as imports of thermal coal fell by 45% amid surging domestic coal production, up 12%, and contracting demand.

The drop in gas consumption of 5% is notable as demand for the fuel had been increasing continuously since the early 2000s.

In total, China’s CO2 emissions have now fallen by some 380MtCO2 across the 12 months from July 2021 through to June 2022, a 3% reduction year-on-year.

Coal bounce

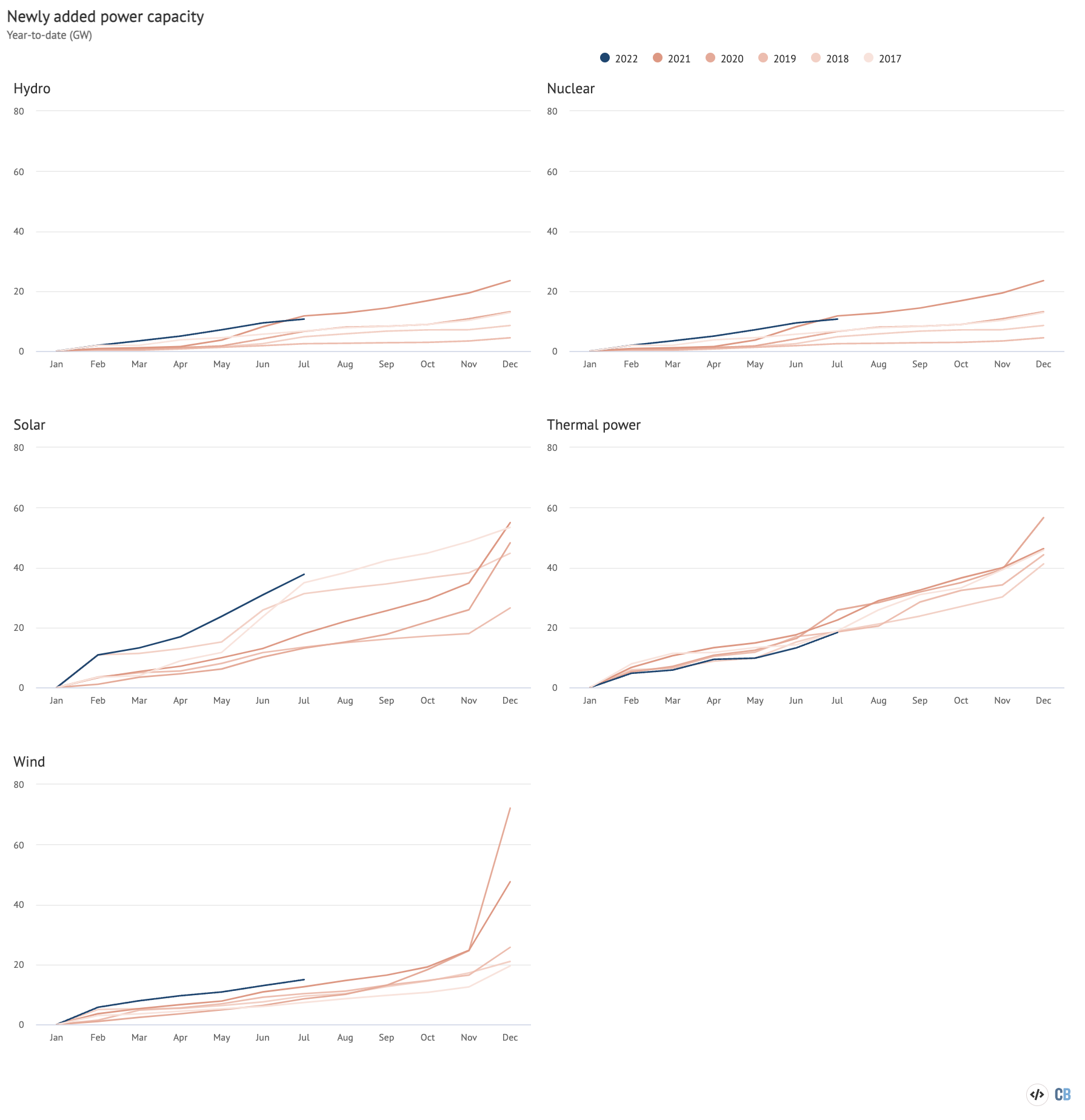

Wind and solar power installations have continued to make new monthly records, as shown in the chart below. In contrast, while thermal power – largely coal – continues to be added to the grid, additions in 2022 to date are at the lowest rate in the past five years.

Nevertheless, emissions from power generation have rebounded in July and August, as a record heatwave has increased electricity demand for air conditioning and droughts have affected hydropower generation at a time that usually has good availability of water.

In the largest hydropower producing province, at the peak of the drought, Sichuan’s hydropower generation has plummeted by more than 50% of typical levels to 440 gigawatt hours, leading to severe power shortages. Factories have been ordered to either close down completely or to limit production, and households and services urged to save power. Other provinces in central China are implementing similar measures.

The new round of electricity shortages is exposing shortcomings in China’s current grid management arrangements, as the drought-hit, hydropower-rich provinces have continued to export large volumes of electricity while rationing local consumption.

The shortages are leading to renewed calls for reforming the electricity system and, on the other hand, for more coal power capacity to be added. Both responses will likely be realised.

On paper, in light of reported peak demand and available capacity, the Central China Grid region should be able to comfortably meet local power needs, despite the present circumstances.

However, the region continues to export very large amounts of hydropower to eastern provinces under inflexible, fixed contracts. In Sichuan, according to Northern China Power University professor Yuan Jiahai, 15 gigawatts (GW) of hydropower continues to be exported, while the capacity shortfall is 13GW.

Furthermore, even taking into account the export commitments, the existing coal power capacity and available hydropower capacity would be sufficient to meet local peak loads, if all thermal power plants were operating at full power when needed and electricity was dispatched efficiently across provinces.

Sichuan’s thermal power plants were reportedly generating at 12.75GW, while the province has 18.25GW of thermal power capacity. This indicates capacity utilisation of 70%, at a time when the shortage was at its worst, a situation where 100% would be expected.

The State Council’s new stimulus package (see below) announced after electricity rationing started, includes 200bn yuan ($29bn) for state-owned power generators to “ensure electricity supply”, which could be designed to persuade plants to keep running despite the high fuel costs.

Full power supply was restored in Sichuan and Chongqing on 31 August, 17 days after electricity rationing first started.

The drop in hydropower output is leading to a surge in coal power generation to make up for the shortfall. Hydropower output will likely remain affected for months as reservoir levels are historically low.

However, the variations in hydropower output are not affecting the more fundamental trends that have seen emissions fall in the first half of the year.

Grid reforms

The Sichuan power shortage is once again revealing the rigid and inefficient way China’s power grid is being operated. Since generation is not shared flexibly between provinces, the only way for local officials to avoid power shortages is to build very large amounts of “dispatchable” capacity, which, in practice, means coal and gas.

The response to this shortage is, therefore, likely to include more coal-fired power projects in central China and could pave the way for inland nuclear power projects, which have been stuck for more than a decade.

But the situation also highlights the need to reform China’s grid operation. Unless a new pricing system is established to consider coal plants’ idle time when clean power is at its peak, these reforms face resistance because they would mean higher-cost coal power generators would operate for fewer hours, leading to large losses of revenue.

The widespread coal and electricity shortage last autumn resulted in fast-tracking changes to the power market that had been stalled for years. It also created momentum for further reforms: a high-level policy on reforming electricity systems and, importantly, institutions is expected late this year.

Analysis of the situation in China’s leading business publication Caixin highlights how the crisis could speed up power system reform even further. It argues that there has been an overemphasis on long-distance bulk electricity transmission, whereas integration of provincial grids has been neglected.

Making grid operation – particularly inter-province transmission – more flexible is the key to avoiding the kinds of electricity shortages currently being seen, according to a recent analysis by Draworld Environment Research Center and the Centre for Research on Energy and Clean Air.

The analysis found that greater flexibility would reduce the need for coal-fired power as a backup during the transition to a lower-carbon grid, avoiding the need for 30GW of coal-fired capacity in the East China grid.

Coal investment

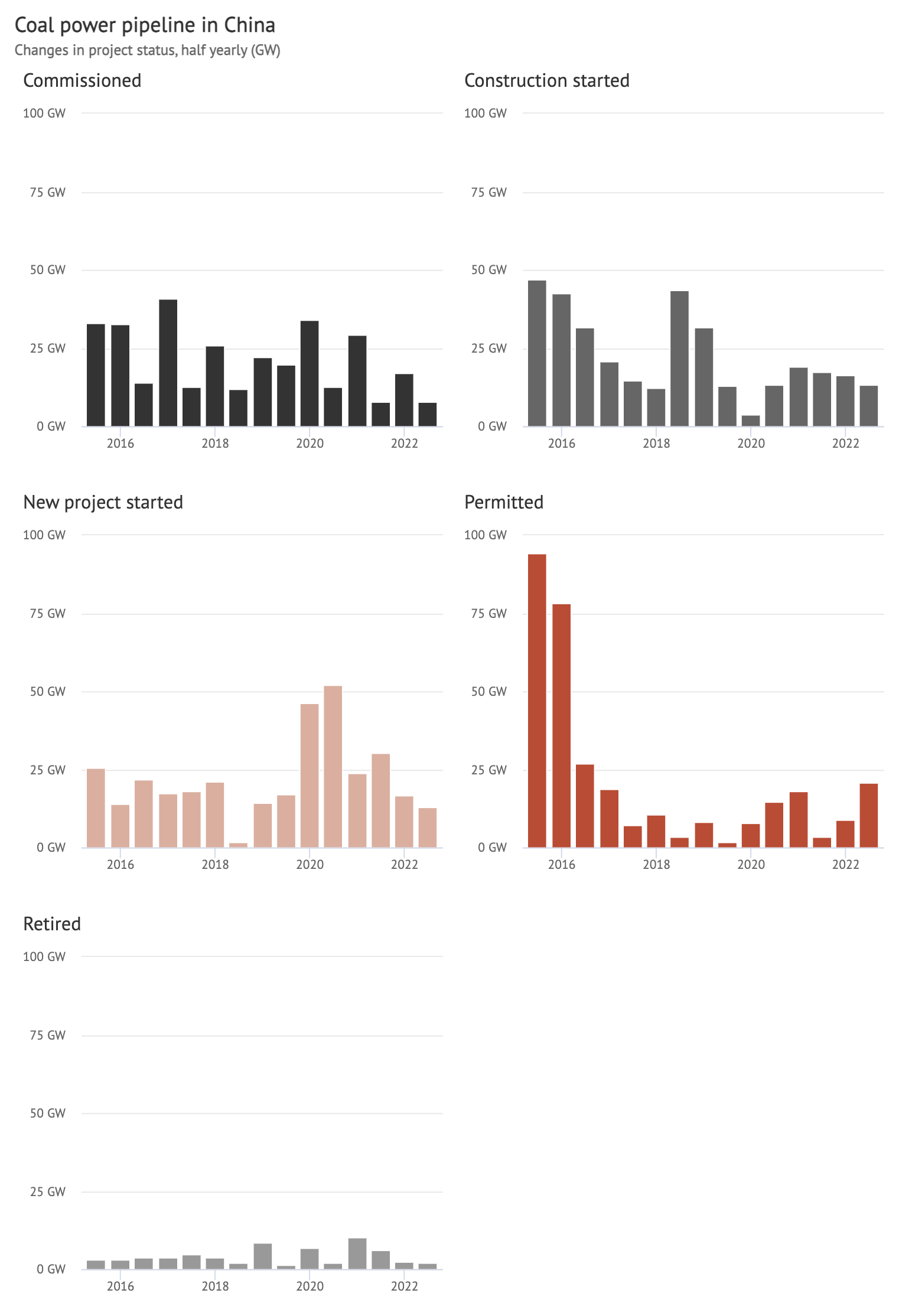

The amount of new coal power projects given government permits in the first six months of the year reached 21GW, the largest amount since 2016.

On the other hand, construction starts, completions and new project announcements slowed down. These project steps are controlled by the power companies, rather than the government.

These divergent trends, shown in the charts below, appear to reflect officials seeking to promote more capacity even as power firms go slow, as coal power has been unprofitable for the past year.

The perceived need for more coal-fired capacity is also leading to a slowdown or even reversal of plant retirements. For example, two 300 megawatt (MW) units of Huaneng Liancheng power plant and two 330MW units of Datang Gansu Gangu power plant had been shut down, but were granted permission to restart in March this year.

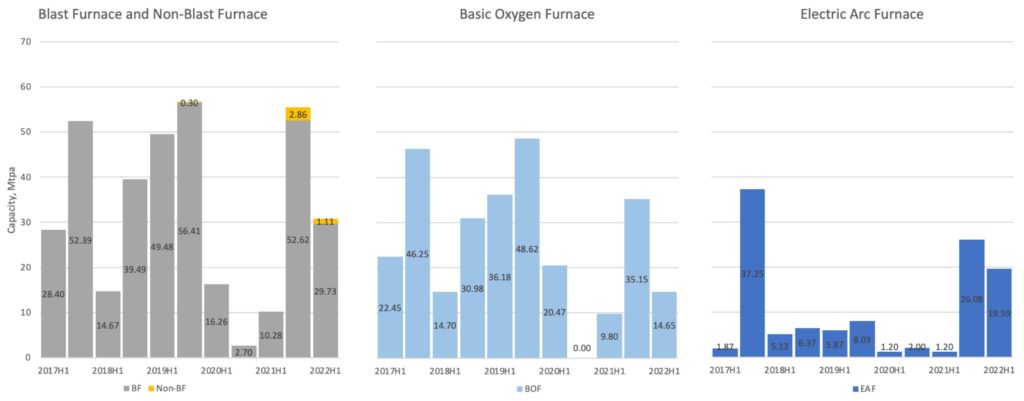

On top of plans for new coal power capacity, there has also been an increase in announcements of new coal-based steelmaking capacity, compared with the level seen in the past two years.

More electric arc furnace capacity was also announced than in previous years, but this is mainly replacing older electric arc capacity, not shifting the mix of capacity, based on data compiled from provincial government websites.

Interest in building new electric arc furnaces might, nevertheless, indicate that the industry is starting to prepare for the shift implied by China’s carbon targets.

Although a government plan for the steel industry has not yet been published, the target of peaking iron and steel emissions before 2025 has been confirmed indirectly. The China Coking Industry Association referenced this target in its CO2 peaking action plan.

Steel is the largest emitting sector in China after power generation, so the industry’s targets have a major bearing on the country’s emissions peaking timetable and level.

New stimulus

With the contraction in the real-estate sector and Covid controls taking a toll on consumer demand, China’s GDP target for this year will be challenging to meet.

In response, the State Council – China’s administrative authority – recently introduced a broad stimulus package worth 1 trillion yuan ($145bn), including measures to revive real estate and accelerate infrastructure projects.

This comes after stimulus policies introduced earlier in the year, which have had a muted effect. This is because the real-estate slowdown strongly affects local government finances – and infrastructure stimulus relies heavily on local governments and local state-owned enterprises to increase spending.

While there is no explicit requirement to prioritise clean energy or other low-carbon projects in the new stimulus, in practice the project lists drawn up by provinces annually to prioritise investments do include many such projects, Indeed, a recent Greenpeace analysis found increases in the share of low-carbon energy investment planned by the provinces.

The latest stimulus push will, therefore, benefit both clean energy and fossil fuel projects, depending on each province’s project mix.

The longer-term policy response from central government will determine whether the current fall in China’s emissions marks the peak being reached earlier than targeted, or whether there will be another rebound before the ultimate peak late this decade.

A successful economic transition away from relying on real estate and infrastructure investment, combined with a continued build-up of clean energy, would be likely to result in an earlier peak in emissions.

Data sources

Data for the analysis was compiled from the National Bureau of Statistics of China, National Energy Administration of China, China Electricity Council and China Customs official data releases, and from WIND Information, an industry data provider.

When data was available from multiple sources, different sources were cross-referenced and official sources used when possible, adjusting data from WIND Information to match.

CO2 emissions estimates are based on National Bureau of Statistics default calorific values of fuels and IPCC default emissions factors. Cement CO2 emissions factor is based on 2018 data.

For oil consumption, apparent consumption is calculated from refinery throughput, with net exports of oil products subtracted.

When official releases did not provide changes from 2021 to 2022, these are calculated from the linked release and previous iterations of the same regular release, although a link is only provided to the latest one.

-

Analysis: China’s CO2 emissions fall by record 8% in second quarter of 2022